Nippon India Passive Flexi cap FOF: Market and industry wisdom in a passive scheme

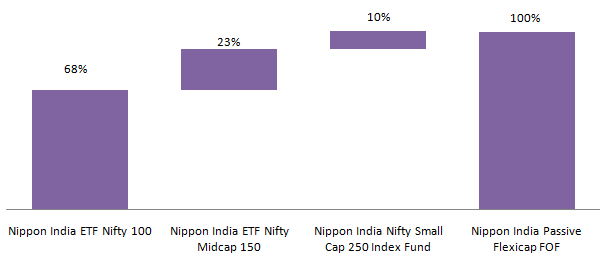

Nippon India Passive Flexi cap Fund of Funds is a fund of funds (FOF) which invests across all three market cap segments i.e. large cap, midcap and small cap. The fund was launched in December 2020 and has given 33% CAGR returns since inception (as on 3rd September 2021). The fund of funds follows a passive strategy by investing in exchange traded funds (ETFs) and index funds of different market segments:-

- Nippon India ETF Nifty 100 (Large Cap)

- Nippon India ETF Nifty Midcap 150 (Midcap)

- Nippon India Nifty Small Cap 250 Index Fund (Small Cap)

Capture market and industry wisdom

Since Nippon India Passive Flexi cap Fund of Funds invests in ETFs and index funds tracking market indices i.e. Nifty 100, Nifty Midcap 150 and Nifty Small Cap 250, there is no unsystematic risk in the scheme. The scheme aims to capture the market wisdom. The market cap allocation of the FOF is based on the mutual fund industry’s previous month multicap market segment allocation as provided by CRISIL. The rationale behind the market cap strategy is to capture the industry wisdom.

Why Flexi cap?

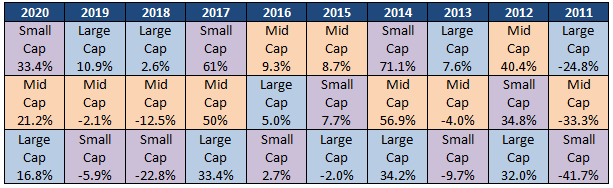

Past data shows market cap segment winners tend to rotate regularly between large, mid and small caps (please see the table below). It is difficult to predict how long a particular market cap segment will outperform. Therefore, staying invested across market caps may help generate potentially better returns over the long run.

Did you know the difference between multi cap and flexi cap mutual funds?

Source: Nippon India Mutual Fund. Disclaimer: Past performance may or may not be sustained in the future.

Diversified equity funds which invest across market cap segments have traditionally been very popular with mutual fund investors. As on July 2021, funds in the flexi cap and multicap categories, which invest across all market cap segments, had more assets under management (AUM) as large cap funds, which is the single most popular equity fund category. In fact, flexi cap funds had almost the same AUM as large cap funds in July 2021, with 17% share of equity fund AUM.

You may like to know more about flexi cap funds – Please read this.

Why follow market wisdom?

- Fund managers of actively managed mutual funds have to be overweight / underweight on certain stocks / sectors relative to the benchmark index in order to beat the index. This gives rise to unsystematic risks in addition to market risk. There is no unsystematic risk in ETFs – only market risks.

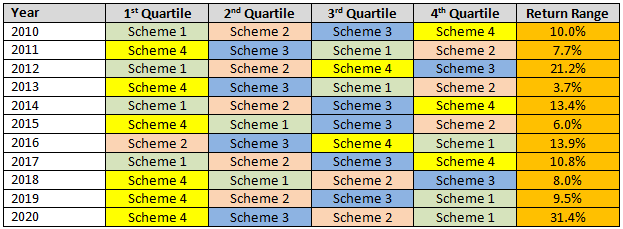

- Relative performance of schemes can fluctuate over the years. For example, four schemes from four different quartiles (first to fourth) had different quartile ranks in different years (see the table below). The return range is the difference between the best performing scheme and the worst performing scheme. The table shows that it is very hard to predict which scheme will outperform in the long term. It may be more prudent to follow what the entire market is doing.

![Relative performance of Nippon India Passive Flexi cap Fund of Funds can fluctuate over the years Relative performance of Nippon India Passive Flexi cap Fund of Funds can fluctuate over the years]()

Source: Nippon India Mutual Fund. Disclaimer: Past performance may or may not be sustained in the future.

- ETFs and index funds invest in a basket of stocks representing a market index. The cost or Total Expense ratios ETFs and index funds are much less than the cost of actively managed mutual funds. Lower cost can result in significantly higher returns over long investment horizons.

Suggested reading: Why passive investing makes a lot of sense for long term SIP investor

Why follow industry wisdom?

Diversified equity funds with multicap or flexi cap mandates have historically been able to capture varying market trends. You can see that the asset management companies, on an average over time, were able to correctly capture market trends even though individual schemes may have outperformed or underperformed. It may therefore, be prudent to follow industry wisdom.

Source: Nippon India Mutual Fund. Disclaimer: Past performance may or may not be sustained in the future.

Current portfolio of Nippon India Passive Flexicap Fund of Funds

Source: Nippon India Mutual Fund (as on 31st July 2021).

Performance of Nippon India Passive Flexicap Fund of Funds

Source: Advisorkhoj Research (as on 31st August 2021). Disclaimer: Past performance may or may not be sustained in the future.

Why invest in Nippon India Passive Flexi cap Fund of Funds?

- Wealth creation over long investment horizon by investing across market cap segments

- Allocation between large, mid and small cap decided by collective industry wisdom. No fund manager biases

- Investments in ETFs and index funds ensure no unsystematic risks

- Low cost as FOF invest in ETFs and index funds

- Consistent returns with lower downside risks (based on back-testing results)

Investors should consult with their financial advisors to see if this fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY