Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

Motilal Oswal large and midcap Fund has completed 3.8 years since launch. Though we usually review funds that have completed at least 5 years, Motilal Oswal large and midcap fund has caught our attention because it has been the best performing fund in the large and midcap category in the last one year (see our Best performing Funds – Equity: Large and Midcap). We think 3 years plus performance period is good enough to evaluate the performance of an equity fund across different market conditions. Since Motilal Oswal large and midcap fund was launched we saw several large market corrections e.g. COVID-19, Russia Ukraine War etc. Despite these large corrections, if you had invested Rs 1 lakh in the NFO Motilal Oswal large and midcap fund, the value of your investment would have nearly doubled in less than 4 years at a CAGR of 18.95 (as on 30th June 2023).

What are Large and Midcap Funds

According to SEBI’s directive large and midcap schemes must mandatorily invest at least 35% of its assets in large cap stocks and at least 35% of its assets in midcap stocks. SEBI classifies the top 100 stocks by market capitalization as large cap stocks and the next 100 stocks by market capitalization as midcap stocks. SEBI’s mandate for large and midcap schemes is quite flexible allowing considerable freedom to fund managers in terms of market cap mix according to their outlook.

Motilal Oswal Large and Midcap Fund - Overview

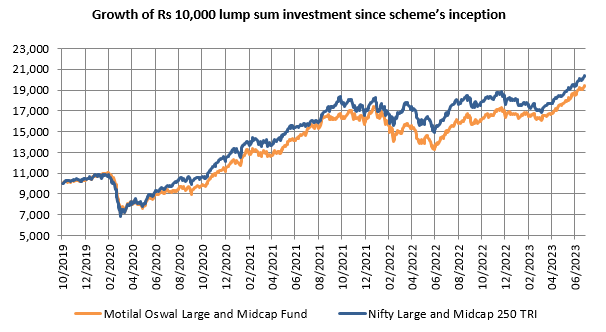

Motilal Oswal large and midcap fund was launched in October 2019. The scheme has Rs 1,829 crores of assets under management (AUM) as on 30th June 2023. The expense ratio of the scheme is 2.05%. Rakesh Shetty, Aditya Khemani and Ankush Sood are the fund managers of this scheme. Aditya Khemani is the key fund managers of this scheme. The scheme benchmark is Nifty large and midcap 250 TRI. The scheme has given 18.95% CAGR returns since inception (as on 30th June 2023). The chart below shows the growth of Rs 10,000 investment in the fund relative to the benchmark index. You can see that the scheme’s performance has caught up with the benchmark index in the last 7 – 8 months.

Source: Advisorkhoj Research, as on 30th June 2023

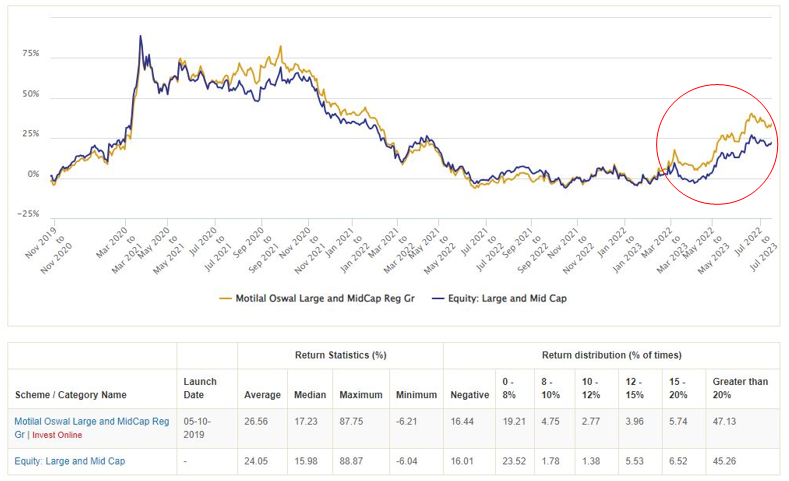

Rolling Returns

We have stated a number of times in our blog that rolling returns are the best measures of mutual fund performance because they are not biased by market conditions prevailing during a particular period. The chart below shows the 1 year rolling returns (1 year investment tenures rolled daily) of Motilal Oswal large and midcap fund versus the large and midcap funds category since the scheme’s inception. The category rolling returns is the simple average of 1 year rolling returns of all the schemes in the large and midcap category over the said performance period i.e. since the inception of Motilal Oswal large and midcap fund. You can see that the scheme outperformed the large and midcap funds category (see average rolling returns of the scheme versus category average). What is even more encouraging is that outperformance has widened over the last few months / quarters (see portion of the chart circled in red).

Source: Advisorkhoj Rolling Returns, as on 19.07.2023

The average and median 1 year rolling returns of Motilal Oswal large and midcap fund since the scheme’s inception were 26.56% and 17.23% respectively beating the category average statistics.

We also looked at the rolling returns of Motilal Oswal large and midcap fund versus the category average for 2 year investment tenures (rolled daily) since the inception of the scheme. You can see that the scheme was able to beat the category more consistently over 2 year investment tenures. Over 2 year investment tenures since the inception of the scheme, Motilal Oswal large and midcap fund was able to give 15%+ CAGR returns in nearly 80% of the instances.

Source: Advisorkhoj Rolling Returns, as on 19.07.2023

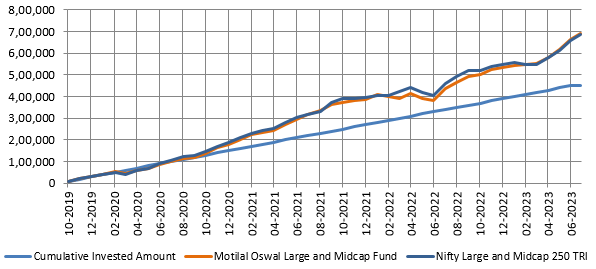

Wealth creation by SIP

The chart below shows the growth of Rs 10,000 monthly SIP in Motilal Oswal large and midcap fund since the inception of the scheme. With a cumulative investment of Rs 4.5 lakhs your investment would have grown to more than Rs 6.92 lakhs (as on 19th July 2023). The SIP XIRR in the last 5 years was around 23.67%. The SIP XIRR of the benchmark index, Nifty Large and Midcap 250 TRI over the same period was 23.17%. In terms of SIP performance, the scheme was able to beat the benchmark index.

Source: Advisorkhoj SIP Calculator

About Motilal Oswal Mutual Fund

Motilal Oswal is one of the most trusted names in the financial services industry. As an organization, Motilal Oswal has extensive and intensive expertise in equity research (250+ companies, 20 sectors). The fund house has its own skin in the game. The largest investors in Motilal Oswal Mutual Fund schemes are its promoters. The fund house has a long track record of performance across many equity product categories.

Investment process / philosophy of Motilal Oswal (Q-G-L-P)

- Quality: Minimum threshold set for ROCE/ROE

- Growth and Longevity: Ensure longevity of growth by investing in sustainable themes identified by the investment team collectively

- Price: Application of PE (Price / Earnings) and PEG (Price / Earnings Growth) framework. Expanding the framework through rolling out discounted cash-flows, implied returns and implied growth.

65% of the portfolio will adhere to the Q-L-G-P theme of Motilal Oswal fund house though bottom up stock picking. The fund manager will have flexibility of investing up to 25% outside the Motilal Oswal fund house themes. Another 10% of the portfolio can be a provision for risk mitigation.

Current investment themes of Motilal Oswal Large and Midcap Fund

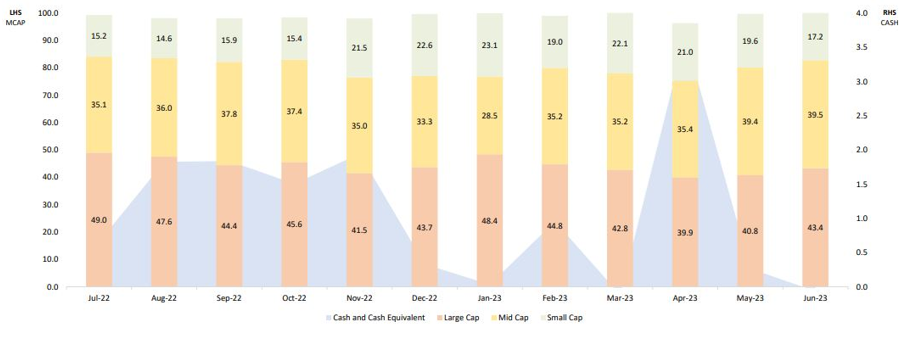

- Market Cap Strategy: Around 50% large cap and 50% mid and small cap (see the chart below).

Source: Motilal Oswal Mutual Fund

- The fund is currently over-weighted on the consumption theme with preference towards discretionary over staples.

- The fund is also over-weight on healthcare as a proxy to domestic consumption, playing it across healthcare spectrum – pharma, hospitals, health insurance & diagnostics

- The fund is over-weight on lenders due to relatively reasonable valuation & because it is one of best sectors to play the macros

- The fund is gradually increasing exposure to capex and industrials sectors

- The fund is under-weight on IT

Why invest in Motilal Oswal Large and Midcap Fund?

- Indian economy is in a structural up cycle which will come to fore as global macroeconomic challenges recede over next few quarters. Corporate and bank balance sheets are now in best possible shape to drive capex and credit respectively. The earnings growth / valuation expectations context is turning more and more favourable.

- Both large caps and midcaps are integral to the India growth story. Both the market cap segments will benefit from the Government’s structural reforms, infra spending which is likely to have multiplier effect on private capex, digitization, shifting geo-politics and implications of global supply chain (e.g. China + 1).

- The bounce back in performance of Motilal Oswal Large and Midcap Fund is a token of confidence in the fund managers’ and fund house’s investment philosophy, strategies, and stock picking skills.

- The fund house’s investment philosophy and process with focus on quality, growth and valuations provide confidence that the fund will continue / improve upon its strong performance.

- The fund managers have combined experience of nearly 30 years. Rakesh Shetty manages 29 schemes of Motilal Oswal fund house.

Who should invest in Motilal Oswal Large and Midcap Fund?

Motilal Oswal Large and Midcap Fund is suited for someone who is looking for long term growth oriented style of equity investing with smooth experience, as the portfolios is relatively well balanced from risk management point of view.

Investors should consult with their financial advisors if Motilal Oswal large and midcap fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

LATEST ARTICLES

- Motilal Oswal Financial Services Fund NFO: Investment for Long Term Capital Appreciation

- Motilal Oswal Digital India Fund: Investment in the future of the Digital Innovations

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY