Why Retirement Planning is important

Retirement planning is one of the most important life-stage goals especially for salaried people. The financial objective of retirement planning is to accumulate a sufficiently large corpus which can meet cash-flow needs of you and your dependent(s) after retirement. Unfortunately, many investors do not give high priority to retirement planning or start their retirement planning late in life, which may put their financial independence at risk after retirement. In this post, we will discuss why retirement planning is important, why you need to start early and other points you should consider.

Why is retirement planning important?

- Changing social milieu and economic circumstances are leading to nuclearization of families. In a joint family construct, the incomes of working family members took care of the whole family including senior citizen parents. In nuclear families, senior citizens may have to depend on their retirement savings to meet their expenses. Even if children in nuclear families wanted to take care of their parents, financial burden on them is higher because of higher education expenses, cost of maintaining two different houses, higher lifestyle expenses etc. Financial independence after retirement should be high priority for nuclear families.

- Working lives are getting shorter as students are pursuing higher education, professional courses before joining the work-force. Also many people may be quit working before their planned retirement age due to voluntary or involuntary retirements, ill-health, forced to quit to take care of ailing family members. Due to unforeseen exigencies that one may face in life, it is prudent to begin retirement planning early in life.

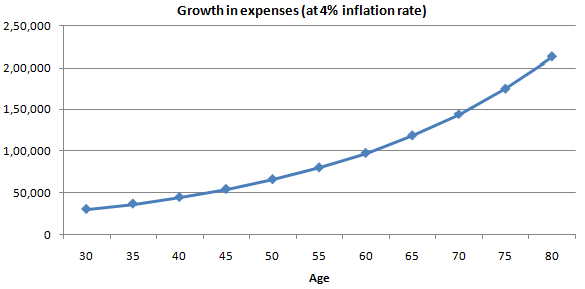

- Higher expenses due to inflation should be one of the most important considerations in retirement planning. If you do not factor inflation in your retirement planning, you may fall woefully short of your retirement savings need. Let us assume that you are 30 years old and your monthly expense is Rs 30,000. Let us further assume that you will retire at the age of 60. Assuming an inflation rate of 4%, your monthly expense at the age of 60 will be Rs 97,320. Even after you retire, your expenses will continue to grow due to inflation. In this example your monthly expenses will Rs 2.13 lakhs by the age of 80.

![Mutual Funds - Higher expenses due to inflation Mutual Funds - Higher expenses due to inflation]()

Disclaimer: The above example is purely for illustrative purposes with the following assumptions – current age 30, current monthly expense Rs 30,000, retirement age 60, retired life up to age of 80 and inflation rate 4% (with annual compounding). Please consult with your financial advisor to calculate your retirement savings need based on your financial situation.

- Higher average longevity implies longer retired lives, even though the length of working life remains the same. Longer retired lives mean more savings will be required to maintain financial independence for the entirety of your retired life and that of your spouse. More longevity makes retirement planning more challenging.

- With improvement in quality of healthcare in the India, medical expenses are also rising at the faster rate than the average inflation rate. Your retirement planning should also factor healthcare related expenses since health risks increase with age.

Advantages of starting retirement savings at a young age

The different challenges in retirement planning make it imperative for investors to start from a very young age. Otherwise they may fall short of their retirement goal. There are several benefits of starting your retirement savings at a young age:-

- Investors usually have fewer responsibilities at a young age. Once they grow older they may have families to take care of, pay children’s school fees, home loan EMIs etc.

- If you begin retirement planning at a young age, you get a considerable head start because you may have contend with multiple life-stage goals later in life e.g. buying your house, children’s higher education, children’s marriage etc in addition to your own retirement.

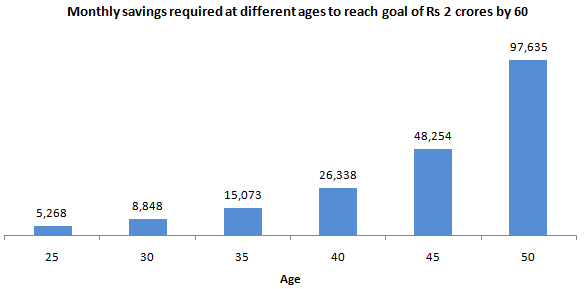

- You can benefit from the power of compounding to create wealth for your retirement plan. The power of compounding can yield large benefits over long investment horizons. Let us understand this with the help of an example. Let us assume your retirement savings target at the age of 60 is Rs 2 crores. Let us see how much you need to save and invest on a monthly basis, to meet your retirement goal if you begin retirement planning at different ages. We have assumed a return on investment of 10% in this example. You can see that, you can reach your retirement goal with much smaller monthly savings if you begin early.

![Mutual Funds - Monthly savings required at different ages to reach goal of Rs 2 crores by 60 Mutual Funds - Monthly savings required at different ages to reach goal of Rs 2 crores by 60]()

Disclaimer: The above example is purely for illustrative purposes with the following assumptions – retirement goal Rs 2 crores, monthly investments and return on investment of 10%. Please consult with your financial advisor to calculate your retirement savings need based on your investment needs.

- If you start retirement planning early, you can cultivate good savings habit which can help you with your other financial goals.

- Investors usually have higher risk appetites at younger age. Risk appetite declines with age. Risk and returns are directly linked. In other words, if you begin retirement planning at a young age you can invest in assets which have the potential of higher wealth creation in the long term. Even if returns are volatile in the short term, you may have sufficient time for investment value to recover and give expected returns to achieve your financial goal.

Axis Retirement Savings Fund

Axis Retirement Savings Fund has three plans which investors can choose from, depending on their needs:-

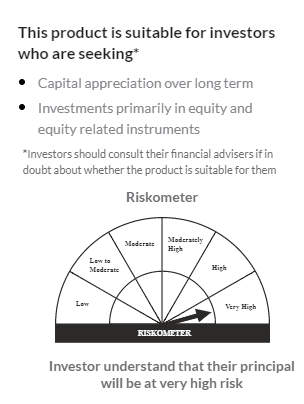

- Aggressive Plan is mainly suited for investors who are seeking capital appreciation over the long term. This plan invests primarily in equity and equity related securities. Young investors (below the age of 35) may find this plan suitable as they have higher risk appetites.

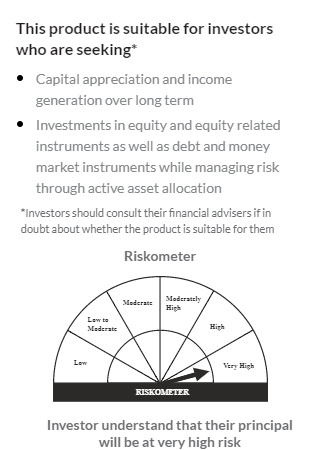

- Dynamic Plan is mainly suited for investors who are seeking capital appreciation and income generation in the long term. The plan invests in equity and equity related securities, as well as debt and money market securities while managing risk through active asset allocation. Investors who are in the mid-stages of their careers (age 35 to 45) may find this plan as suitable.

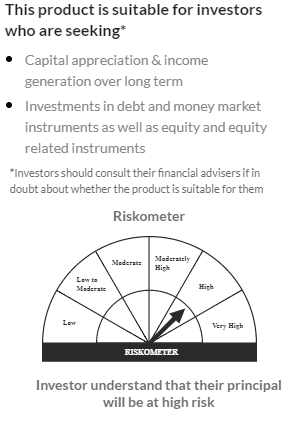

- Conservative Plan is mainly suited for investors who are seeking capital appreciation and income generation in the long term. The plan invests primarily in debt and money market securities to provide stability, as well as equity and equity related securities to generate inflation beating returns in the long term. The risk profile of this plan is lower than the Aggressive and Dynamic Plans. Investors who are in the later stages of their careers (about to enter retirement years) may find this plan as suitable.

You should select the appropriate plan based on your investment needs and risk appetite. You should consult with your financial advisor to understand the risk profiles of the different plans and select the one which is suitable for you. The table below summarized the main features of the three plans of Axis Retirement Savings Fund.

Axis Retirement Savings Fund also comes with complimentary insurance (iPlus SIP) cover for long term SIPs. Please read the Scheme Information Document or consult with your Axis Mutual Fund Distributor to know more about *iPlus SIP and its Terms and Conditions.

*For detail Terms & condition please refer SID of the Scheme along with the addendum.

Conclusion

In this article, we discussed about the importance of retirement planning, why you should start planning for retirement early in your career and the benefits of starting early. You may consider Axis Retirement Savings Fund for your retirement planning investments. You should consult with your financial advisor to know which option will be suitable for your specific retirement planning needs.

AXIS RETIREMENT SAVINGS FUND– AGGRESSIVE PLAN An open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier)

RISK-O-METER AXIS RETIREMENT SAVINGS FUND– Conservative PLAN An open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier)

RISK-O-METER AXIS RETIREMENT SAVINGS FUND– Dynamic PLAN An open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier)

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team