LIC MF Focused 30 Equity Fund: Potential of higher alphas from focused investment

What are Focused Funds?

Focused funds are equity mutual fund schemes that invest in maximum 30 stocks (as per SEBI’s mandate). There are no market cap restrictions for these funds, in other words, they can invest across market capitalization segments. Though focused funds have higher concentration risks compared to more diversified funds which invest in a larger portfolio of stocks (e.g. 50 – 60 stocks), slightly concentrated holdings allow the fund manager to allocate higher weights to high conviction stocks which have the potential of creating alphas for investors over long investment horizon. Each stock is expected to contribute significantly to the Scheme's overall performance. Adding a focused fund to your equity mutual fund portfolio may increase potential portfolio alphas.

Current market context

The equity market saw a strong rally in 2023 with midcaps and small caps outperforming. However, we have seen deep cuts in midcaps and small cap stocks in February / March since SEBI issued an advisory on froth (high valuations) building in these market cap segments. The broad market has recovered from the bout of volatility, but caution is nevertheless warranted since the market is at its all time highs. With Fed rate cuts in the horizon sometime this year, equities may rally further from current levels.

From a long term perspective, the outlook for Indian equities remains strong. The Indian economy has strong resilience amidst slowdown in other major economies; the IMF has projected India to be the fastest growing G-20 economy. The changing global supply chain dynamics e.g. China + 1 strategy is likely to benefit Indian companies. In the medium to long term, Indian companies across market cap segments are likely to benefit from the structural reforms made by the Government e.g. shift from unorganized to organized, Make in India, digitization of payments (Digital India) etc. In our view, one should have a diversified portfolio across different market cap segments to benefit from the long term India Growth Story.

About LIC MF Focused 30 Equity Fund

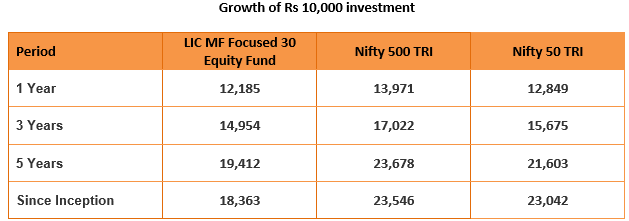

LIC MF Focused 30 Equity Fund was launched in 2017 and has double digit CAGR returns since inception. The expense ratio (TER) of the scheme is 2.51% (as on 29th February 2024). Jaiprakash Toshniwal has been managing the scheme since July 2023. If you had invested Rs 10,000 in LIC MF Focused 30 Equity Fund 5 years back, its value would have almost doubled to Rs 19,412 (as on 29th February 2024).

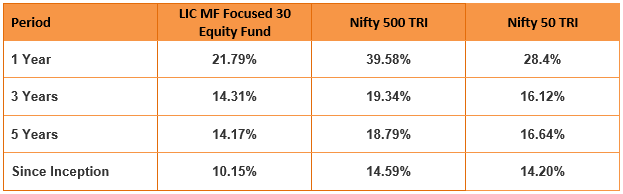

Performance of LIC Focused 30 Equity Fund

The table below shows the performance of the scheme across different time-scales since inception.

Source: LIC MF February Factsheet, as on 29th February 2024

Source: LIC MF February Factsheet, as on 29th February 2024

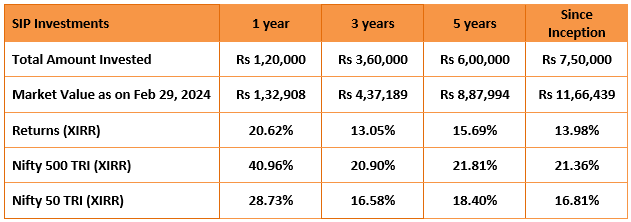

Wealth creation through SIP

Source: LIC MF February Factsheet, as on 29th February 2024

Portfolio strategy and positioning

- Scheme invests in best opportunities that the market presents, without any sector bias with an underlying focus to build a portfolio of both value and growth companies.

- It follows a bottom-up approach for stock-picking and chooses companies across industry sectors and market capitalization segments.

- It primarily focuses on companies that have demonstrated characteristics such as market leadership, strong financials and quality management.

- It selects companies that have the potential to create wealth for their shareholders by delivering steady performance through the ups and downs of the market.

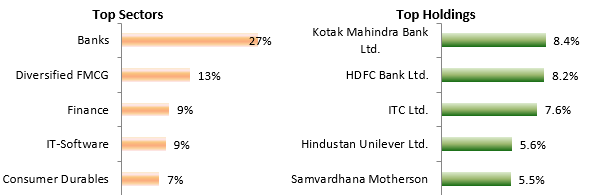

The scheme is currently biased towards large caps. The large cap allocation of the portfolio is 67.3%, while midcap is 14.5%. Around 13.7% of the portfolio is allocated to small caps. The chart below shows the top sectors and holdings of the LIC MF Focused 30 Equity Fund.

Source: LIC MF February Factsheet, as on 29th February 2024

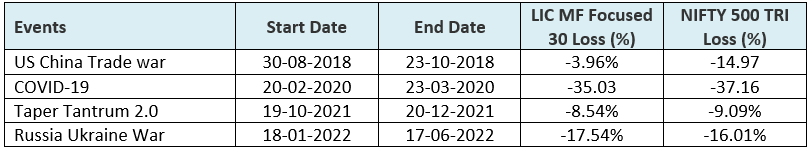

Downside risk – Smaller drawdowns

We have shown the drawdowns of LIC MF Focused 30 Equity Fund versus the Nifty 500 TRI in the biggest corrections since the inception of the scheme. You can see that in most big corrections, LIC MF Focused 30 Equity Fund was able to limit the downside risks for the investors.

Source: Advisorkhoj Research, as on 29th February 2024

Why invest in LIC MF Focused 30 Equity Fund?

- High conviction stock picks - The scheme will focus on concentrated portfolio of securities across the sectors. Main aim of the scheme is to generate better risk adjusted returns from a certain high conviction stock picks.

- Buy and Hold strategy - Scheme adopts "Buy and Hold” strategy for investment. The focus will be on selecting the right stock at right price and holding the same skilfully through different business cycles which will help the investors to get benefits from entire growth cycle.

- Reasonable diversification - Though the scheme will have concentrated Portfolio, Fund Manager will try to create the reasonable diversification across sectors which will help to control the risk associated with such funds.

- Potential for long term growth - The stocks are selected after considering the performance of these stocks over different market cycles. The scheme focuses to benefit from the long term performance of these stocks without getting affected by their short term market volatility.

Who should invest in LIC MF Focused 30 Equity Fund?

- The fund is suitable for the investors who are looking for capital appreciation with a long-term investment horizon of more than 5 years.

- Those who have high to very high risk appetite

- You can invest either in lump sum or SIP depending on your financial situation and investment needs.

- If you are worried about volatility, you can also invest in the scheme through 3 to 6 months Systematic Transfer Plan (STP) from LIC MF Liquid Fund.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Focused 30 Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY