SBI Magnum Multicap Fund: One of the best performing multicap mutual funds

Very often we see investors selecting mutual funds based on last 1 year performance but this often than not leads to results not meeting investor’s expectations. In Advisorkhoj, we believe that consistency is one of the most important performance factors for selecting mutual funds. SBI Magnum Multicap Fund is one of the most consistent multicap mutual funds. The fund featured in top 2 performance quartiles for the last 4 consecutive years (please see our tool, Top 10 mutual funds in India). Consistent mutual fund performers usually give the best returns in the long term. SBI Magnum Multicap Fund was among the top 3 multicap mutual funds in the last 5 years (please see our tool, Top Performing Mutual Funds (Trailing returns) - Equity: Multi Cap).

Multicap mutual funds are market cap agnostic – they invest across different market cap segments like large cap, midcap and small cap. Different market segments outperform each other in different parts a market cycle. For example, midcap and small cap outperformed large cap from 2014 to 2017, while large cap has been outperforming small/midcap in 2018. Since multicap mutual funds are not constrained by market cap mandates, they are better positioned to ride the market trend and deliver superior outperformance over a full market cycle. The chart below shows the trailing returns of SBI Magnum Multicap Fund versus the benchmark BSE-500 and multicap funds category over different periods (ending August 17, 2018).

Source: Advisorkhoj Research

You can see that SBI Magnum Multi Cap Fund outperformed its benchmark over 5 and 10 years periods. The fund also outperformed the category in the last 3 and 5 years periods. The scheme was launched in September 2005 and has Rs 5,850 Crores of Assets under Management (AUM). The expense ratio of the scheme is 2.43%. Anup Upadhyay, who also served as Head of Research in SBI Mutual Fund, is the fund manager of this scheme. The chart below shows the NAV movement of SBI Magnum Multicap Fund over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns of SBI Magnum Multi Cap Fund

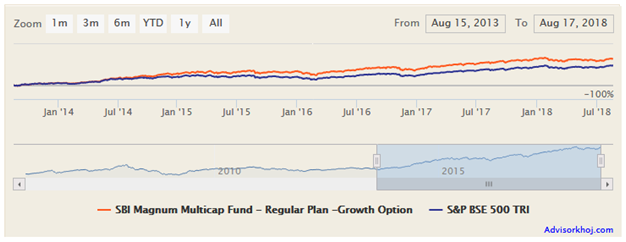

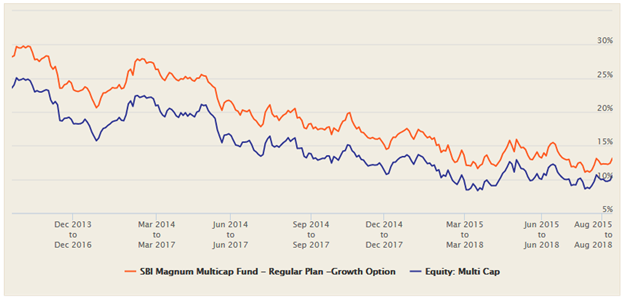

Rolling returns is the best measure of performance consistency of a mutual funds scheme across different market conditions. The chart below shows the 3 year rolling returns of SBI Magnum Multicap Fund over the last 5 years versus the benchmark index, BSE-500. In the last 5 years, the market had experienced different types of movements – rallies, corrections, range-bound, volatility etc. We are showing 3 year rolling returns, because investors should always have a long investment tenor for equity funds. A 3 year tenor is considered to be the minimum length of time investors should be ready to hold an equity fund – longer the tenor, the more likely that, investors will get better returns.

Source: Advisorkhoj Research

You can see that SBI Magnum Multicap Fund consistently outperformed its benchmark across different market conditions. This chart tells us that, over a sufficiently long investment horizon, the fund manager has been consistently able to create alphas for investors.

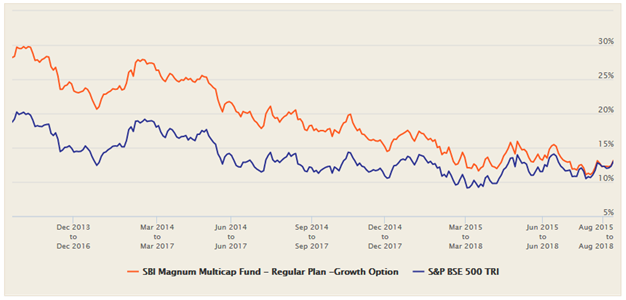

Let us compare the rolling returns of SBI Magnum Multicap Fund versus its multicap peer funds in general. The chart below shows the 3 year rolling returns of SBI Magnum Multicap Fund versus the multicap funds category over the last 5 years.

You can see that SBI Magnum Multicap consistently outperformed multicap funds category in the last 5 years. The outperformance margin is also quite significant. The average 3 year rolling returns of the fund was 19.7% (versus 15.5% for the category). The median 3 year rolling returns of the fund was 18.7% (versus 12% for the category). The maximum 3 year rolling returns of the fund was 30% and the minimum 3 years rolling returns was 11%. It should be apparent to readers, why this fund is considered to be one of the best performing multicap funds.

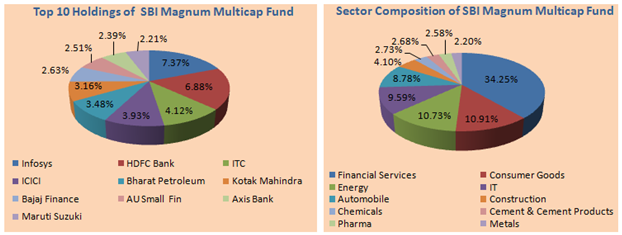

Portfolio Construction

The investment objective of the scheme is to provide investors with opportunities for long-term growth in capital along with the liquidity of an open ended scheme through an active management of investments in a diversified basket of equity stocks spanning the entire market capitalization spectrum and in debt and money market instruments. The scheme follows a bottom-up approach to stock-picking and chooses companies across sectors/styles. The scheme is fairly well diversified across different sectors. Company concentration risk is also low.

Lump Sum and SIP returns

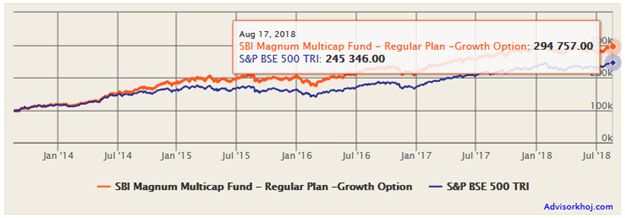

The chart below shows the growth of Rs 1 lakh lump sum investment in the scheme’s growth option over the last 5 years. Your investment in the scheme would have nearly tripled in value over the last 5 years.

Source: Advisorkhoj Research

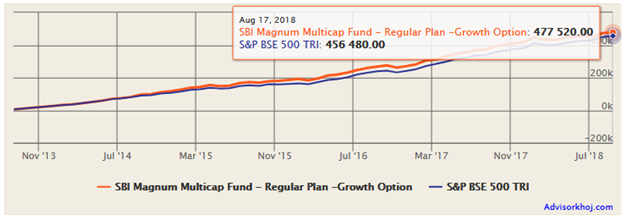

The chart below shows the returns of Rs 5,000 monthly SIP in the scheme’s growth option over the last 5 years. The XIRR return of monthly SIP in the scheme over the last 5 years was nearly 18%.

Source: Advisorkhoj Research

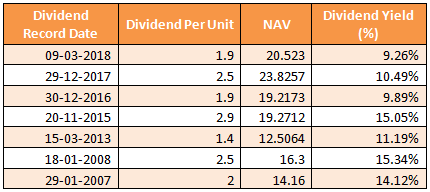

Dividend Payout Track Record

The scheme has been regularly paying dividends from 2015 onwards. The dividend yield is fairly high. It is, however, important for investors to remember that the dividends in mutual funds are not assured. In our opinion, long term capital appreciation should be your investment objective, when investing in this scheme. Investors should also know that in this year’s budget, a 10% dividend distribution tax (DDT) was introduced for equity mutual funds. While dividends are tax free in the hands of the investors, the AMCs will have to pay DDT before paying dividends to investors. Therefore, if your goal is long term capital appreciation, then growth option is better for you because you can avail Rs 1 lakh long term capital gains tax exemption.

Outlook

Over the past 8 months or so, Nifty has outperformed Nifty Midcap and understandably, this has made many mutual fund investors, who invested heavily in midcap and small cap funds worried. Many investors have asked us, whether large cap is the way to go? While large cap funds have certainly outperformed in this year, investors should also understand that Nifty valuation is at its historic high. There is nervousness in the market with regards to the outcome of assembly elections in Rajasthan, Madhya Pradesh and Chhattisgarh. There are also concerns about the Indian Rupee depreciation and interest rates. What we are trying to say here is that, despite the buoyancy in large cap segment over the past few weeks, investors should brace themselves for more volatility in the coming months. The multicap mandate of SBI Magnum Multicap Fund and bottoms up approach is ideally suited for long term investors, because the fund manager of the scheme will focus on high quality stocks in volatile times.

Conclusion

In this post, we have reviewed SBI Magnum Multicap Fund. The fund has completed 13 years since inception and boasts of a very strong performance track record. Investors should have high risk appetite and ideally, a 5 year plus investment tenure for this fund. If you are worried about volatility in the near term, then you can invest in this scheme through SIP or STP. Investors should consult with their financial advisors if SBI Magnum Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY