PGIM India ELSS Tax Saver Fund - Regular Plan - Growth Option

Fund House: PGIM India Mutual Fund| Category: Equity: ELSS |

| Launch Date: 11-12-2015 |

| Asset Class: Equity |

| Benchmark: NIFTY 500 TRI |

| TER: 2.24% As on (28-11-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 500.0 |

| Minimum Topup: 500.0 |

| Total Assets: 784.17 Cr As on 28-11-2025(Source:AMFI) |

| Turn over: 45% | Exit Load: NIL |

34.83

-0.2 (-0.5742%)

13.18%

Benchmark: 12.43%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The primary objective of the Scheme is to generate long-term capital appreciation by predominantly investing in equity & equity related instruments and to enable eligible investors to avail deduction from total income, as permitted under the Income Tax Act, 1961 as amended from time to time. However, there is no assurance that the investment objective shall be realized.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 11.73 |

| Sharpe Ratio | 0.54 |

| Alpha | -2.16 |

| Beta | 0.85 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

Scheme Characteristics

Minimum investment in equity & equity related instruments - 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance).

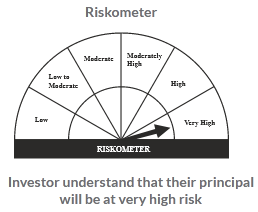

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

13.96%

Others

2.42%

Large Cap

65.06%

Mid Cap

18.56%