What should be your debt mutual fund investment strategy in current economic climate

This year RBI has been on a trajectory of tightening interest rates in an effort to control inflation. Repo rate has been raised three times. Regular Advisorkhoj readers know that repo rate hikes by the RBI raise bond yields, cause bond prices to fall and results in lower returns, especially for long term debt mutual funds. Surprisingly, RBI did not increase the repo rate in their October monetary policy meeting despite the US Federal Reserve hiking the Fed Funds rate in September. The 10 year Government Bond yield has moderated slightly from 8.2% to 7.8%. Long duration funds and Gilt Funds were the best performing debt mutual funds in the last 1 month; these two fund categories, on the other hand, were the worst performing debt fund categories in the last 1 year.

You must read – do you know how to select debt funds and types of debt funds

In this blog post, we will discuss debt fund investment strategy in the current economic situation in India.

History of RBI interest rate actions

The chart below shows the history of RBI repo rate actions over the last 5 years. You can see in the chart below that repo rate peaked in January 2014 and since then RBI had been bringing down interest rate till August 2017. From August 2017 to June 2018, RBI maintained status quo on interest rates and then in the next two monetary policy meetings hiked the repo rate twice, each time by 25 bps. Surprisingly in the October meeting, RBI held repo rate at 6.5%, when the market was expecting a rate hike to arrest INR (Indian Rupee) depreciation.

Source: RBI

Let us now see what RBI rate actions did to the benchmark 10 year G-Sec (Government of India bond) yield in the last 5 years. You can see that the 10 year G-Sec yield was declining from April 2014 to July 2017. This was a great phase for long term debt mutual funds investors; many investors got double digit returns. Since August 2017, bond yields have been rising and this has caused long term debt fund returns to be disappointing for investors.

Source: Investing.com

Returns of different debt fund categories in the last one year

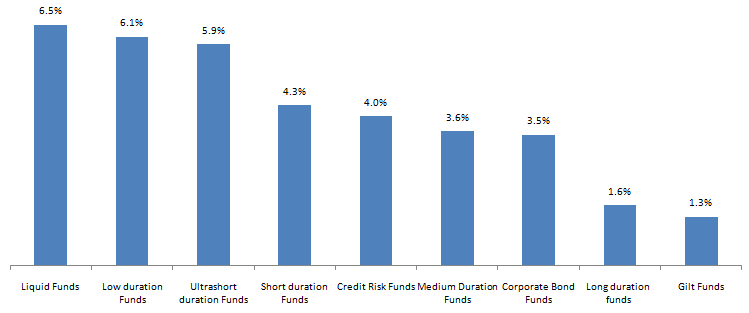

The chart below shows the returns of different debt fund categories in the last one year. You can see that shorter duration funds clearly outperformed longer duration funds. This shows that the shorter end of the yield curve presents better investment opportunities in the current interest rate environment. Please note that we are showing category average returns; individual debt mutual fund schemes may have outperformed or underperformed the category returns.

Source: Advisorkhoj Research

Here we suggest that you must read How you should invest in debt mutual funds: Short term versus Long term

Underlying factors in fixed income returns

Investors should clearly understand that the most important factor in determining future fixed income or debt fund returns in the near to medium term will be interest rates in the US. We have discussed the US Federal Reserve’s rate actions a number of times in our blog. For the benefit of new readers, we will discuss it briefly again. In the wake of the financial crisis in 2008, the US Federal Reserve embarked upon an extraordinary journey of monetary easing, which included injecting massive amounts of liquidity in capital markets through Government Bond purchasing program and also by keeping interest rates very low (close to zero percent). The Fed thought that these actions were necessary to keep the financial system in the US from collapsing, which would have contagion effects around the world.

This monetary easing continued for quite a long time, the bond purchase program (known as quantitative easing) continued for 5 years, while the very low interest rate regime continued till 2015. From 2015 onwards, Fed started raising interest rates (Fed Funds rate) in a calibrated manner to contain inflation in the US. Economists knew then that this will have an impact on the global economy, especially emerging economies like India. However, as long as the interest rate differential between India and US was wide enough, the RBI could lower interest rates to accelerate our GDP growth, without significant FII outflows.

At one point of time, however, an inflexion point would be reached, where the interest rate differential between US bonds and Indian bonds would make US Treasury bonds more attractive for investors, from a risk return perspective. That point was reached about 15 months back; bond prices in India started falling and yields rose. Rising yields affect long term (or long duration bonds) much more than short duration bonds. This explains why short or very short duration debt funds outperformed long duration debt funds.

What exacerbated this situation was the accelerated decline of the INR. What caused the accelerated decline? We are a major importer of crude oil for domestic consumption. The price of crude increased from $50/ barrel to $75/ barrel in the last 1 year – an increase of 50%. You need US dollars to purchase crude oil in international markets; when demand for dollar increase, INR will decline in value relative to dollar. The rise in crude prices has put tremendous pressure on the INR.

You should understand that foreign investors in India are interested in dollar returns. Even if investors get higher yields from Indian bonds, if the Rupee declines faster relative the US Dollar (USD), foreign investors get lower returns. US treasury bonds are the safest asset class in the world because it backed by the strongest economy in the world; rising US Treasury bond yields relative to dollar yields in emerging market bonds is causing a flight of capital from emerging markets like India to the US.

Must read: Do you know how to select Debt Funds: Modified Duration and Volatility

Outlook

It is like a vicious cycle. The more capital outflows take place from India higher will be downward pressure of USD / INR exchange rate, which is already under pressure due to high crude prices. There are a number of economic uncertainties which are facing. The impending US sanctions on Iran will come into effect in a few days time. We import crude oil from Iran and to avoid US sanctions we will have to source crude from elsewhere. The impact of this on our currency may be adverse; we will have to wait and see. There will be downstream effect on our bond yields and debt market returns. The RBI’s monetary policy stance in October sent a signal to investors that RBI will not be putting its resources to use, to defend the Indian Rupee. This should be taken into consideration by investors. Overall, the outlook on the bond market in India is a little cloudy at this point of time.

What should your fixed income strategy be?

When outlook on bond yields is uncertain, with rising short term yields the best strategy in the near to medium term is accrual. In an accrual strategy, you hold short duration or very short duration bonds or money market instruments till maturity. In this strategy, you will earn the interest (coupon) paid by the bond and bond price changes will not affect your returns because by holding the bond to maturity, you will get the face value (price changes in the interim will be irrelevant).

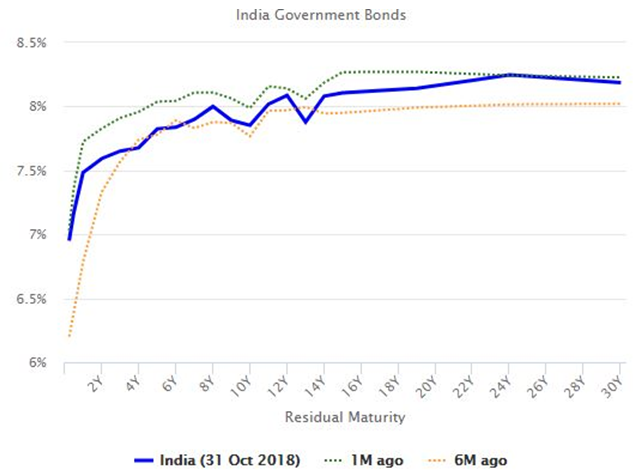

The chart below shows the India yield curve and its shifts in the last 6 months. You can see that the yield curve has shifted upwards more towards the short end compared to the longer end in the last 6 months. From a risk return perspective therefore, it makes more sense to invest in shorter end of the curve because you will get better returns relative to risk taken by investing in the longer end of the curve.

As such, in our view, for investors with shorter investment tenors (less than 3 years), it is better to invest in shorter duration funds compared to longer duration funds. You can invest in liquid funds, ultra short duration funds, money market funds, low duration funds, short duration funds etc, depending on your risk appetite. To get higher yields you can also invest in corporate bond funds or credit risk funds, but you should be clear about the risk factors before investing.

Did you know the difference between investing in short term versus long term debt funds

Conclusion

In this blog post, we discussed the factors affecting debt fund returns over the last year or so. The outlook, as discussed in this post is cloudy and there are still several risk factors. We also discussed what your fixed income strategy should be to minimize risk and get stability in returns. You should discuss with your financial advisor you debt fund investment strategy in line with your investment needs and risk appetite.

You must read – how you can invest in debt funds by understanding the risk

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY