Why investments in large cap based index funds / ETFs matter in your portfolio?

Large cap based passive funds are among the most popular index funds and ETFs. Among 170 equity ETFs trading in the stock market, nearly 40% ETFs are large cap based ETFs. Large cap based ETFs and index funds are among the oldest passive funds and also account for a sizeable percentage of assets under management AUM. In this article we will discuss why large cap based index funds or ETFs should be an important part of your core investment portfolio.

Why should large cap be part of your core portfolio?

- Large cap companies are market leaders in their industry sectors

- They have robust business models and strong balance sheets

- These companies have high percentage of institutional ownership (FII and DII)

- Large cap companies tend to be more resilient in recessions compared to mid and small cap companies

- Large cap stocks are highly liquid

- Large cap stocks tend to be less volatile than mid and small cap stocks

Large cap ETFs / index funds versus active funds

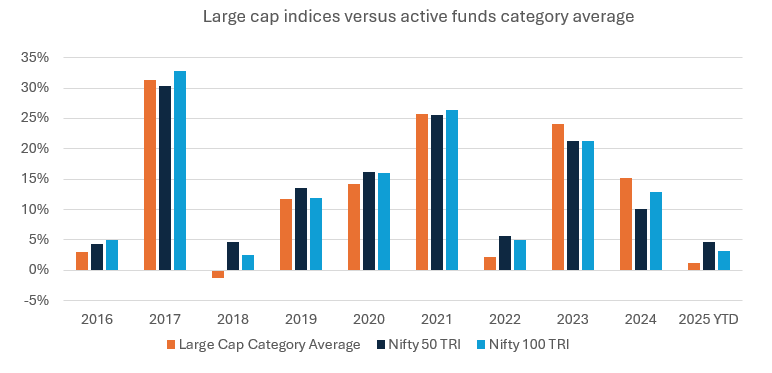

Active funds aim to beat the benchmark index returns, while passive funds aim to track the benchmark. While active funds may beat the benchmark returns in certain periods, they may underperform relative to the benchmark in other periods. The chart below shows the annual category average returns of actively managed large cap funds versus Nifty 50 and Nifty 100 indices over the last 10 years. You can see that Nifty 100 beat active large cap category average in 7 out of last 10 years, while Nifty 50 beat active large cap category average in 5 out of last 10 years.

Source: Advisorkhoj Research, as on 14th May 2025

Outperformance of passive funds across different market conditions

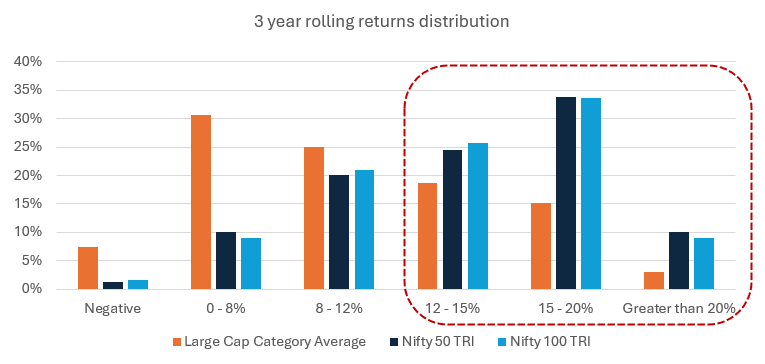

The chart below shows the distribution of 3 year category average rolling returns versus Nifty 50 TRI and Nifty 100 TRI across different return ranges over the last 10 years. On an average, active large cap funds gave 12%+ CAGR returns in 37% instances (observations). Nifty 50 TRI and Nifty 100 TRI, on the other hand, gave 12%+ CAGR returns in nearly 70% instances (observations). We should clarify here that, we are only referring to category average here, individual funds may outperform the benchmarks.

Source: Advisorkhoj Research, as on 14th May 2025

Why invest in large caps now?

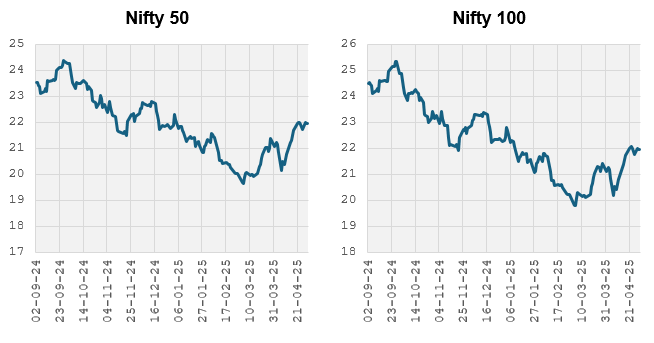

After months of volatility, the market is in a consolidation phase after the Trump Administration announced a 90 day pause on tariffs and cessation of hostilities between India and Pakistan after the May 7th strikes on Pakistan’s terrorist camps. However, the deep correction has moderated valuations (PE ratios) in the large cap segment to much more reasonable levels compared to the peak valuations (PE ratios).

Source: Advisorkhoj Research, as on 30th April 2025

Large Cap Passive Funds - Beyond Nifty and Sensex

Nifty 50 and Sensex passive funds are among the most popular index funds / ETFs since Nifty and Sensex are the bell weather indices of our stock market. However, there are many other investment opportunities in the large cap segment beyond Nifty and Sensex:-

- Nifty Next 50 index: Nifty Next 50 index comprises of 51st to 100th stocks by market capitalization. It is a market cap weighted index.

- Nifty 100 index: Nifty 100 index comprises of Top 100 stocks by market capitalization. It is a market cap weighted index.

- BSE Sensex Next 50 index: BSE Sensex Next 30 index comprises of 51st to 100th stocks by market capitalization listed on the BSE. It is a market cap weighted index.

VICTER framework for selecting ETFs

Points to consider in selecting large cap based index funds

- Large cap passive funds can be part for your core investment portfolio for your long-term financial goals.

- If you do not have demat account, you can invest in large cap-based index funds.

- You can invest in index funds from your regular savings through SIP.

- You should have minimum 5-year investment horizon for these funds.

- You should have high risk appetite and should remain disciplined in face of market volatility.

Investors should consult their financial advisors or mutual fund distributors if large cap-based index funds or ETFs can be suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY