UTI Conservative Hybrid Fund - Regular Plan - Monthly Payment Option

(Erstwhile UTI - MIS-Advantage-Monthly Payment)

Fund House: UTI Mutual Fund| Category: Hybrid: Conservative |

| Launch Date: 16-12-2003 |

| Asset Class: Mixed Asset |

| Benchmark: NIFTY 50 Hybrid Composite Debt 15:85 |

| TER: 1.82% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 25000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 1,703.12 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 31% | Exit Load: For subscriptions received w.e.f. May 17th, 2018, applicable Exit load: Redemption/Switch out within 1 year from the date of allotment : (i) Upto 10% of the allotted Units - NIL (ii) Beyond 10% of the allotted Units- 1%. |

70.1519

0.45 (0.6437%)

9.19%

Benchmark: 9.74%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The primary objective of the scheme is to invest predominantly in debt and money market instruments and part of the portfolio into equity/equity related securities with a view to generating income and aim for capital appreciation. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 4.21 |

| Sharpe Ratio | 0.97 |

| Alpha | 1.75 |

| Beta | 0.67 |

| Yield to Maturity | 7.42 |

| Average Maturity | 10.1 |

PEER COMPARISON

Scheme Characteristics

Investment in equity & equity related instruments - between 10% and 25% of total assets; Investment in Debt instruments - between 75% and 90% of total assets.

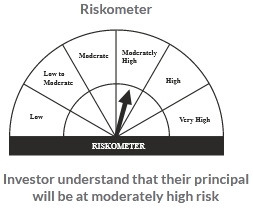

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

4.05%

Others

75.41%

Large Cap

15.59%

Mid Cap

4.95%

Scheme Documents

There are no scheme documents available