Volatile Markets: Just Stay Invested

Yes, the markets are volatile & hence I call them as “Behavior of the Beast”.

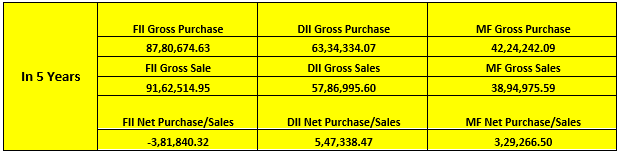

I have taken data points from April 2018 till April of 2023. It covers the FII, DII & MFs Gross Purchase, Gross Sales & Net Purchase/Sales and the S&P BSE 500 movement.

In 5 Years, the flow trend shows as below:

Cash market numbers. Figures in Crore. Data Source moneycontol.com

The FIIs have been Net Negative at INR 3,81,840.32 Crore while DIIs have been Net Positive at INR 5,47,338.47 Crore & Mutual Funds have been Net Positive at INR 3,29,266.50 Crore. It’s very evident for the data that DIIs & Mutual Funds play a MUCH important role in our markets today than the FIIs swingy trends. This is despite the fact we witnessed multiple head winds Globally & Domestically during this time period.

S&P BSE 500 has given a positive return (point to point annualized) of 12.17%

The above Graph clearly shows that in spite of the volatile large flows, S&P BSE 500 steadily marched towards a positive momentum generating a return of 12.17% annualized, the thick Brown Line indicates it. The trend of DIIs is shown in the thick Green line & Mutual Funds is shown through the thick Dark Grey line. The Trend is loudly saying that DIIs & Mutual Funds have become extremely large market participants in our markets today. Must note & not miss, the Insurance & Individuals equity investments etc as well.

The earning yields spread is much below 200 basis point from over 230 basis in December 2022, further indicating an attractiveness towards equities & its positive trend.

Since 2018, we have seen multiple FED actions from a bloated balance sheet effect to a hopefully trimming balance sheet, though not so evident yet through their actions. But each time there is FED meeting our worries move up, why? Their problems are self-created & we are reasonably well insulated.

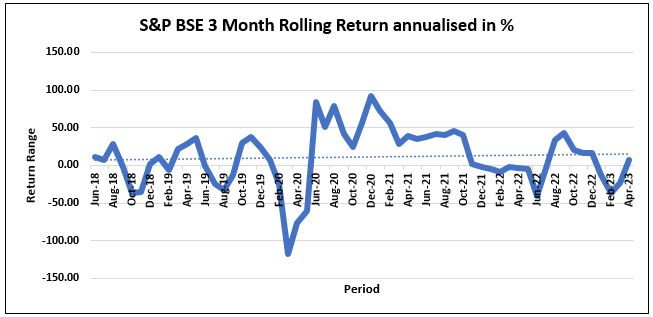

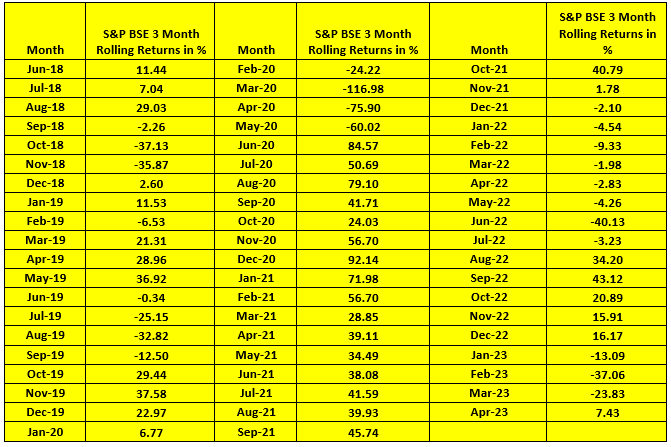

In this period of 5 years we did see, Inflation Yo-Yoing across the globe & at home, Oil Prices moving as low as USD 19.33/barrel on 21st April 2020 to high of USD 123.58/barrel as on 8th June 2022, Geo-Political factors, Interest rates sharply moving, Covid & it’s deep economic effects. Through all this, we of course had our impact as show in the below Graph of 3 months rolling return, but post this jerk digestion, the positive trend emerged & caught its momentum again.

These returns factor in all Financial, Political, Geo-Political movements etc.

Finally, someone who stayed invested made CAGR Return of 11.38% from the broader index.

Data of 3 months rolling return annualized in percentage:

The essence is to ride over the volatility & not to panic, cut the Human Behavioral aspect.

Don’t over react to “Global Actions” around you & reduce the noise!

Stay Invested for the Longer Term

Consult your Mutual Fund Distributor/Financial Advisor before investing & before redeeming.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team