Motilal Oswal curated funds basket: Aim to transcend growth effortlessly

The market has rallied after Israel and Iran agreed to cessation of hostilities. Crude prices which rose to nearly $78 per barrel reassuring investor risk sentiments. FII flows continue to be robust despite geopolitical and global trade uncertainties. Valuations have moderated across market capitalization segments after the sharp correction from September to March. However, there are concerns about the US economy slowing down (as per US Fed's latest FOMC meeting's statement) and the fluid situation in ongoing trade talks between United States and its trading partners.

Markets are unpredictable; they can be up one day and down another day. However, your financial goals do not change. You should remain disciplined and continue to invest for your financial goals. Motilal Oswal Mutual Fund has come up with a basket of three equity funds, which are designed to ride out uncertainty and capture opportunity - with sharp focus on quality.

Why Motilal Oswal mutual funds?

- Motilal Oswal is one of the most trusted names in the asset management industry as far as equities are concerned. Many Motilal Oswal MF equity schemes are among the top / upper quartiles performers in their respective categories.

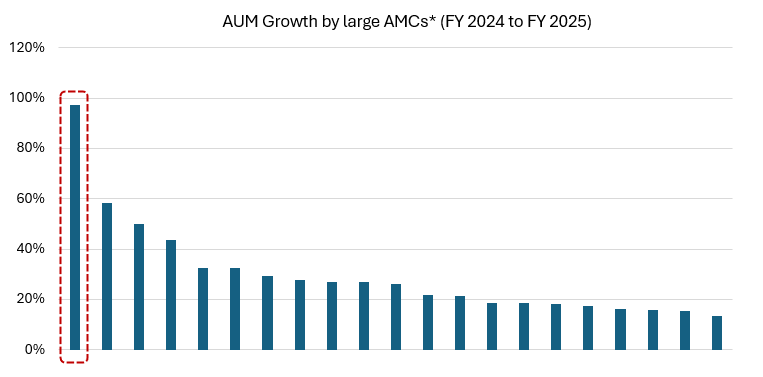

- The chart below shows the assets under management (AUM) growth of the AMCs (we have only considered AMCs which have sufficiently long history and minimum Rs 50,000 crores of AUM) from FY 2024 to FY 2025. Motilal Oswal MF circled in red enjoyed the highest AUM growth in the last fiscal. While the mutual fund industry AUM grew at a healthy rate of 25.8%, Motilal Oswal AMC AUM almost doubled, growing at a whopping 97%.

Source: AMFI, Advisorkhoj Research, as on 31st March 2025. Only AMCs that had minimum Rs 50,000 crores of AUM as on 31st March 2024, were considered for this analysis

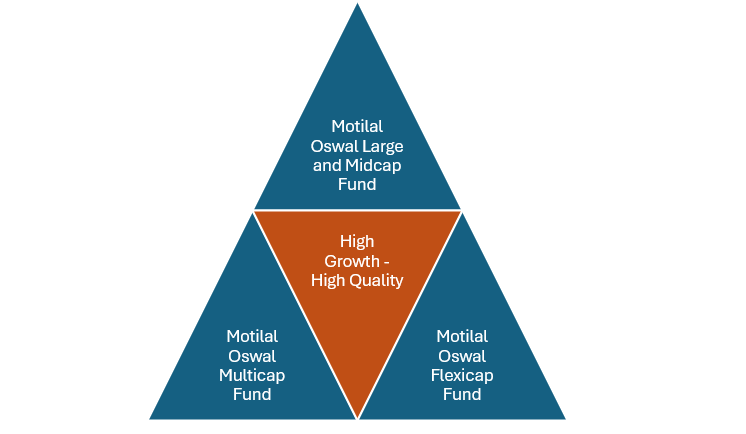

- Motilal Oswal MF's performance is anchored on its key philosophy – high quality, high growth.

- The fund managers aim to invest only in high-quality businesses with a proven track record of earnings growth.

- The fund managers strongly prefer this future growth potential to be available at attractive valuations

- Motilal Oswal AMC has strong track-record of spotting and investing in multi-bagger stocks.

With that, let us introduce the three funds that truly reflect Motilal Oswal AMC's investment DNA in the context of today's market conditions.

Motilal Oswal Large and Midcap Fund

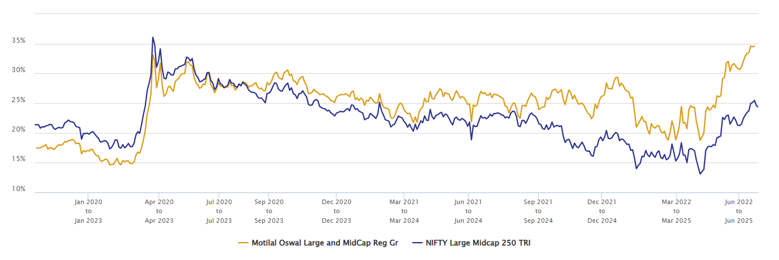

The fund invests primarily in large cap (minimum 35% exposure) and midcap (minimum 35% exposure) stocks. Large caps provide stability and liquidity, while midcaps offer growth potential. The fund may be suitable in current global macro environment where there both near term risks and longer term opportunities. Large caps can limit downside risks in volatile market, while midcaps can capitalize on opportunities. The fund is a strong performer; see the 3 year rolling returns of the fund versus the benchmark index since inception of the fund in the chart below.

Source: Advisorkhoj Research, as on 24th June 2025

The median 3 year rolling returns of the fund (25.84%) is significantly higher than that of the benchmark index (22.11%). The consistent outperformance of the fund versus its benchmark across different market conditions makes it a compelling choice for long term investors, who want to prepare both for risk and rebound.

Motilal Oswal Multicap Fund

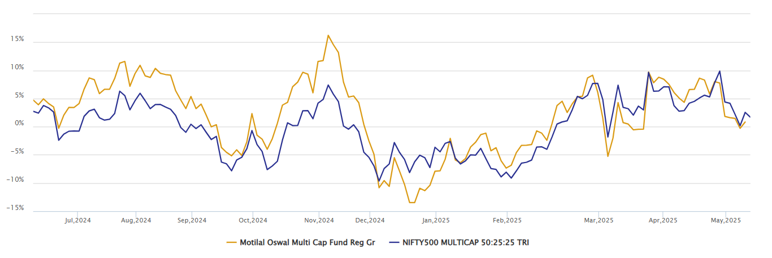

Motilal Oswal Multicap Fund is a new fund, which just completed one year. The fund invests across market capitalization segments i.e., large cap, midcap and small cap (minimum 25% in each segment). It is tailor made for investors who want exposure all three market cap segments. Each market cap segment has its own risk / return characteristics. Meaningful allocations (25% or higher) to all the market cap segments will not provide more diversification, it will also provide exposure to investment opportunities that are unique to a market cap segment e.g., small caps provide varied set of investment opportunities in sectors where large caps do not have presence. Though Motilal Oswal Multicap Fund is new, it has outperformed the benchmark index – the chart below shows the 1 month rolling returns of the fund versus the benchmark index.

Source: Advisorkhoj Research, as on 24th June 2025

You can see that the fund has outperformed the benchmark in both up and down markets. In the last 1 year the up-market capture ratio of the fund was more than 200% (where 100% means capturing the entire market upside), while the down-market capture ratio of the fund was 86% (which means that if the market fell by 1%, the fund's NAV fell by only 0.86%). Motilal Oswal Multicap Fund is diversified, dynamic, and built for any kind of market cycle.

Motilal Oswal Flexicap Fund

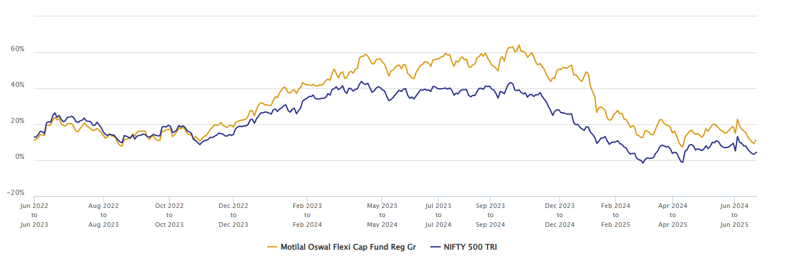

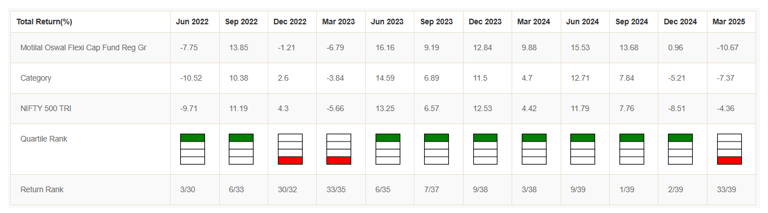

The fund invests dynamically across market cap segments. There are no allocation constraints for one or more market cap segment. The fund manager is empowered to bag the most promising ideas, no matter the market cap. The fund has made a strong turnaround in the last 3 years and is consistently outperforming the benchmark index – see the 1 year rolling returns of the fund versus the benchmark over the last 3 years in the chart below.

Source: Advisorkhoj Research, as on 24th June 2025

The fund figured in the Top Quartile in 9 out of the last 12 quarters, embellishing its reputation as one of the strongest performers in the flexicap category.

Source: Advisorkhoj Research, as on 24th June 2025

The key ingredient in the recipe of strong outperformance of Motilal Oswal Flexicap Fund, as well as the other two funds (Motilal Oswal Large and Midcap and Motilal Oswal Multicap) is stock selection – investing in powerful ideas. Motilal Oswal AMC has been leveraging its decades of equity expertise, innovative research and deep experience to craft portfolios positioned for growth – delivering alphas to investors.

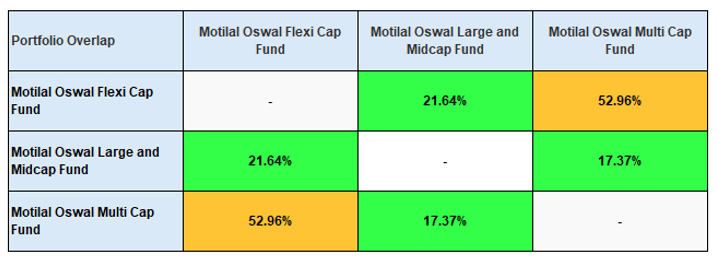

Can you invest in all three funds?

The table below shows the portfolio overlap between the three funds. You can see that there is reasonably low overlap between them. In other words, each offer sufficiently differentiated investment opportunities, which can play distinct roles in your core equity portfolio and your growth journey towards your financial goals.

In conclusion

- Motilal Oswal has a vaunted reputation in stock picking. Fund performance matters the most and Motilal Oswal has excelled in that regard.

- Motilal Oswal MF has earned the trust of investors on the back of robust performance.

- Investor's trust and confidence in Motilal Oswal is evidenced in the AUM and folio growth. In a year where the mutual fund industry grew folios by 36%, investors' trust in Motilal Oswal AMC resulted into a staggering 218% growth in our folios. That's nearly 7x the industry.

- Motilal Oswal MF's basket of offerings with three funds – Motilal Oswal Large and Midcap Fund, Motilal Oswal Multicap Fund and Motilal Oswal Flexicap Fund highlights the AMC's understanding of the pulse of the market and investor expectations

- All 3 funds in this basket have been strong performers, outperforming their benchmark indices and peers across different market conditions

- All 3 funds have sharp focus on quality

- You can select a fund from this basket based on your risk appetite and investment needs

- You can also invest in all 3 funds as additions to your core equity portfolio

Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Large and Midcap Fund, Motilal Oswal Multicap Fund and Motilal Oswal Flexicap Fund can be suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

LATEST ARTICLES

- Motilal Oswal Financial Services Fund NFO: Investment for Long Term Capital Appreciation

- Motilal Oswal Digital India Fund: Investment in the future of the Digital Innovations

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY