Kotak Gilt-Investment Provident Fund and Trust-Payout of Income Distribution cum capital withdrawal option

Fund House: Kotak Mahindra Mutual Fund| Category: Debt: Gilt |

| Launch Date: 11-11-2003 |

| Asset Class: Fixed Income |

| Benchmark: NIFTY All Duration G-Sec Index |

| TER: 1.48% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 3,263.42 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: - | Exit Load: Nil |

11.6676

0.02 (0.21%)

5.71%

Benchmark: 7.11%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The objective of the Plan is to generate risk-free returns through investments in sovereign securities issued by the Central Government and/or State Government(s) and/or any security unconditionally guaranteed by the Government of India, and/or reverse repos in such securities as and when permitted by RBI. A portion of the fund may be invested in Reverse repo, Triparty repo on Government securities or treasury bills and/or other similar instruments as may be notified to meet the day-to-day liquidity requirements of the Plan. To ensure total safety of Unitholders' funds, the Plan does not invest in any other securities such as shares, debentures or bonds issued by any other entity. The Fund will seek to underwrite issuance of Government Securities if and to the extent permitted by SEBI/RBI and subject to the prevailing rules and regulations specified in this respect and may also participate in their auction from time to time. Subject to the maximum amount permitted from time to time, the Plan may invest in securities abroad, in the manner allowed by SEBI/RBI in conformity with the guidelines, rules and regulations in this respect. There is no assurance that the investment objective of the Plan will be achieved. It is however emphasized, that investments under the Plan are made in Government Securities, where there is no risk of default of payment in principal or interest amount.

Current Asset Allocation (%)

Indicators

| Standard Deviation | - |

| Sharpe Ratio | - |

| Alpha | - |

| Beta | - |

| Yield to Maturity | 7.2 |

| Average Maturity | 28.55 |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Kotak Gilt-Investment Provident Fund and Trust-Payout of Income Distribution cum capital withdrawal option | 11-11-2003 | 1.11 | 4.56 | 5.16 | 4.35 | 5.73 |

| ICICI Prudential Gilt Fund - Growth | 19-08-1999 | 5.85 | 6.89 | 7.51 | 6.21 | 8.13 |

| Franklin India Government Securities Fund - Growth | 07-12-2001 | 4.64 | 6.01 | 5.86 | 4.82 | 5.97 |

| UTI - Gilt Fund - Regular Plan - Growth Option | 21-01-2002 | 4.55 | 6.17 | 6.73 | 5.38 | 7.45 |

| Axis Gilt Fund - Regular Plan - Growth Option | 05-01-2012 | 4.34 | 6.36 | 7.02 | 5.39 | 7.1 |

| Baroda BNP Paribas GILT FUND - Regular Plan - Growth Option | 21-03-2002 | 4.05 | 6.5 | 7.03 | 5.28 | 6.46 |

| HDFC Gilt Fund - Growth Plan | 01-07-2001 | 3.95 | 6.08 | 6.58 | 5.15 | 6.76 |

| SBI GILT FUND - GROWTH - PF (Regular) Option | 28-11-2003 | 3.95 | 5.82 | 6.71 | 5.82 | 7.75 |

| SBI GILT FUND - REGULAR PLAN - GROWTH | 30-12-2000 | 3.93 | 5.81 | 6.7 | 5.82 | 7.75 |

| SBI GILT FUND - GROWTH - PF (Fixed Period - 3 Yrs) Option | 28-11-2003 | 3.93 | 5.81 | 6.7 | 5.82 | 7.75 |

Scheme Characteristics

Minimum investment in Gsecs- 80% of total assets (across maturity).

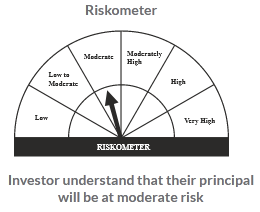

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%

Scheme Documents

There are no scheme documents available