LIC MF Large and Midcap Fund: A promising diversified equity fund for long term investors in current market conditions

What are large and midcap funds?

Large and midcap funds are diversified equity mutual fund schemes, which invest primarily in large and midsized companies. They can be suitable for long term investment options for investors looking for growth potential of midcap stocks along with the relatively stability of large cap stocks. As per SEBI’s mandate, large and midcap funds must invest at least 35% of their assets in large cap stocks (top 100 stocks by market capitalization) and 35% in midcap stocks (next 150 stocks by market capitalization). The balance of 30% can be invested across market cap segments e.g., large, mid or small caps, or other asset classes. In this article we will review LIC MF Large & Midcap Fund.

What are the benefits of investing in large and midcap funds?

- These funds have minimum 35% exposure to large caps stocks, which can go up to 65% as per SEBI’s mandate. Large cap stocks tend to be less volatile than midcap stocks and provide stability to your portfolio in volatile market conditions.

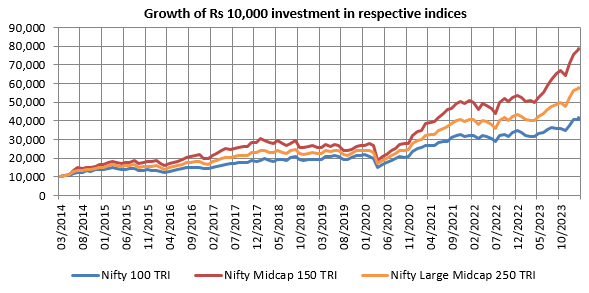

- A diversified portfolio of large cap and midcap stocks can produce superior long-term returns, while reducing downside risks in volatile markets. The chart below shows the growth of Rs 10,000 investment in Nifty 100 TRI (large cap), Nifty Large Midcap 250 TRI (large and midcap) and Nifty Midcap 150 TRI (midcap) over the last 10 years.

Source: National Stock Exchange, Advisorkhoj Research; Period: 01.03.2014 to 29.02.2024. Disclaimer: Past performance may or may not be sustained in the future

- Large caps have a heavier tilt towards certain sectors like BFSI, IT, Oil and Gas, FMCG. Large and midcaps provide more balanced exposure to sectors like Capital goods, Consumer services and Realty, where large cap has low or no exposure. These sectors can benefit from India’s consumption driven economic growth, rising per capita income, changing global supply chain landscape (e.g. China+1), Government’s policies e.g. import substitution (Make in India), digitization, infrastructure spending, shift from unorganized to organized sectors etc.

About LIC MF Large & Midcap Fund

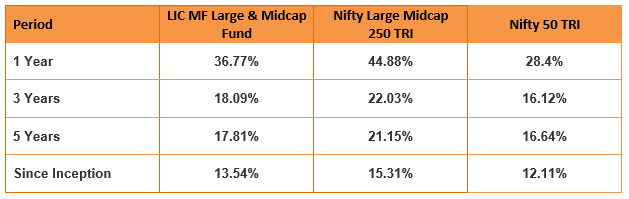

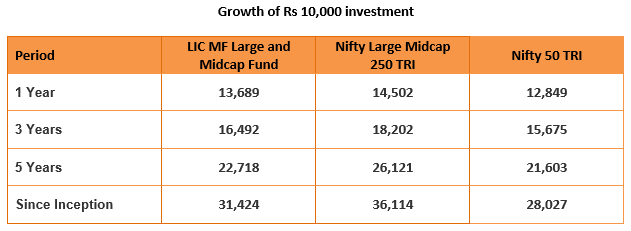

LIC MF Large & Midcap Fund was launched in 2015 and has Rs 2,550 crores of assets under management (as on 29th February 2024). The expense ratio (TER) of the scheme is 1.93% (as on 29th February 2024). Yogesh Patil (since 2020) and Dikshit Mittal (since 2023) are fund managers of this scheme. The scheme has given 13.54% CAGR returns since inception (as on 29th February 2024). If you had invested Rs 10,000 in LIC MF Large & Midcap Fund at the time of its launch, its value would have grown to Rs 31,424 (as on 29th February 2024).

Performance of LIC MF Large & Midcap Fund

The fund has delivered strong returns over past 1 – 3 years. The table below shows the performance of the scheme across different time-scales.

Source: LIC MF February Factsheet, as on 29th February 2024

Source: LIC MF February Factsheet, as on 29th February 2024

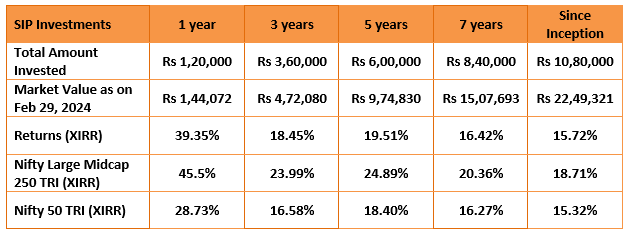

Wealth creation through SIP

Source: LIC MF February Factsheet, as on 29th February 2024

Portfolio strategy and positioning

- The scheme invests in large and mid-cap stocks in pre-defined proportion providing the diversification benefit to investors.

- Identify companies from the universe with strong competitive position in a good business and having quality management.

- Focus on fundamental driven investment.

- Following bottom up approach to stock selection and looking at intrinsic value.

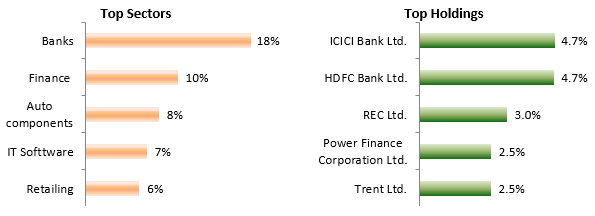

The scheme is currently reasonably balanced between large caps and mid / small caps. The large cap allocation of the portfolio is 44%, while midcap is 36%. Around 16% of the portfolio is allocated to small caps. The chart below shows the top sectors and holdings of the scheme.

Source: LIC MF February Factsheet, as on 29th February 2024

Why invest in LIC MF Large & Midcap Fund now?

Midcaps and small caps were strongly in favour with retail investors over the past year or so, as these two market cap segments outperformed large caps by a wide margin. However, we have seen deep cuts in midcaps and small caps over the past few weeks since SEBI issued an advisory on froth (high valuations) building in these market cap segments. In last one month (ending 20th March 2024) midcaps and small caps have declined by 6 to 10%. In these market conditions balanced market cap allocations will reduce your portfolio volatility.

At the same time, the outlook for midcaps in the long term remains strong. The Indian economy has strong resilience amidst slowdown in other major economies. The changing global supply chain dynamics e.g. China + 1 strategy is likely to benefit Indian companies. In the medium to long term, midcap Indian companies are likely to benefit from the structural reforms made by the Government e.g. shift from unorganized to organized, Make in India, digitization of payments (Digital India) etc. In our view, you should have allocations to midcaps to benefit from the long term India Growth Story.

The US Federal Reserve in the recently held FOMC meeting indicated 3 possible interest rate cuts in 2024. This has cheered global equity markets and risk sentiments of Foreign Institutional Investors. The International Monetary Fund (IMF) has projected India to be the fastest growing G-20 economy in CY 2024. Accordingly, one can expect India to get higher percentage to FIIs emerging market allocations. This can benefit both large and midcap stocks.

Who should invest in LIC MF Large & Midcap Fund?

- The fund is suitable for the investors who are looking for capital appreciation with a long-term investment horizon.

- Those who have moderately high risk appetite and may want to invest in both large-cap and mid-cap stocks.

- Those who would like to invest in stocks of large cap & midcap category.

- You can invest either in lumpsum or SIP depending on your financial situation and investment needs.

- If you are worried about volatility, you can also invest in the scheme through 3 to 6 months Systematic Transfer Plan (STP) from LIC MF Liquid Fund.

- Those who have an investment horizon of more than 3 years.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Large & Midcap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY