Demystifying Mutual Fund Myths

Mutual Fund is an investing tool that is gaining popularity among masses and willing investors. It usually generates returns more than the traditional tools of investment. Mutual Funds schemes are often more tax efficient than many other investment options. Mutual funds are also extremely flexible instruments. One can pay a small sum of Rs 500 (through SIP) and become an investor. In most cases Mutual funds also offer more liquidity than comparable asset types. While there are many advantages of Mutual Funds, there also exists certain myth which often becomes an obstacle for potential investors. If you are one such investor or you have already invested and have nagging doubts about your investment decisions, maybe it is time you read this. Here are some myths that have been demystified for potential investors and existing investors.

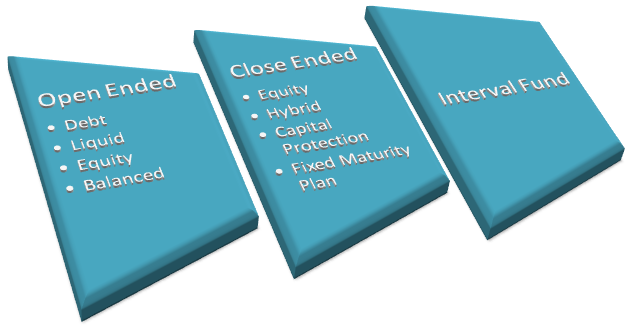

Types of various mutual funds schemes:

Mutual Funds are risky as they invest only in Equities

Mutual Funds can be broadly divided into these three categories:

The corpus created in a Mutual Fund is further invested in different asset classes like equities and fixed income instruments, gold etc depending upon the asset allocation & investment objective of the scheme. Mutual funds invest in number of stocks and debt securities as per fund’s objective and to spread the risk of investment and diversify the fund, fund manager buys variety of stocks. Funds which are Open Ended allows an investor to withdraw his investment at any time. Investors can buy or sell units any time making these type of funds liquid in nature.

- Debt funds allow investors to invest in Government and Corporate bonds carrying low to moderate risks and moderate to high returns depending upon their risk profile.

- Liquid funds allow investors to invest in money market instruments ((up to 91 days residual maturity) with very low risk and moderate returns.

- Equity funds invest in equities and the returns are market linked. Returns can be high, but so is the associated risk. However, over a sufficiently long time horizon, it has been seen that equity funds have beaten inflation and created wealth for its investors

- Balanced fund invests in equities and bonds to produce moderate to high returns at moderate risk.

Close ended funds aim at providing returns like above funds depending upon if it is debt or equity, however, the investment is locked in for a fixed period of time.

- Close ended equity funds have a specified lock in period. The lock in period ensures that fund managers do not face any redemption pressures and therefore enables the fund manager to stick to their long term convictions.

- Close ended hybrid schemes invest in both debt and equity, with twin objectives of capital appreciation and income generation.

- Capital Protection schemes are designed to safeguard the principle amount to provide moderate returns. They invest in high quality bonds along with marginal exposure to equities. The orientation towards protection of the capital originates from the portfolio structure of the Scheme and not from any bank guarantee, insurance cover etc.

- Fixed Maturity Plans consist of a fixed maturity period. They carry low risk and invest in debt instruments of maturities which are aligned with the maturity of the FMP. This reduces re-investment risks and therefore a high degree of stability with respect to returns.

Hence, one can conclude that Mutual Funds provide varying avenues of investment and not just equities. Investors are free to choose a scheme based on their risk appetite and personal financial goals.

Mutual Funds are only for Experts

Mutual Fund is no rocket science. To be able to invest in Mutual Funds you need to have a basic understanding of the scheme. The details regarding schemes are available in the Asset Management Company’s (AMC) website. The product literature and the various public disclosures equip you with knowledge about a scheme. You should also consult your financial advisor regarding the same.

Mutual Funds are managed by experts and they are called Fund Managers. Every AMC has their Fund Managers who have the knowledge and experience of the stock & bond markets. They will endeavor that the investments goals are fulfilled and returns generated as per scheme’s objective. Hence, you do not have to be an expert but get help of these experts.

Lump sum is required to invest in Mutual Funds

There are two modes of investing in Mutual Funds:

- Lump sum or one time

- Systematic Investment Plan (SIP)

It is not mandatory to invest a lump sum. SIP is a mode of investment where an investor invests a pre determined amount every month in Mutual Fund schemes. The minimum lump sum investment amount for all schemes, except ELSS, is normally Rs 5000. However for SIP, the monthly installment could be as small as Rs 500 per month. For equity linked savings schemes or tax saver funds as they are commonly known, the minimum lump sum investment amount is as low as Rs 500.

Mutual Fund SIPs are only for small investors

SIP is a convenient mode of investment. Minimum investment through SIP in a scheme is generally Rs 500 and there is no maximum limit. Investments done through SIP take advantage of volatility by applying the principle of rupee cost averaging in the investments. Hence, if you wish to invest a lump sum of Rs 100,000 every month or meager Rs 500, the choice is yours.

Lower NAV = Good Scheme

This is one of the most common myths that investors hold.. A scheme with a NAV of Rs 30 rose to Rs 36. Another scheme with a NAV of Rs 400 rose to Rs 480. As an investor you might be inclined to invest in the first scheme as for a lower NAV you will be able to buy more units, with the same amount of investment. However, both the schemes had a 20% rise so buying the first scheme over the other does not give you any particular advantage. The same principle applies to NFOs as investors feel they are giving units at par value. To decide on a particular scheme one should look at the performance track record, fund managers experience, historic returns, expense ratio and volatility of the fund.

Only Demat Account holders can invest in Mutual Funds

Demat Account is mandatory for investing in the equity markets directly but not mutual funds. A Mutual Fund requires the investors to get a ‘Know Your Customer’ or KYC done. Filling up of a single KYC is sufficient to make multiple investments. You can keep your mutual funds in Demat account also along with your equities, however it is not mandatory.

SIP Mutual Fund scheme are different from lump sum Mutual Fund schemes

Systematic Investment Planning is a mode of investment and hence, benefits from a scheme or the possible returns are not affected by the mode of investment. The lump sum and SIP amounts collected by AMCs are put in the same scheme. SIPs are only a tool used by investors to take advantage of market volatility through rupee cost averaging of the units.

Lump sum investment is not possible in a Mutual Fund SIP account

You can make either SIP or lump sum or both in the same account or the folio number provided by the AMC.

Penalties levied on missed SIP dates

One of the traits of a good investor is to ensure that all the investments are continuing and payments are done at the right time. In case of auto debit, sufficient balance should be maintained in the bank account. However, if on any of the months you are unable to make the monthly investment no fines are levied by the AMCs. For a fixed sum of investment every month investor buys certain units of the fund. If for a month this investment is not done, the units are not purchased. SIPs are not like loan premiums, where a missed premium comes with a penalty. However, some banks do debit bank charges in case of missed SIP payments which must be checked with your respective banks.

Latest top performing funds are better

Decision to invest in mutual funds should be made only after thorough product knowledge. A singular aspect of a fund should not be the sole decisive factor. The performance of the funds should be taken into consideration but that does not make it better than the other funds available in the market. A fund with a consistent performance track record could be a better option than a fund that has suddenly spiked its performance.

Investing in a large number of funds means more profit or risk diversification

Investors often tend to go for quantity rather than quality assuming more numbers of funds will lead to more diversification and returns. This is unfortunately not always the case. Investing in a large number of funds of the same type results in over diversification. Over diversification may cause returns to be lower, without necessary reducing risks. For example, instead of investing in ten different types of large cap equity funds, investor can invest in a mix of large cap, multi cap, small and midcap, balanced and income funds. The amounts invested in each fund will depend on the investment objectives and time horizon of the investor. Investing in the right mix of funds will ensure more consistent returns across different market cycles and also help the investors meet their different investment objectives.

Investors must periodically book profits

There is no hardcore rule that profits have to be booked by the investors when a certain amount of returns have been generated. Sometimes investors book profits in their best performing mutual funds, while remaining invested in underperforming mutual funds. This leads to sub-optimal performance from their investment portfolio. Investors should redeem their mutual funds when the financial goal towards which the investment was made is met. An investor should usually invest in mutual funds with a particular goal and book the profits when that goal has been met.

MFs with higher rankings by third party agencies make the best buy

As an investor it is wise to exercise discretion as and when required. It is also in the investor’s best interest to check the AMCs website and read the product literature and the various public disclosures that are on the website including Scheme Information Document. Investors can use ratings issued by various research agencies as an input in evaluating their portfolio performance or fund selection, however it is very important that investors should be clear about their own investment objectives and needs. Research agencies employ their own methodology to rate funds. Investors should understand the methodology and logic of the ratings, and make sure it is aligned with their investment objectives. It is also prudent to check multiple reviews of the same product to verify its consistency and standing. The opinions or advice of a third party agency should not supersede the recommendation of your financial advisor, because your financial advisor is best positioned to understand your financial situation and needs. You can use third party research as a reference point, if you want to understand and discuss the recommendation made by your financial advisor.

In a vast country like ours the penetration of mutual funds is very low. The primary reasons are the myths and lack of investor education. We have tried addressing these myths through this blog. Investors willing to invest in mutual funds should first consult a qualified mutual fund advisor to check their risk taking appetite and then select appropriate mutual fund scheme/s suitable for their profile.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This article is for information purposes only and is not an offer to sell or a solicitation to buy any mutual fund units/securities. These views alone are not sufficient and should not be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions and estimates included here constitute our view as of this date and are subject to change without notice. Neither SBI Funds Management Private Limited, nor any person connected with it, accepts any liability arising from the use of this information. The recipient of this material should rely on their investigations and take their own professional advice

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY