Best performing Children’s Fund: SBI Magnum Children’s Benefit Fund

Your children’s future is one of your most important aspirations in life. Your childhas the right to dream big and you should support their dreams. But parents have to be realist. You need to think about how much you need to save and invest to help your child fulfil his / her aspirations.

Concerns of parents

- As per an insurance survey, 35% of parents worry that they may not be able to fund their children’s higher education. Rising cost of higher education is the primary concern. Cost of higher education for courses like MBA, Medical, Engineering and Law are increasing at 10%. Assuming a similar trajectory of increase, a course which costs Rs 15 – 20 lakhs at current prices now will cost Rs 60 – 80 lakhs 15 years later.

- In recent years, more and more students are aspiring for post graduate education (e.g. MBA, CA, MD etc), and specialized courses / programs which provide better career prospects to our children. With rising levels of education, higher education costs have also increased for parents.

- With rising prosperity in our country, many parents want to send their children to foreign university for graduate or post graduate level education. If you are planning high quality foreign education for your child, then the cost will be several times higher than that in India.

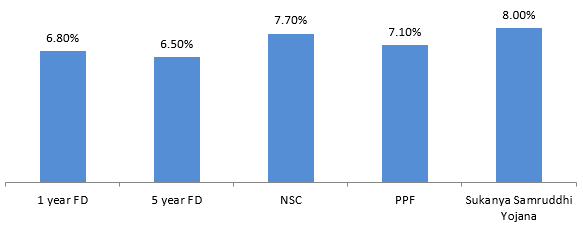

- Returns from traditional fixed income investments may not be sufficient to meet your child’s financial goals. Further, the interest rates have been declining on a secular basis over the past 20 years and are expected to fall further.

Source: SBI, India Post (as on 30th September 2023). Disclaimer: Interest rates may change in the future

How to plan for your children’s education?

- Define your goal: You need to translate the aspiration for your child into an actionable goal, specifically in quantitative terms, factoring in inflation. Once you have a quantifiable goal, you can work on it in an objective way.

- Start early: By starting early, you give yourself sufficient time to accumulate the corpus needed for your children’s education. You will benefit from the power of compounding over long investment tenure.

- Saving is not enough, you need to invest: To accumulate a sufficiently large corpus for your children’s education, you need to invest your savings in the right asset class in order toget the returns needed to achieve your child education plan goals. You should invest in mutual fund schemes of suitable risk / return profiles.

- SIP for your children’s education: Through mutual fund SIP, you can start investing from your monthly savings when your child is young and leverage the power of compounding over long investment horizons.

- Have a separate fund for children’s education: Do not invest your savings for children’s education in a general purpose fund, where you are saving / investing for other financial goals also. Have a separate fund for your children’s education, so that you do not comprise their aspirations for other priorities. You should consult with your financial advisor or mutual fund distributor if you need help in planning for your children’s education.

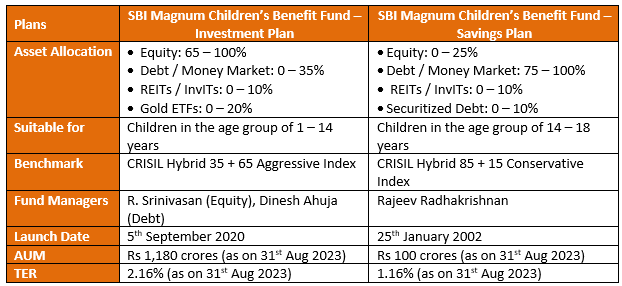

SBI Magnum Children’s Benefit Fund

SBI Magnum Children’s Benefit Fund is an open-ended fund for investment for children having a lock-in for at least 5 years or tillthe child attains adulthood (whichever is earlier). From June 2023, SEBI has allowed parents / legal guardians to invest in mutual funds for their children from their own bank accounts (parents / guardians bank accounts) or a joint account of the minor child with the parent / legal guardian. Earlier investment in your child’s name was allowed only from the child’s bank account. The regulatory has made it very convenient for parents to start investing in this fund without going through the hassle of opening a bank account in your child’s name. The fund has two plans, Investment Plan (launched in 2020) and Savings Plan (launched in 2002):-

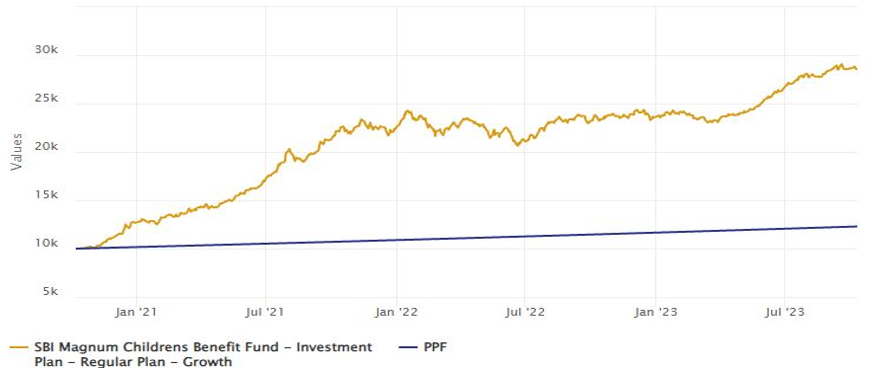

3 times returns in 3 years! SBI Magnum Children’s Benefit Fund – Investment Plan

The chart below shows the growth of Rs 10,000 lumpsum investment in SBI Magnum Children’s Benefit Fund – Investment Plan since the inception of the scheme. The fund has given nearly 42% CAGR returns since inception – your investment for your child would have nearly tripled in value in the last 3 years. SBI Magnum Children’s Benefit Fund – Investment Plan is the best performing Children’s Fund as 9th October 2023.

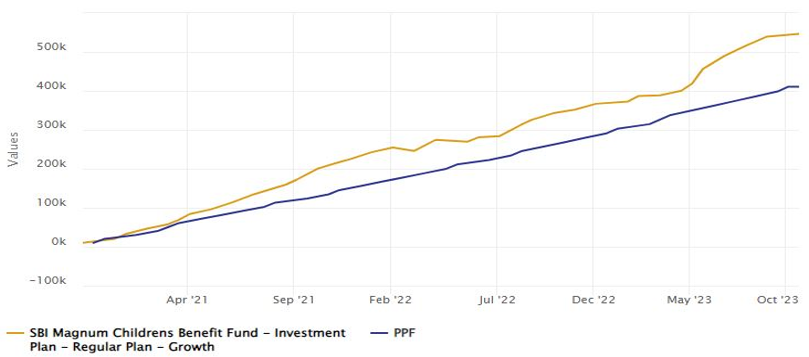

The chart below shows the growth of Rs 10,000 monthly SIP in SBI Magnum Children’s Benefit Fund – Investment Plan since the inception of the scheme. With a cumulative investment of around Rs 3.6 lakhs you could have accumulated a corpus of Rs 5.5 lakhs in the last 3 years. The SIP XIRR of the fund is nearly 22%.

Source: Advisorkhoj Research, as 9th October 2023

Performance of SBI Magnum Children’s Benefit Fund – Savings Plan

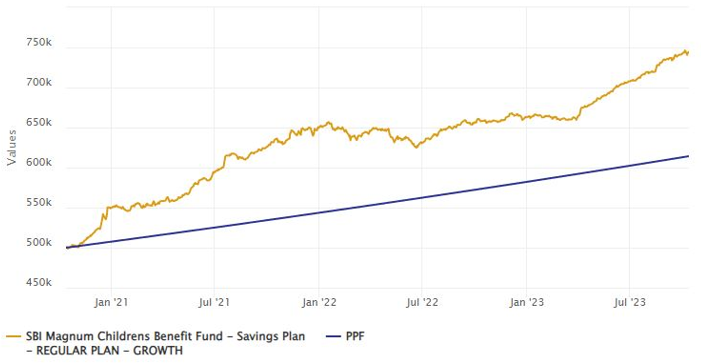

SBI Magnum Children’s Benefit Fund – Savings Plan is a debt oriented fund. The fund invests at least 75% of its assets in debt and money market instruments – this fund is suitable if you have slightly older children, who nearing their higher education goals. The chart below shows the growth of Rs 5 lakh investment in SBI Magnum Children’s Benefit Fund – Savings Plan over the last 3 years. Your investment would have grown to nearly Rs 7.5 lakhs in value (nearly 50% growth in just 3 years) at CAGR return of 14%.

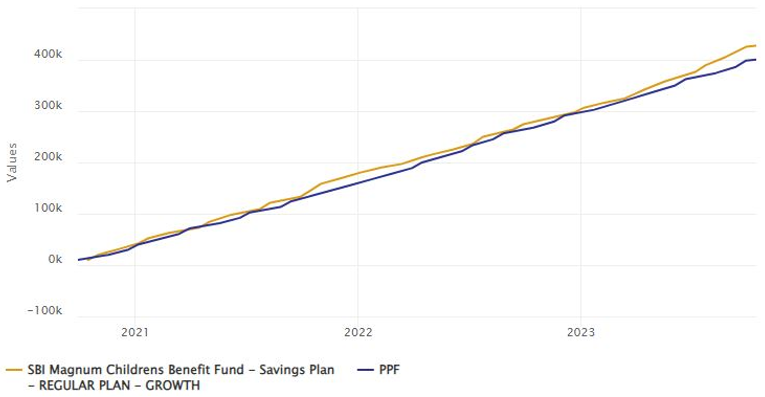

If you invested in this plan through monthly SIP of Rs 10,000 then with a cumulative investment of Rs 3.6 lakhs you could have accumulated a corpus of Rs 4.3 lakhs at a XIRR of 11.5%

Source: Advisorkhoj Research, as 9th October 2023

Conclusion

Children’s future is the most important priority of any parent. In order to ensure success of your / your children’s aspirations, you should have a plan and remain committed to it.

SBI Magnum Children’s Benefit Fund is one of the best solutions for child’s investments. You can invest in this fund either in lump sum or through SIP till your child is 18 years old. If your child is very young and you have more than a 5 year plus investment horizon, you can choose the Investment Plan. If your child is a little older say, 14 years old, which gives you less than 5 years investment horizon, you can choose the savings plan which will have significantly less risk. You should always consult with your financial advisor or mutual fund distributor, if you are in any doubt which plan will be more suitable for you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY