Bajaj Finserv Gilt Fund - Regular - Growth

Fund House: Bajaj Finserv Mutual Fund| Category: Debt: Gilt |

| Launch Date: 15-01-2025 |

| Asset Class: Debt |

| Benchmark: CRISIL Dynamic Gilt Index |

| TER: 1.29% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 20.76 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: - | Exit Load: Entry Load: Nil Exit Load: Nil The Trustee / AMC reserves the right to change the load structure any time in the future if they so deem fit on a prospective basis. The investor is requested to check the prevailing load structure of the scheme before investing. |

1026.6894

0.11 (0.011%)

2.52%

Benchmark: 7.15%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The objective of the Scheme is to generate credit risk-free returns through investments in sovereign securities issued by the Central Government and/or State Government(s) and/or any security unconditionally guaranteed by the Government of India, and/or reverse repos in such securities as per applicable RBI Regulations and Guidelines. The Scheme may also be investing in Reverse repo, Triparty repo on Government securities or treasury bills and/or other similar instruments as may be notified from time to time. However, there is no assurance that the investment objective of the Scheme will be achieved.

Current Asset Allocation (%)

Indicators

| Standard Deviation | - |

| Sharpe Ratio | - |

| Alpha | - |

| Beta | - |

| Yield to Maturity | 7.01 |

| Average Maturity | 17.24 |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Bajaj Finserv Gilt Fund - Regular - Growth | 15-01-2025 | 2.0 | - | - | - | - |

| ICICI Prudential Gilt Fund - Growth | 19-08-1999 | 6.35 | 7.31 | 7.76 | 6.15 | 8.11 |

| Franklin India Government Securities Fund - Growth | 07-12-2001 | 5.09 | 6.31 | 6.07 | 4.71 | 5.96 |

| Axis Gilt Fund - Regular Plan - Growth Option | 05-01-2012 | 4.58 | 7.08 | 7.25 | 5.34 | 7.08 |

| UTI - Gilt Fund - Regular Plan - Growth Option | 21-01-2002 | 4.47 | 6.68 | 6.86 | 5.23 | 7.39 |

| Baroda BNP Paribas GILT FUND - Regular Plan - Growth Option | 21-03-2002 | 4.41 | 7.06 | 7.27 | 5.14 | 6.44 |

| HDFC Gilt Fund - Growth Plan | 01-07-2001 | 4.22 | 6.54 | 6.85 | 4.99 | 6.73 |

| SBI GILT FUND - GROWTH - PF (Regular) Option | 28-11-2003 | 4.18 | 6.37 | 6.93 | 5.72 | 7.73 |

| SBI GILT FUND - REGULAR PLAN - GROWTH | 30-12-2000 | 4.16 | 6.35 | 6.93 | 5.72 | 7.72 |

| SBI GILT FUND - GROWTH - PF (Fixed Period - 3 Yrs) Option | 28-11-2003 | 4.16 | 6.35 | 6.93 | 5.72 | 7.72 |

Scheme Characteristics

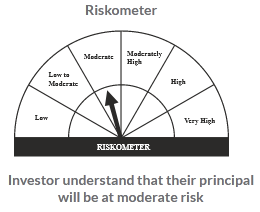

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%