What Makes You a Good Investor

"The only way to permanently change the temperature in the room is to reset the thermostat. In the same way, the only way to change your level of financial success 'permanently' is to reset your financial thermostat. But it is your choice whether you choose to change" - T.Harv Eker

It is often said that the fundamental difference between the rich and the poor is: rich invest their money and spend what is left of it. The poor spend and invest what is left of it. You might already know which of these categories you fall into. What makes an investor successful? What is the root cause of so many investment disasters? Is it even possible to thrive in this sea of failure? Let us shed some light upon the traits of a good investor.

The age old Mantra of Discipline

One cannot possibly emphasize the importance of discipline. It has always been proclaimed to be one of the traits that make you successful and it is no different for investing. Successful investors are intrinsically motivated to ensure to watch their investments like a hawk. They are strict with investment or premium payments. They exercise strict discipline in making sure that all obstacles that could hinder the growth of their corpus are removed. The strict discipline is also indicative of the strong commitment they have to the future that they are trying so hard to build.

The art of Risk and Persistence

Investors are often known to have a varied risk appetite. The distinguishing factor between an average investor and a good investor is their risk appetite. Good investors always have a strong risk management system in place. Average investors usually fear making losses and losing capital. Hence, when they earn marginal profits they redeem the investments. A good investor allows the same investment to compound over a long period of time to reap profits. Hence, they make more money than the average investors. Good investors along with a high risk appetite and good instinct are also persistent. They could be putting all their investments in one stock or fund or following a diversified portfolio. They do not change these patterns and invest in time and allows compounding to work its magic. An average investor remains average because slight speculations and changes in the market make them hurriedly change their investment decisions. The average investor also takes these decisions as they follow a herd mentality.

Nail the Timing: When to Buy and Sell

One cannot overemphasise the importance of the right time. The art of buying and selling at the right time is known to a few. Usually the tendency is to sell appreciated investments. Investors tend to hold on to underperforming stocks in the hope of a rebound. If an investor doesn't know when it's time to let go of hopeless stocks, he or she can, in the worst-case scenario, see the stock sink to the point where it is almost worthless. Of course, the idea of holding onto high-quality investments while selling the poor ones is great to preach, but even the best often fumble while practicing.

The Winning Whiz – ‘Tenbagger’, conceptualized by iconic Fund Manage Peter Lynch which shed light upon investments that increased tenfold in value. Lynch was able to earn tenfold on his investments because of the small number of well performing stocks. He allowed the investment to show their true potential in terms of returns. A lot of investors have the personal view about booking profits or withdrawing investments when appreciation occurs. A mild appreciation tempts the investors and also inculcates the fear of losing the profits. However hurried withdrawals cannot be tenbaggers. To invest in a winning stock an investor invests in the stock as much he/she invests in time. One cannot allow their personal ideas about investing to interfere in what could be a potentially winning investment in the long term.

The Lousy Losers – As an investor you have to maintain a realistic outlook about your investments. You cannot afford to be overly idealistic or optimistic. Once a stock or fund has been performing badly or not performing as per your expectation keep that in watch. Let go of the stock if necessary before you make losses and lose the principal amount. It is also important to recognize such stocks because it points towards an investment mistake you may have made earlier. Do not underestimate a good stock hurriedly and do not keep investing in an underperforming stock because you believe it will do well. Don't be afraid to swallow your pride and move on before your losses.

Pick a Strategy and Stick to it

Investors use varying methods to fulfil investing goals. While different strategies work for different investors, there is no one golden strategy that will do miracles to your investments. However, once you find a strategy that has continuously produced positive results, it is ideal to stick to it. If you are constantly fidgeting with your investments and changing strategies, it will deprive your investments from the long term capital growth. The best potential of a stock is always realized during the long term. If you are trying to make huge profits in short span of time them it might prove disastrous for your investments. Take Warren Buffett's actions during the dotcom boom of the late '90s as an example. Buffett's value-oriented strategy had worked for him for decades - and despite criticism from the media - it prevented him from getting sucked into tech startups that had no earnings and eventually crashed.

Being Dynamic about Diversification

Diversification of investments is necessary because of factors such as age, risk appetite and so on. Depending on the age of the investor, the investments are diversified. A young investor could heavily invest in equity funds and to balance out the risk invest in Debt funds or traditional tools such as PPF. The investor also has a long time to fulfill his goals. Hence, longer time period reduces risk in equities. A middle aged investor who has relatively less time to fulfill his goals could invest heavily in debt or balanced funds because along with moderate returns they also require moderate risk. Losing the capital partly or entirely could be fatal at a stage so close to your goals.

Investors who are fearful of taking risks could diversify their investments to reduce risk in their portfolio. Some investors choose capital protection over high returns, while others focus on returns and take high risk to achieve the same. Depending on the varying taste one should diversify the investment. However, because equity funds generate the higher returns, it would be foolish to put all investments in one asset class. For example, if you are risk aversive and all your investments are concentrated in traditional forms such as fixed deposit or comparatively low return instruments like debt fund. Such investments lack diversification and fail to give your portfolio the push to achieve moderate to maximum returns.

Young investors, numbers of which are growing in India, need returns for fulfillment of long term goals and also security for the family. Hence, adequate life insurance cover and debt investments like PPF, Sukanya Samridhi (if there is a female child to provide security) and returns without high exposure to risk are also advised. However, a larger Equity investment will boost the overall portfolio return and become crucial in achieving long term goals.

How Taxing are Taxes

Investors often make bad investment decisions when they focus more on saving taxes and less on the yield of investments. Saving taxes should definitely be a priority but not by compromising on the returns. This usually happens when investors is in a hurry to save taxes, usually towards the end of the financial year, invest in tax saving instruments. They invest lump sum to avoid paying hefty taxes. Due to the short period of investment, they save taxes but they might do not get the desired returns. Hence, the tax money they saved gets nullified because of the returns they failed to tap. As an investor you have to decide the varying gains/losses by such a step. Tax planning and start saving at the beginning of the financial year is the most ideal thing.

Finding a Financial Adviser

To be a seasoned investor one needs the advice of a financial adviser. A financial adviser who is experienced and qualified will provide customized advice which is suitable for achieving your financial goals. Investors often follow the herd mentality and fall prey to market speculations. A financial advisor who has your best interest in mind will give you all services starting from chalking a financial strategy, assistance in investments and setting up a periodical review of your portfolio. All of this will usually be done at a small fee but is a small price to pay for the knowledge and the skill provided.

Conclusion: Debates are often based on what makes a good investor? Good strategy and calculated moves or good instincts and a little bit of luck? A lot has been said on this without reaching an iron clad conclusion. It can be safely assumed, to be successful one needs concrete data and instincts. The experience of an investor cannot be discounted. If one has been investing for a long period of time they are more attuned and have better instincts than an amateur investor. However, it all boils down to this: if you reaped profits you are a good investor. You have faced losses or no profits, then better luck next time. Happy Investing!

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

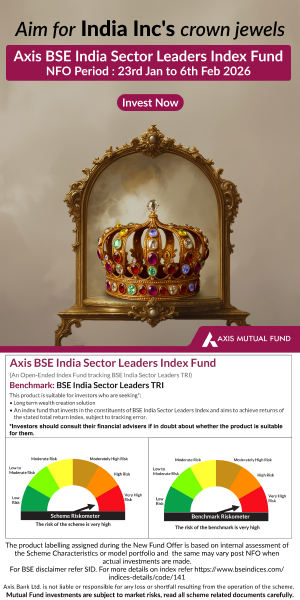

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team