Aditya Birla Sun Life Digital India Fund -Regular - IDCW

(Erstwhile Aditya Birla Sun Life New Millenium Fund - Dividend - Regular Plan)

Fund House: Aditya Birla Sun Life Mutual Fund| Category: Equity: Sectoral-Technology |

| Launch Date: 15-01-2000 |

| Asset Class: Equity |

| Benchmark: BSE Teck TRI |

| TER: 1.87% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 4,836.82 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 31% | Exit Load: For redemption/switch-out of units on or before 30 days from the date of allotment: 1.00% of applicable NAV. For redemption/switch-out of units after 30 days from the date of allotment: Nil |

42.78

-0.16 (-0.374%)

10.96%

Benchmark: 14.94%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The primary investment objective of the scheme is to generate long term growth of capital, through a portfolio with a target allocation of 100% equity, focusing on investing in technology and technology dependent companies, hardware, peripherals and components, software, telecom, media, internet and e-commerce and other technology enabled companies. The secondary objective is income generation and distribution of IDCW.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 17.84 |

| Sharpe Ratio | 0.42 |

| Alpha | 3.42 |

| Beta | 0.88 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Digital India Fund -Regular - IDCW | 15-01-2000 | -3.74 | 2.19 | 11.84 | 13.2 | 16.25 |

| WhiteOak Capital Digital Bharat Fund Regular Plan Growth | 11-10-2024 | 4.6 | - | - | - | - |

| Edelweiss Technology Fund - Regular Plan - Growth | 06-03-2024 | 3.76 | - | - | - | - |

| SBI Technology Opportunities Fund - Regular Plan - Growth | 01-01-2013 | 1.82 | 9.45 | 14.29 | 16.33 | 16.99 |

| Motilal Oswal Digital India Fund - Regular Plan- Growth | 04-11-2024 | 1.15 | - | - | - | - |

| Franklin India Technology Fund-Growth | 22-08-1998 | -2.73 | 7.75 | 19.53 | 13.35 | 16.3 |

| ICICI Prudential Technology Fund - Growth | 03-03-2000 | -2.96 | 6.43 | 13.45 | 14.9 | 17.24 |

| HDFC Technology Fund - Growth Option | 08-09-2023 | -3.15 | 8.86 | - | - | - |

| Aditya Birla Sun Life Digital India Fund - Growth - Regular Plan | 15-01-2000 | -3.32 | 2.64 | 12.43 | 13.73 | 17.12 |

| Kotak Technology Fund - Regular Plan - Growth Option | 04-03-2024 | -4.75 | - | - | - | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments of a particular sector/ particular theme - 80% of total assets.

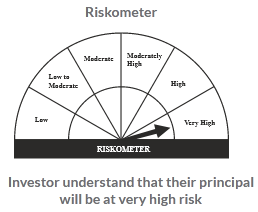

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

15.84%

Others

5.54%

Large Cap

58.51%

Mid Cap

19.52%

Scheme Documents

There are no scheme documents available