Hybrid Mutual Funds can be effective risk diversification solutions

Asset allocation is the most important characteristic of a balanced investment portfolio. A balanced portfolio has exposure to different asset classes like equity, fixed income, gold etc in the right proportions. Mutual funds can help investors build balanced portfolios through equity funds, debt funds, gold funds etc. There is a large variety of equity and debt fund schemes in the market, with different risk and return characteristics. For example, within equity funds we have large cap funds, multi-cap funds, midcap funds, thematic funds, sector funds etc. Within debt funds we have funds employing accrual based and duration call strategies, funds with different bond maturity and credit risk profiles. Investors can get confused trying to match products with their financial objectives. Hybrid funds provide very efficient solutions for investors in building a balanced portfolio.

Hybrid funds, as the name suggests, have portfolio exposure to both equity and fixed income in different proportions. The fund managers of hybrid schemes actively manage the asset allocation within ranges specified in their investment mandate (you read the scheme information document of these funds). Hybrid funds offer solutions to wide variety of medium to long term investment goals and risk profiles. There are two broad categories of hybrid funds.

- Equity oriented hybrid funds, commonly known as Balanced Funds: These funds have minimum 65% exposure to equity and the balance in fixed income. The equity portion is usually diversified across sectors and market cap segments. Equity oriented hybrid funds or balanced funds enjoy equity taxation.

Debt oriented hybrid funds

: These funds have a majority exposure to debt (more than 50%) and, therefore, are much less risky compared to equity oriented hybrid funds. They are two asset allocation based sub-categories of debt oriented hybrid funds – conservative and aggressive. Conservative debt oriented hybrid funds have 5 – 10% exposure to equity and while aggressive debt oriented hybrid funds have 25% or more exposure. Conservative debt oriented hybrid funds are suitable for investors with low risk appetite while aggressive debt oriented hybrid funds are suitable for medium risk appetites. Debt oriented hybrid funds are taxed like debt funds.

You will come across a variety of other hybrid categories like Monthly Income Plans, Child Plans, Retirement Funds / Plans, Asset Allocation Funds, Life Stage Funds etc. All these funds are either equity oriented or debt oriented hybrid funds.

Advantage of Hybrid Funds

Asset Allocation

- Over the past few years, there has been much greater investor awareness in India about hybrid funds and they are becoming one of the most popular mutual fund product categories among retail investors. We have discussed a number of times in our blog that, asset allocation is the most important characteristic of a well balanced portfolio. Based on numerous queries we have received in Advisorkhoj over the past year or so, we are very happy to observe that, Indian investors are increasingly paying more attention to asset allocation. Asset allocation will help you diversify your risk and at the same time, help you meet your financial goals.

A well balanced portfolio should have equity and fixed income in the right proportion. Unfortunately, in India, most retail investors still associate mutual funds with equity investments only. If you only have equity funds in your investment portfolio, you may be exposed to more market risk than your risk capacity can afford. Fixed income investment is an important component of a well balanced portfolio.

Hybrid funds will get your portfolio fixed income exposure and address asset allocation needs. In bear markets, when your equity portions of the investments lose value, the fixed income portions continue to earn returns. Over the past 10 years, hybrid equity oriented funds have given double digit plus average annualized returns, higher than what average large cap funds have given over the same period (please see our research tool Mutual Fund Category Returns). We are not suggesting that, balanced funds will give higher returns than large cap equity funds in the future; but in difficult market conditions balanced funds are likely to outperform large cap equity funds.

Asset rebalancing

- Investors should understand that, asset allocation is a dynamic process because different asset classes give different returns in different market conditions. Let us assume, your desired asset allocation is 60% equity and 40% debt; accordingly, you invested 60% in equity and 40% in debt. Suppose, equity gives 15% annualized returns, while debt gives 8%. In three years, your asset allocation will be 65% equity and 35% debt. You will need to re-balance your portfolio to bring the asset allocation back to the desired 60% equity and 40% debt; otherwise you will be left with higher risk exposure. In a hybrid fund, the fund manager will do the rebalancing for you. Asset rebalancing is a very important part of portfolio management.Returns

- Most retail investors in India have a preference for risk-free investments like bank fixed deposits and Government small savings schemes. However, returns on these investments, on a post tax basis, are often lower than the inflation rate. The small equity component of a debt oriented hybrid provides a kicker to the income generated by fixed income, which over a sufficiently long investment horizon can give inflation beating returns, if the investor can afford to take small amounts of risk. Hybrid debt oriented funds as a category have given nearly 9% returns in the past 10 years (please see our research tool, Mutual Fund Category Returns).Tax efficiency of hybrid funds

- Mutual funds are the most tax efficient investment options. Long term capital gains (investment held for over 12 months) and dividends paid by Equity oriented balanced funds are tax free. Debt funds, including hybrid (debt oriented) funds, are much more tax friendly compared to fixed deposits and most small savings schemes over a 3 year plus investment horizon. While income from FD and most small savings schemes are taxed as per the income tax rate of the investor, capital gains (profit) from Hybrid debt mutual funds are taxed at 20% after indexation, which reduces the tax obligation of investors substantially.

Risk factors in Hybrid Funds

To understand how hybrid funds can help you effectively diversify, we should discuss the risk factors. Hybrid funds are subject to 3 major risk factors:-

Market Risk:

All equity investments are subject to market risk. Stock prices are volatile; they change constantly. This volatility can be stock specific, sector specific or market related. If the market has moved up, the stock price of a company is down then the price movement of it is due to either some sector specific or company specific reason. If other stocks of the sector are up, and only the stock price of the said company is down, then the price movement is due to company specific reasons. Fund managers diversify the stock specific risk, by investing in a large number of stocks. Fund managers also aim to the diversify sector specific risks, by investing across a number of sectors.

So diversified equity portfolio is only subject to market risk (also known as uncontrollable risk). It is important to note that, this risk is lower in hybrid funds than diversified equity funds because of the debt allocation. For example, if the debt allocation of a hybrid fund is 30%, then this risk is lower by 30% compared to a diversified equity fund.Interest Rate Risk:

The debt portion of a hybrid fund is a portfolio of fixed income or debt securities like, government bonds, corporate bonds, commercial paper etc. All debt securities are subject to interest rate risk. Price of debt securities are inversely related to interest rates. If interest rate goes up, the price of the security or bond goes down and vice versa.

Investors should understand that, by interest rate, here we do not mean the repo rate set by the RBI. By interest rate we mean the relevant (maturity specific) interest rate on the yield curve. Yield curve is a graph, which plots interest rate or yields of Government bonds of different maturities. The RBI repo rate has a direct impact on yields, but it depends on a variety of other macro factors like, fiscal deficit, inflation, demand and supply of credit etc.

The interest rate risk of a fund will depend on the investment strategy. If the fund manager employs accrual based strategy, then interest rate risk is low. On the other hand, if the fund manager takes duration calls, based on his / her interest rate outlook, then the risk is higher. The investment strategy is articulated in the scheme related documents and therefore, you should read it carefully, to understand the risk factor.Credit Risk:

Credit risk refers to risk of default of interest and principal payment by the debtor. Government bonds have no credit risk. Credit rating agencies like CRISIL, ICRA etc assign ratings to corporate bonds. High credit rating (e.g. AAA denotes high safety, very low risk of default). The probability of default increases as the credit rating goes down. If credit rating of a bond worsens the bond price will fall, if the credit rating improves the price will rise. Most mutual fund houses have robust mechanisms (guided by SEBI norms) in place to monitor credit risk.

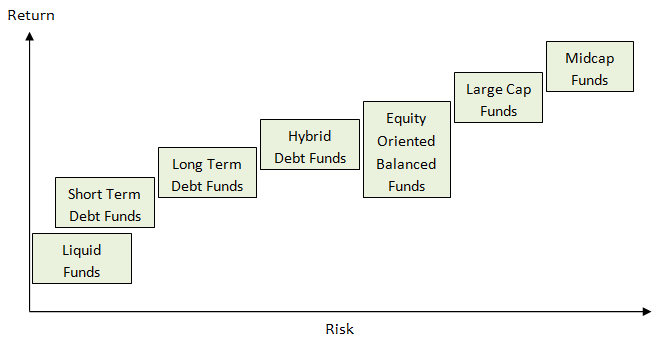

Since hybrid funds have allocations in both equity and debt, investors should understand these risk factors well. They should apply their understanding of risks to schemes, by reading the scheme information document and factsheets carefully, so that they are able to make the right investment decision. The graph below maps risk return characteristics of different fund categories.

Conclusion

In this post, we discussed the basic characteristics of the balanced funds. We also discussed how hybrid funds can help you diversify your portfolio risks and meet your investment objectives. Hybrid funds are also very tax efficient. Investors should consider hybrid funds in building a balanced investment portfolio.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY