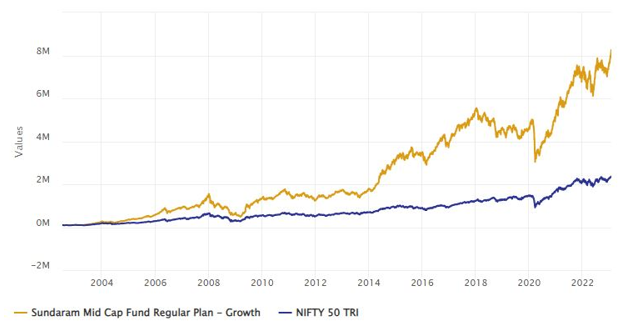

The wealth creation story of Sundaram Midcap Fund

Sundaram Midcap Fund is a phenomenal long term wealth creation story. If you invested Rs 1 lakh in the scheme at the time of its launch in 2002, the value of your investment as on 23rd June 2023 would have been over Rs 80 lakhs. In other words, Sundaram Midcap Fund would have multiplied your investment by more than 80 times in the last 21 years. The compounded annual growth rate (CAGR) of investment in this midcap scheme since inception is more than 23%.

Source: Advisorkhoj Research

About the scheme

Sundaram Midcap Fund was launched in July 2002 and has Rs 7,549 crores of assets under management (AUM). The expense ratio of the scheme is 1.82%. The portfolio turnover ratio of the scheme is 46%. After the acquisition of Principal Asset Management Company (AMC) by Sundaram MF, the erstwhile Principal Midcap Fund was merged with Sundaram Midcap Fund. Mr. Bharath S and Mr. Ratish B Varier are the fund managers of this scheme.

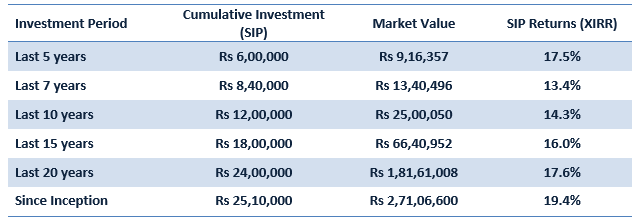

Wealth creation through SIP

The table below shows how much money would have accumulated over different periods (as on 23rd June 2023), if you invested Rs 10,000 every month in the scheme through Systematic Investment Plan. You can see that you could have created substantial amounts of wealth by investing in this scheme through SIP over long investment tenures.

Source: Advisorkhoj Top Performing Systematic Investment Plan - Equity: Mid Cap

Suggested reading – how much mid and small cap allocations you should have in your portfolio

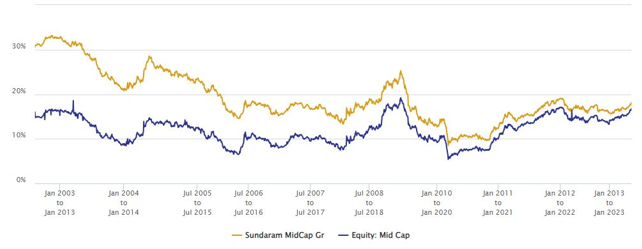

Rolling Returns

The chart below shows the 7 year rolling returns of Sundaram Midcap Fund versus the midcap funds category average rolling returns since the inception of the scheme. You can see that across different market conditions, the scheme has outperformed the category average most of the times over 7 year investment tenures. The average 7 year rolling returns of the scheme since inception is nearly 20%.

Source: Advisorkhoj Rolling Returns Calculator

If we increase our investment tenure to 10 years, the outperformance of Sundaram Midcap Fund versus its average peers is even higher. You can see scheme has outperformed the category average 100% the times over 10 year investment tenures. The average 10 year rolling returns of the scheme since inception is also nearly 20%.

Source: Advisorkhoj Rolling Returns Calculator

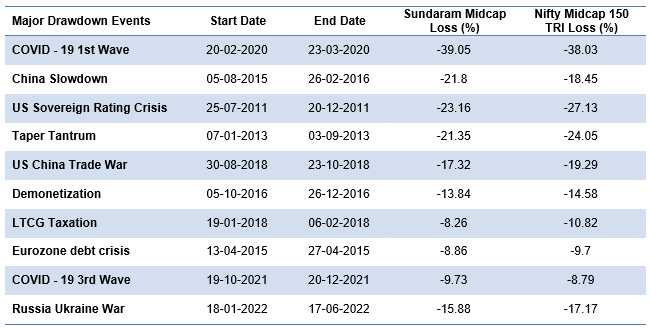

Downside risk limitation

The table below shows the performance of Sundaram Midcap Fund versus its benchmark index, Nifty Midcap 150 TRI in various large drawdowns. You can see that in most major drawdowns the scheme was able to limit downside risks for investors.

Source: Advisorkhoj Research

Investment Strategy

- Stock selection is bottom-up using in-house research

- Business Dynamics: Size of the opportunity, Scalability of business, entry barriers, market share changes, sustainability and longevity of the competitive edge

- Operating Matrix: Skill Vs Luck

- Skill: Operational efficiencies, Scale of Operation, Technology and Innovation & Value Migration;

- Luck: Raw material prices, Inventory valuation, Fuel price change and temporary disruption with competitors

- Profitability: Markets ascribe a premium only to companies with quality and sustainability of profits

- Quality of Growth: Reflected in ROE & ROCE

- Capital Allocation: Capital Expenditure is a certainty while revenue and profits are an illusion

- Valuation: It is important to “price the value and not value the price”

Current investment themes

- The scheme is currently overweight on sectors aligned towards impending domestic economic and consumption growth recovery.

- The portfolio is moderately overweight on banking and manufacturing themes, and has stock-specific overweight positions within consumption.

- Within Financials, the fund manager’s preference is towards lenders with strong liability franchise, diversified presence across verticals and ability to grow sustainably above industry rates with adequate capital levels and consistent underwriting practices. The fund manager expects a revival in credit growth, improving asset quality, and steady profitability.

- Within Industrials the preference is towards businesses which benefit from government spending on infrastructure and better capex environment. It also includes those businesses whose technological capabilities accelerate their internal investments to benefit from the capex cycle.

Why invest in Sundaram Midcap Fund?

- Indian equities has made broad based recovery after initial months of volatility in 2023.

- After underperforming till March 2023, MSCI India Index (USD) has outperformed MSCI Emerging Market Index (USD) in both April and May 2023. India’s outperformance in the emerging market pack is attracting FII flows to India. This is providing tailwinds to the broad market, including midcaps.

- Midcap stocks will be likely beneficiaries of impending domestic economic and consumption growth recovery.

- Sundaram MF as an AMC has a strong long term track record of performance in the midcap market segment.

- Sundaram midcap fund has a 20 plus year track record of wealth creation.

Who should invest in Sundaram Midcap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high risk appetites.

- Investors with minimum 5 year investment tenures.

- We think that SIP is the best mode of investment in midcap funds over long investment horizons.

- However, investors can also take advantage of deep corrections to tactically invest in lump sum.

- You can also invest in this fund through 3 – 6 months STP from Sundaram Liquid Fund. You may like to read STP – a comprehensive guide for investors.

Investors should consult with their financial advisors or mutual fund distributors to see if Sundaram Midcap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team