Should you invest in Quantum Small Cap Fund NFO Review

Quantum Mutual Fund has launched a small cap equity scheme, Quantum Small Cap Fund. The New Fund Offer has opened for subscription on 16th October 2023. The NFO will close on 27th October 2023. Small cap has been the best performing segment of the equity market in 2023; Nifty Small Cap 250 TRI has given 28.73% return on a year to date basis (as on 29th September 2023). There is a huge amount of retail investor interest in small cap funds and in the last few months, small cap funds have seen the largest inflows among all actively managed equity fund categories (source: AMFI Monthly Data, April to September 2023). In this article, we will review the Quantum Small Cap Fund NFO.

Why invest in small caps?

- The addressable universe of small cap stocks is much larger than large and midcaps. While large caps (top 100 companies by market cap) and midcaps (101st to 250th companies by market cap) have a combined universe of 250 stocks, there are 1,374 stocks in the small cap universe.

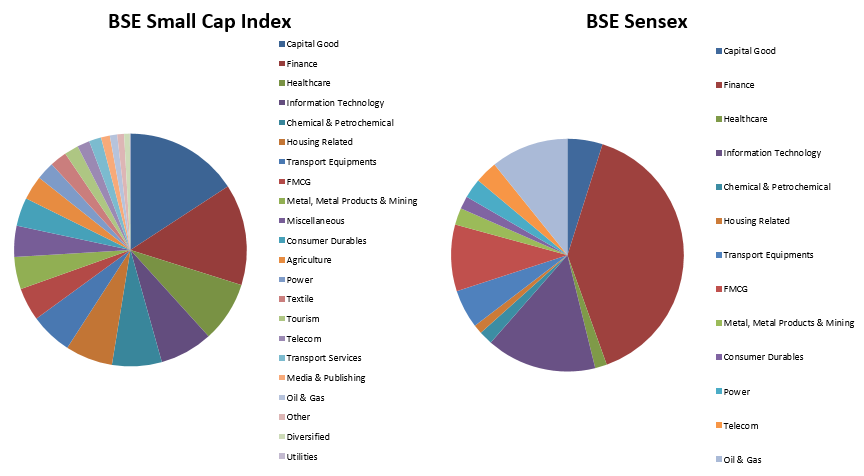

- The large cap segment is dominated by a few sectors. Financials, IT, Oil & Gas and FMCG account for more than three quarters (>75%) of the large cap space in terms of market cap (source: Quantum MF, as on 29th September 2023). On the other hand, in small cap segment account, the same market cap share (in percentage terms) is spread over 10 sectors (source: Quantum MF, as on 29th September 2023). You get exposure to some niche sectors, where large caps have virtually no presence through small cap stocks. Investment opportunities in small caps are therefore, much more numerous and diverse compared to large and midcaps.

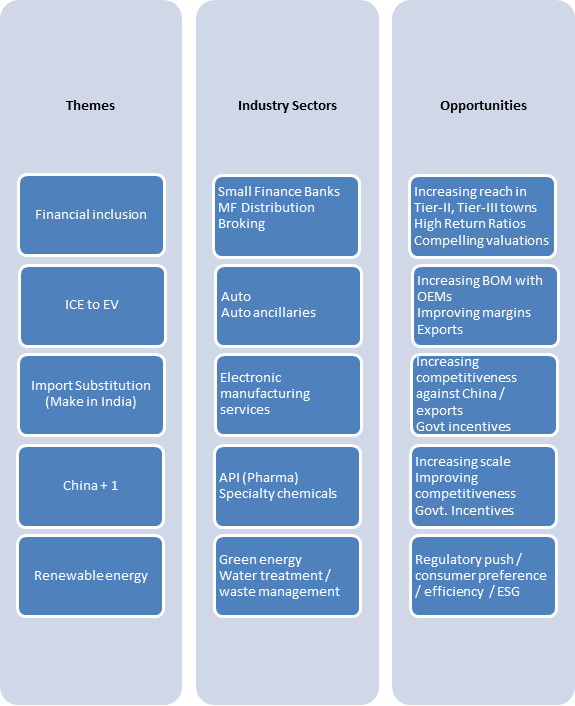

- Small caps will provide you exposure to numerous themes. These themes can have great potential in the India Growth Story due to rising per capita income, structural changes in our economy, Government policies and structural realignments taking place in global supply chains.

- Smalls caps have relatively lower institutional participation (especially FIIs), tend to be under-researched and hence lacking sufficient price discovery. Fund managers can find attractive investment opportunities in undervalued or mispriced small cap stocks. There can be considerable room for valuation re-rating and alpha creation for investors. Small cap stocks also have higher earnings growth potential due to differentiated products or market segments.

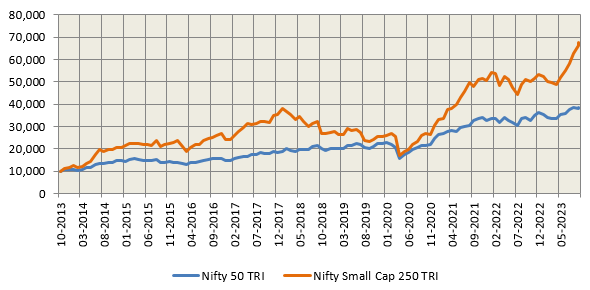

- The chart below shows the growth of Rs 10,000 investment in Nifty Small Cap 250 TRI versus the Nifty 50 TRI over the last 10 years. You can see that the wealth creation by the small cap index was nearly twice the wealth creation by Nifty

Source: National Stock Exchange, Advisorkhoj Research, as on 29th September 2023. Disclaimer: Past performance may or may not be sustained in the future

Unique Features of the Quantum Small Cap Fund

- Liquidity and market cap will be important considerations – Disciplined about fund capacity to avoid large size becoming a hindrance to performance.

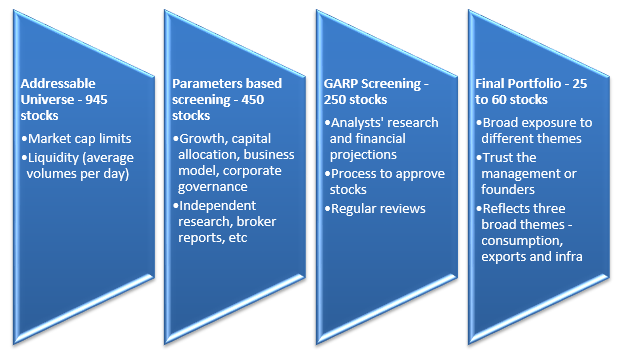

- Strong Research Capabilities to navigate through the vast small cap universe.

- Emphasis on Governance and Management Quality.

- Growth at Reasonable price (GARP) approach - Prudent capital allocation for better returns. Growth / Valuation levers to deliver upside potential.

- Long term Approach to capitalise on compounding that small businesses offer.

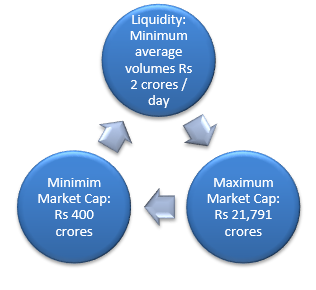

Quantum Small Cap Fund will have a well defined universe to overcome traps of illiquidity and size.

Stock picking approach

Why invest in Quantum Small Cap NFO?

- Small cap stocks are characterized by relatively low free float shares i.e. shares not owned by the promoters or management, compared to large and midcap stocks.

- If a small cap fund keeps on adding stocks to invest the AUM inflows coming to the scheme, then the fund will at a certain point of time start resembling the market index (if the number of stocks are too high). For an actively managed fund, over-diversification leads to sub-optimal performance.

- Quantum Small Cap Fund will have defined universe based on liquidity and market cap limits. This will prevent over-diversification and can potentially superior returns / alpha.

- If a fund owns a large percentage of the free-floating shares of the company, there can a high impact cost (share price will fall) if the fund tries to exit the stock to meet redemption or portfolio rebalancing needs, even if the stock constitutes a relatively small holding in the fund. This will have an impact on performance.

- Quantum Small Cap Fund will ensure that it holds less than 5% of a company. This will reduce the impact costs of any buy / sell transactions.

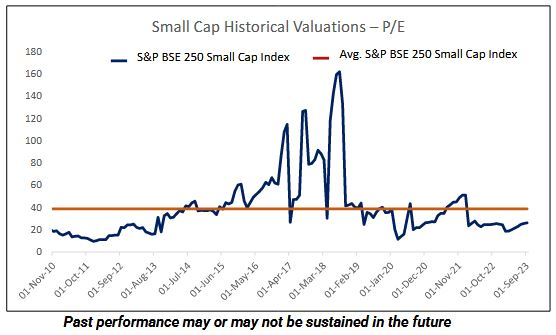

- Though the small cap rally over the past 3 years has resulted in valuations creeping up from March lows, the small cap index is still trading close to its long term average valuation (P/E). Therefore, valuations seem quite reasonable and there is considerable scope of price appreciation in the medium to long term if earnings growth supports the valuations.

Source: Quantum MF, as on 29th September 2023.

Who should invest in Quantum Small Cap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high-risk appetites.

- Investors with minimum 5-year investment tenures.

- We think that SIP is the best mode of investment midcap funds over long investment horizons.

- However, investors can invest in lump sum provided they have long investment tenures.

Investors should consult with their financial advisors or mutual fund distributors if Quantum Small Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team

-

Shriram Mutual Fund launches Shriram Money Market Fund

Jan 19, 2026 by Advisorkhoj Team

-

PPFAS Mutual Fund launches Parag Parikh Large Cap Fund

Jan 19, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team