Nippon India Tax Saver Fund: Good tax saving fund for long term wealth creation

We are in the third quarter of this tax assessment year (AY 2023-24). If you have not made your tax planning investments in this financial year, now is a good time to plan your 80C investments. You can claim up to Rs 150,000 deduction from your taxable income by investing in schemes eligible under Section 80C of Income Tax Act 1961. For investors with moderately high to high risk appetites, mutual equity linked savings schemes (ELSS) are one of the best 80C investment options for wealth creation.

If you had invested Rs 10,000 per month in Nippon India Tax Saver Fund through Systematic Investment Plan (SIP) 10 years back, your investment would have grown in value to nearly Rs 21.11 Lakhs by now (XIRR of 10.97%) against your investment of Rs 12.00 Lakhs (SIP start date Nov 01, 2012. Return as on 14/10/22).

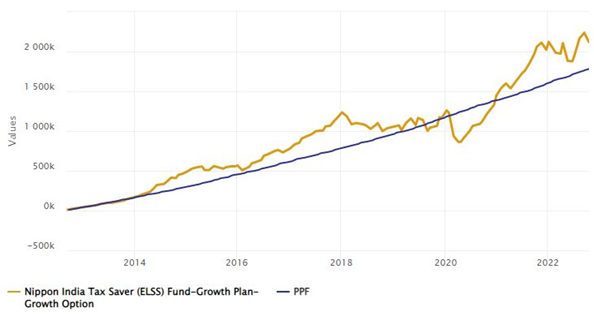

The chart below shows the growth of Rs 10,000 monthly SIP investment in Nippon India Tax Saver Fund over the last 10 years compared to Public Provident Fund. You can see that Nippon India Tax Saver Fund created much more wealth than PPF.

Source: Advisorkhoj Research, as on 12th October 2022. Disclaimer: Past performance may or may not be sustained in the future. Unlike PPF, mutual funds are subject to market risks. Consult with your financial advisor before investing.

Rolling Returns

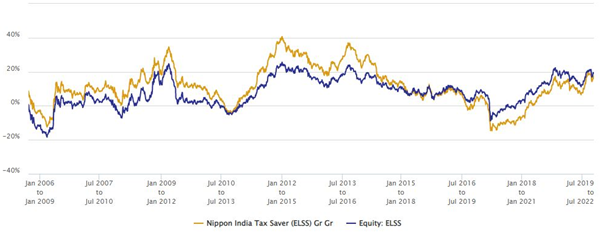

The chart below shows the 3 years rolling returns of Nippon India Tax Saver Fund versus the category average rolling returns since inception. We are analyzing 3 year rolling returns of the scheme versus benchmark because ELSS funds have a 3 year lock-in period; investors need to remain invested for at least 3 years in ELSS.

You can see that, Nippon India Tax Saver Fund had consistently outperformed the ELSS category for many years since its inception. It has underperformed in more recent years due to its consistent large cap bias and may missed out a bit on capturing the midcap and small cap rally in 2020 and 2021 relative to other ELSS funds which had higher allocations to midcaps and small caps. However, you can see that Nippon India Tax Saver Fund is starting to close the gap with its peers. Furthermore, the large cap bias (large caps constitute 72% of the scheme portfolio) of the fund will provide a more stable investment experience for new investors or investors who do not have very high risk appetites.

Source: Advisorkhoj Research, as on 12th October 2022. Disclaimer: Past performance may or may not be sustained in the future. Unlike PPF, mutual funds are subject to market risks. Consult with your financial advisor before investing.

Lump Sum Returns since inception

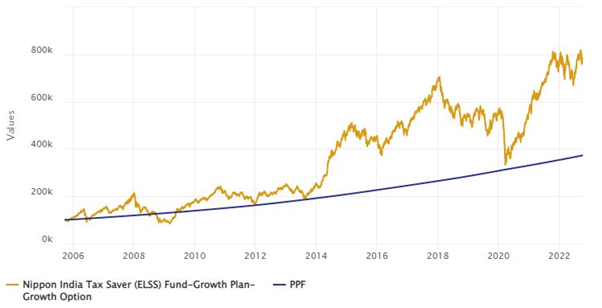

The chart below shows the growth of Rs 1 Lakh lump sum investment in Nippon India Tax Saver Fund since inception compared to PPF. You can see that your investment would have multiplied nearly 8 times over the last17 years (CAGR of 12.7%).

Source: Advisorkhoj Research, as on 12th October 2022. Disclaimer: Past performance may or may not be sustained in the future. Unlike PPF, mutual funds are subject to market risks. Consult with your financial advisor before investing.

Wealth Creation through SIP

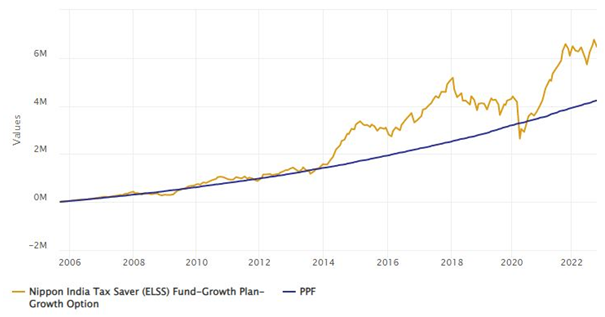

The chart below shows the return of Rs 10,000 monthly SIP in Nippon India Tax Saver Fund since inception. With a cumulative investment of around Rs 20.50 lakhs you could have more than Rs 65 lakhs over the last 17+ years (XIRR of 12.31%). The SIP return of the fund is a testimony of its wealth creation potential over long investment horizons (Return as on date Oct 14, 2022)

Source: Advisorkhoj Research, as on 12th October 2022. Disclaimer: Past performance may or may not be sustained in the future. Unlike PPF, mutual funds are subject to market risks. Consult with your financial advisor before investing.

Why Nippon India Tax Saver Fund for your 80C tax savings?

- Historical data shows that Equity Linked Savings Scheme has one of the highest wealth creation potential among all 80C investment options.

- ELSS with a lock-in period of just 3 years is also the most liquid investment options of all the 80C schemes.

- ELSS is also one of the most tax friendly investment options under Section 80C. Capital gains of up to Rs 1 lakh is tax exempt and taxed at 10% thereafter.

- Nippon India Tax Saver Fund has a strong track record of wealth creation over the last 17 years.

- Since the fund is large cap oriented, it will provide a more stable investment experience to new investors or investors who do not have high appetite for volatility

- The recent correction in equities can provide attractive investment opportunities for investors with long investment horizon.

Who should invest in Nippon India Tax Saver Fund?

- Investors looking for tax savings under Section 80C and also capital appreciation over sufficiently long investment tenures.

- Investors need to have minimum 3 year investment tenure for this scheme since you will not be able to redeem units of the scheme before three years. However, we recommend 5 years or longer investment horizons for this scheme.

- Investors who are investing in this scheme through SIP, each SIP instalment will be locked in for 3 years. Investors need to plan their investments accordingly.

- Investors who have high to very high risk appetites for this scheme.

Investors should consult with their mutual fund distributors or financial advisors, if Nippon India Tax Saver Fund is suitable for their tax planning needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team