Kotak Credit Risk Fund - Regular Plan - Standard Income Distribution cum capital withdrawal option

(Erstwhile Kotak Income Opportunities Fund - Annual Dividend)

Fund House: Kotak Mahindra Mutual Fund| Category: Debt: Credit Risk |

| Launch Date: 11-05-2010 |

| Asset Class: Fixed Income |

| Benchmark: CRISIL Credit Risk Debt B-II Index |

| TER: 1.71% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 706.86 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: - | Exit Load: For redemption / switch out of upto 6% of the initial investment amount (limit) purchased or switched in within 1 year from the date of allotment: Nil. If units redeemed or switched out are in excess of the limit within 1year from the date of allotment: 1% If units are redeemed or switched out on or after 1 year from the date of allotment: NIL |

13.358

-0 (-0.021%)

5.89%

Benchmark: 7.11%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The investment objective of the scheme is to generate income by investing in debt /and money market securities across the yield curve and predominantly in AA rated and below corporate securities. The scheme would also seek to maintain reasonable liquidity within the fund. There is no assurance that the investment objective of the Schemes will be realised.

Current Asset Allocation (%)

Indicators

| Standard Deviation | - |

| Sharpe Ratio | - |

| Alpha | - |

| Beta | - |

| Yield to Maturity | 7.8 |

| Average Maturity | 2.12 |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Kotak Credit Risk Fund - Regular Plan - Standard Income Distribution cum capital withdrawal option | 11-05-2010 | 8.23 | 7.56 | 7.64 | 5.76 | 5.34 |

| HSBC Credit Risk Fund - Regular Growth | 01-01-2013 | 19.78 | 13.28 | 10.97 | 8.53 | 7.16 |

| DSP Credit Risk Fund - Regular Plan -Growth | 05-05-2003 | 19.71 | 13.55 | 14.3 | 10.97 | 7.73 |

| Aditya Birla Sun Life Credit Risk Fund - Regular Plan - Growth | 05-04-2015 | 16.58 | 14.25 | 11.83 | 9.81 | 8.5 |

| BANK OF INDIA Credit Risk Fund - Regular Plan | 27-02-2015 | 11.55 | 8.78 | 7.68 | 27.14 | 2.03 |

| ICICI Prudential Credit Risk Fund - Growth | 05-12-2010 | 8.98 | 8.46 | 8.42 | 7.32 | 7.85 |

| Invesco India Credit Risk Fund - Regular Plan - Growth | 04-09-2014 | 8.73 | 7.93 | 9.23 | 6.76 | 5.71 |

| Nippon India Credit Risk Fund - Growth Plan | 01-06-2005 | 8.5 | 8.37 | 8.25 | 8.42 | 6.02 |

| Kotak Credit Risk Fund - Growth | 01-05-2010 | 8.23 | 7.56 | 7.64 | 5.83 | 6.72 |

| Axis Credit Risk Fund - Regular Plan - Growth | 15-07-2014 | 8.17 | 8.08 | 7.77 | 6.75 | 6.8 |

Scheme Characteristics

Minimum investment in corporate bonds - 65% of total assets (investment in below highest rated instruments).

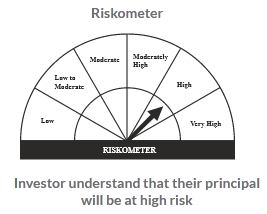

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%

Scheme Documents

There are no scheme documents available