Reliance Nivesh Lakshya Fund: Capturing Prevailing Long Term Yields

Many investors have mixed experience with long term debt mutual funds. This is primarily because, despite the nomenclature of these funds, many investors hold these funds for short tenures and aim to profits from favorable interest rate movements. However, if interest rate moves in the opposite direction, then investors do not get satisfactory returns. Therefore, investors and financial advisors view long term debt mutual funds as risky investments because these funds can be volatile in the short term.

We have discussed a number of times in our blog that bonds, which are underlying securities of debt funds, have two fundamental characteristics – Yield to Maturity and Modified Duration. Yield to maturity (YTM) of a bond is the anticipated return on the bond, if it is held to maturity. Modified Duration, which is closely related to bond duration, is the price sensitivity of the bond to interest rate changes. When investing in short term debt mutual funds, yield to maturity is understandably, the most important consideration for investors. Since modified duration of short term debt mutual funds is relatively low, these funds are relatively less volatile with interest changes.

For long term debt mutual funds, on the other hand, Modified Duration is the most important consideration for investors. If the Modified Duration of a debt mutual fund is 8 years then a 0.5% fall in interest rates in a year will generate an extra return of 4%, often taking overall returns to double digits – the opposite will happen if interest rates rise. Investors with high risk appetite, invest in long term debt mutual funds, while investors with low risk appetite avoid these funds. Higher YTM of long term debt mutual funds (compared to short term debt mutual funds) it seems is not an important consideration for investors. This betrays a speculative attitude towards long term debt mutual funds, among sections of investors.

Reliance Nivesh Lakshya Fund

Reliance Mutual Fund’s upcoming new fund offer (NFO), Reliance Nivesh Lakshya Fund, is a unique long term debt mutual fund scheme which aims to remove the speculative element from long term debt investing. It is an open ended long duration mutual fund scheme which provides investors with an opportunity to capture the prevailing interest rates over long tenures. Investments in long term fixed income securities predominantly Government Securities at the current yields. The fund will invest in long duration G-Secs such that the Macaulay’s duration of the portfolio will be greater than 7 years. Most of the securities would be bought and held till maturity. The portfolio will be rebalanced periodically to ensure that similar securities mix is maintained.

How does this fund aim to take out the speculative element out long term debt investing?

Long duration bonds are more sensitive to interest changes. If interest rate falls by 1%, then the price of a bond with a Modified Duration of 8 years will rise by 8%. On the other hand, if interest rate rises by 1%, then the price of a bond with Modified Duration of 8 years will fall by 8%. However, it is important for investors should understand that, if they hold the bond till maturity then the price volatility is irrelevant because the investor will receive the face value of the bond (the principal amount) on maturity. Throughout the tenure of the investment, the investor will also get interest payments (coupon) which will be the return on investment for the investor.

Interest rate risk is not a factor if your investment tenure matches the residual maturity of the bond. The fund manager of Reliance Nivesh Lakshya Fund will hold the bonds in scheme portfolio till maturity; he will not take duration calls based on changes in interest rate scenarios. Prospective investors in this scheme should also have long investment horizon to reduce investment risk. For many investors this might be a paradigm shift in how they perceive long term debt fund investments, however, in our view, Reliance Nivesh Lakshya Fund can be a suitable, low to moderate risk investment option for long term goal planning e.g. retirement planning, children’s education, children’s marriage etc. With reduced investment risk, there is a higher assurance of wealth preservation for longer term goals.

Why invest in a long duration “hold till maturity” debt fund?

Higher Yields

: We had mentioned earlier that Yield to Maturity does not seem to be an important consideration for long term debt fund investors. Investors should understand that the yield curve is upward sloping. Long duration bonds give higher yields than short duration bonds. The 10 year versus 2 year Government Bond spread is 33 basis points. Over a long investment horizon, this can result in a substantial difference in returns, especially with reinvestment risk in short duration bonds. We will discuss re-investment risk in more details later. If you have long investment tenure close to residual maturities of long duration bonds and are not worried about price volatility in the interim, then investing in long duration funds makes more sense.Capture prevailing yields because they may fall over time

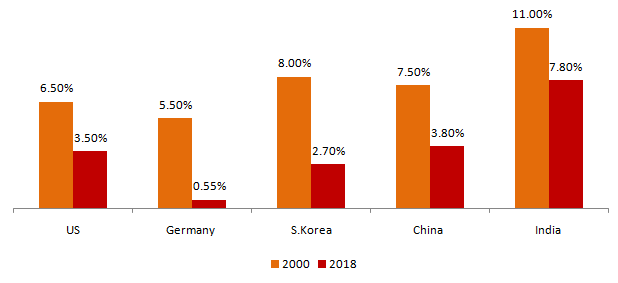

: Historical data shows that as countries transition from emerging to developed economies inflation and interest rates fall. The chart below shows the change in yield to maturities of 10 year Government Bonds of some developed and emerging countries from 2000 to 2018.

![Change in yield to maturities of 10 year Government Bonds of some developed and emerging countries Change in yield to maturities of 10 year Government Bonds of some developed and emerging countries]()

Source: Reliance Mutual Fund

You can see that countries in South Korea and China have seen massive drop off in yields. Yields fell even in India, though in percentage terms, the fall was not as sharp in South Korea or China. In the future, it is likely that yields will fall further. It is useful to remind our readers, that if you buy a bond and hold it till maturity, you will be able to lock the current YTM till the maturity of the bond. Reliance Nivesh Lakshya Fund enables you to do that.Eliminate reinvestment risk due to falling interest rates

: If you invest in a short duration bond or debt fund, you will be faced with reinvestment risk at the end of tenure. Imagine you invested in 3 year term deposit (FD) paying an interest rate of 8%. For the sake of simplicity, let us assume that the 5 year term deposit was paying the same interest. At the end of the 3 year FD term, if you renew the FD, the bank will renew it at applicable rates. If interest rate has fallen over 3 years, then there will be an opportunity loss for you.

Given the context of yields possibly coming down over the long term, it is pertinent to keep re-investment risk to the minimum. For Example, if an investor invests Rs 1 cr. into a 25 year bond at 7% yield and holds it till maturity, then his corpus grows to Rs 5.43 Crores; whereas if the same investor invests in a 3 year bond at 7% yield and reinvests the proceeds every 3 years at the then prevailing interest rates (assuming interest rates fall 10 bps every year) his corpus would become Rs 4.19 Crores in 25 years.

Potential Benefits of investing in Reliance Nivesh Lakshya Fund

- Capture current yields (interest rates) for the long term. Yields of 10-year Government Bond have been declining from 2014 till the middle of 2017; in the last one year, bond yields have risen again to nearly 8%. This is a good opportunity for long term debt fund investors to capture higher long yields of duration bonds for the long term.

- Since Reliance Lakshya Nivesh Fund will invest in Government Bonds, the investor will be insulated from credit risks.

- For long term investors, this is a highly tax efficient investment due to availability of indexation benefits on long term capital gains (investments held for more than 3 years).

- Since this is an open ended scheme, you have the flexibility to withdraw your money anytime.

- Investors can generate regular cash flows through Systematic Withdrawal Plan (SWP) with flexible withdrawal amount and frequency. (Preferably after 3 years for availing long term capital gains tax)

Conclusion

In this post, we reviewed Reliance Mutual Fund’s upcoming offer, Reliance Nivesh Lakshya Fund. This is fund is suitable for moderately conservative investors for their long term goals. We must reiterate that, you should have long investment horizon for this fund because the fund may be volatile in the short term. The NFO opens on June 18 and closes on July 02. You can contact your financial advisor or the nearest Reliance Mutual Fund office for more details.

KIM of Reliance Nivesh Lakshya Fund

SID of Reliance Nivesh Lakshya Fund

Product Note of Reliance Nivesh Lakshya Fund

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY