Why Nippon India Nivesh Lakshya Fund is a good long term debt fund

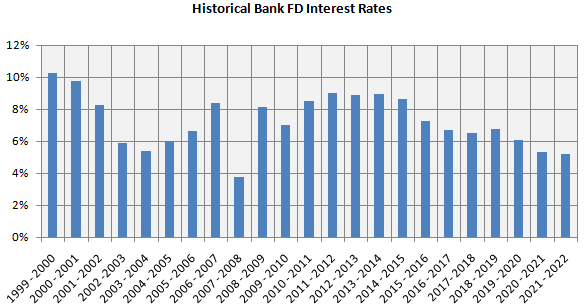

Retail investors in India have traditionally favoured Bank Fixed Deposits and Government Small Savings Schemes for their fixed income investments. However, fixed deposit interest rates have generally been declining over the years (see the chart below). Nominal interest rates are directly related to inflation. As our economy grows in the future, inflation and interest rates will come down even more in the long term. We have seen this in most developed markets.

Source: RBI, Bank Bazaar. Note that interest rates till FY 2004 related to 5 major PSU banks. After FY 2004, the rates related to 5 major PSU and private sector banks. Disclaimer: Past performance may or may not be sustained in the future.

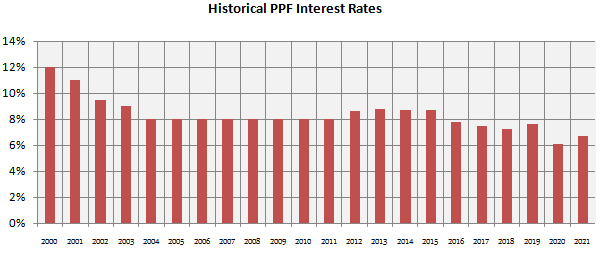

Like Bank FD rates, Government small savings interest rates have also generally been declining (see the chart below for historical Public Provident Fund interest rates). The interest rates of Government small savings schemes are usually linked to G-Sec yields of similar maturities. G-Sec yields in the long term are related to interest rate in the economy. So in the future, we are likely to see further decline in Government Small Savings interest rates as well.

Source: Advisorkhoj.com. Disclaimer: Past performance may or may not be sustained in the future.

What should investors do?

Declining interest rates of traditional fixed income investments has long been a concern for many investors, especially investors who depend on the interest income for their regular long term needs e.g. senior citizens. A long term roll down maturity debt mutual fund scheme can be suitable investment options for such investors since it can give higher returns than traditional fixed income investments. Long term debt fund investor can also enjoy long term capital gains taxation benefits. In this article, we will discuss Nippon India Nivesh Lakshya Fund, a one of its kind scheme in the debt mutual fund space.

What is roll down maturity in debt funds?

The shape of yield curve is usually upward sloping i.e. bonds of longer maturity give higher yields than a bond of lower maturity. If you buy a long dated bond (long maturity) and hold it, then you lock-in higher yield even as the bond maturity rolls down (reduces). Let us understand this with the help of an example. Let us assume a 10 year bond is available at 6.7% yield while 9 year bond is available at 6.5% yield. You invest in the 10 year bond. So after 1 year, your 10 year bond will effectively be a 9 year bond but with additional 0.2% yield. Since the duration of the bond reduces over time, the interest rate risk also reduces but the yield remains the same. Nippon India Nivesh Lakshya Fund rolls down maturities of the underlying bonds by holding them till maturity.

You may like to read why rolling down SDLs are good long term fixed income investment solutions

Who should invest in Nippon India Nivesh Lakshya Fund?

- Investors looking for regular income over long investment tenures

- Investors should have moderate appetite for volatility

- You can also invest in this fund for the long term e.g. 7 to 10 years or longer

About Nippon India Nivesh Lakshya Fund

Most long duration funds (Macaulay Duration of 7 years or longer) take duration calls i.e. invest in bonds of different maturities depending on expected interest rate changes to generate higher returns from bond price appreciation. Nippon India Nivesh Lakshya Fund is long duration with a difference. The scheme invests predominantly in long duration Government bonds (25-30 year maturities) and intends to hold these securities till maturity to lock-in the current yields for the long term.

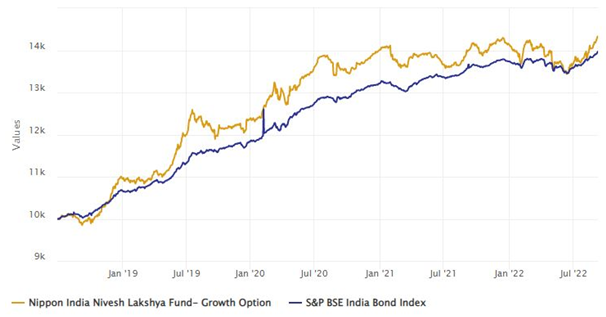

The scheme was launched in July 2018 and has around Rs 2,100 crores of assets under management. The expense ratio of the scheme is just 0.54%. Nippon India Nivesh Lakshya Fund has given 9.0% CAGR returns since inception. The chart below shows the growth of Rs 10,000 investment in the scheme from inception till 9th September 2022. The average maturity of the Nippon India Nivesh Lakshya Fund as on 31st August is 22.67 years. The portfolio Macaulay Duration is 10.9 years. The portfolio yield to maturity is 7.4%

Source: Advisorkhoj Research

No credit risk

Credit risk is an important concern for all fixed income investors. While interest rate risk can be obviated if you hold a debt instrument till maturity, credit risk can cause permanent loss. Nippon India Nivesh Lakshya Fund invests only in Government Securities (G-Secs). Government securities have sovereign guarantee and hence there is no credit risk in Nippon India Nivesh Lakshya Fund.

Why is this a good time to invest in Nippon India Nivesh Lakshya Fund?

High inflation has been pushing up bond yields globally for the past year or so, as markets anticipated aggressive rate hikes by the central banks to bring down inflation discounted higher interest rates in bond prices / yields. The 10 year Government Bond yield hit a high of 7.6% in June. Since then yields have eased as global commodity prices, especially crude oil started cooling off. July inflation rate in the US was lower compared to previous month after many consecutive months of increases. This has resulted in bond yields easing further. The consensus view among economists is that August US inflation data will show a further drop.

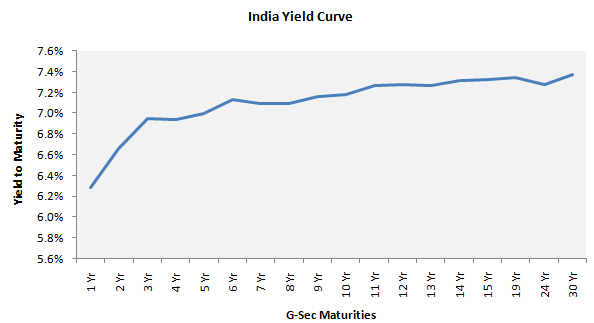

The yield curve has been flattening (see the chart below) over the past couple of months, indicating that we are approaching the end of rate tightening cycle. A flattening yield curve indicates lower inflation expectations and possible slowdown in the economy, which will then prompt the central banks to cut interest rates. Many economists expect the US Fed to increase interest rates till the first quarter of CY 2023 and start cutting rates to revive economic growth before the end of CY 2023. The RBI may follow a similar trajectory. Since the market discounts future interest rates in prices, long term bond yields may decline further. Since long term yields are attractive, it may be a good time to lock in these yields for long investment tenures.

The 25 to 30 year bond yields are in the range of 7.27 – 7.37% (see the chart below). The portfolio YTM of Nippon India Nivesh Lakshya Fund is 7.4% (as on 31st August 2022). This is much higher than interest rates of traditional fixed income investments. You can lock in the current yield of Nippon India Nivesh Lakshya Fund for a long period of time, even if interest rates and bond yields come down in the future. Further when we enter the new interest rate cycle (declining interest rates), you can also benefit from price appreciation.

Source: worldgovernmentbonds.com (as on 9th September 2022). Disclaimer: Past performance may or may be sustained in the future.

Benefits of Nippon India Nivesh Lakshya Fund

- Visibility of Returns: The current YTM of the scheme portfolio is 7.4%. YTM is the expected return on investment if you hold a fixed income security (bought at current price) till maturity. You can get this yield (adjusted for expense ratio) for the next 20 years or so, if you remain invested in the fund. Unlike funds which take duration calls, Nippon India Nivesh Lakshya Fund will not sell securities to benefit from price movement but continue to accrue the current yields till the maturity of the security.

- Flexibility to withdraw: You can redeem your investments anytime at prevailing market prices. Investors should note that scheme NAV at any point of time will depend on the prevailing market prices of the underlying securities. Prices can go up or down depending on the interest rate situation and other factors – investors should decide accordingly depending on their needs. Nevertheless, the flexibility to withdraw provides an easy liquidity facility for investors not available in several traditional schemes like NSC, PPF, life insurance policies etc

- Benefit of Indexation: One of the biggest advantages of debt funds is tax advantage in long term capital gains. While interest from bank FDs and several Government Small Savings Schemes are taxable as per the income tax rate of the investor, long term capital gains in debt funds (holding period of more than 3 years) are taxed at 20% after allowing for indexation benefits. Indexation benefits can reduce your tax obligations and reduce the effective tax rate

- Can be used to draw out annuities at current (high) yields, using Systematic Withdrawal Plan (SWP). You can get regular fixed cash-flows from your invest in Nippon India Nivesh Lakshya Fund using SWP. The balance units after each SWP instalment will continue to accrue the current (high) yields. Also for withdrawals made after 3 years from the date of investment, you can get the benefits of long term capital gains tax. As such, SWP from Nippon India Nivesh Lakshya Fund can be an excellent investment option for senior citizens who are looking for post retirement inflation adjusted returns for long periods of time.

Investors should consult with their financial advisors, if Nippon India Nivesh Lakshya Fund is suitable for their long term fixed income investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty 500 Healthcare ETF

Jan 30, 2026 by Advisorkhoj Team