How to be prepared for uncertain times

The stock market has surged in the last few days with the Nifty near its 52-week high. Nifty has gained nearly 6% in the last month but it has given negative returns over the last 6 months. The Nifty Midcap 100 Index has gained more than 8% in the last one month, but is down 7.5% on a year on year basis (as on March 15). Nifty Small Cap 250 TRI Index has also surged in the last one month but is down nearly 20% on a year on year basis. There are concerns about a slowdown in the US coupled with US/ China trade issues which will affect risk sentiments around the world. The upcoming elections are also adding to the uncertainty with opinion polls not giving clear majority to any party. However, the NDA seems closer to the half way mark compared to what was being projected 3 months ago. In our view, uncertainty and volatility will last till the elections and possibly, even beyond. In this blog post, we will discuss how investors can be prepared for uncertain times.

Do not try to read too much into market moves

Volatility is an intrinsic feature of equity as an asset class. The market makes different moves – upwards or downwards. These can be bull market rallies, bear market corrections, bull market pull back, bear market crashes, short covering rallies, consolidation, sideways markets, etc. Apart from bull market rallies and bear market crashes, all the other movements can be misleading. Also, these movements can be confirmed only after the fact and this makes timing the market very difficult, if not impossible. Do not take a rally over the last few days as a sign of things to come – you will be disappointed if the trajectory gets reversed. At the same time, do not let a 10 - 20% correction cause panic. The gospel truth about the equity market is that periods of growth are much longer than periods of corrections and these provide investors with good long-term returns.

Remain calm – Invest according to your risk appetite

Investment experts on TV and financial advisors urge investors to be patient and disciplined in volatile markets. This is easier said than done because nobody likes to lose money. Over the last few years, we have increasingly seen that investors have become more mature and that there has been no increase in redemptions during corrections. Although, we did see redemptions last year when midcaps and small caps suffered sharp corrections.

The question is how to remain calm in volatile markets. The answer is, to invest according to your risk appetite. Different investors have different risk appetites. Some investors may get nervous with a 10% fall in portfolio value, while other investors have an appetite to absorb a 20 – 30% loss. If you belong to the first group then you have a lower risk appetite and should invest in low to moderate risk asset classes, e.g. debt funds, hybrid funds, large cap funds, etc. These funds will fall less, when the market corrects and will not test the threshold of your patience. If you have higher risk appetites, then you can invest in multi-cap funds, midcap, small cap funds, etc. Determine your risk tolerance and invest accordingly. If you are a new investor, you can go with a moderately conservative approach and then modify your investment strategy as you gain more experience.

Focus on Asset Allocation to reduce risk

Asset allocation means diversifying your investment over different risk classes. Some assets like debt funds have lower risk profiles, while others like equity funds have higher risk profiles. Debt funds will be far less impacted by a market downturn than equity funds. Low risk debt funds can continue to generate positive returns, when equity funds are making losses. Portfolio stability will enable you to remain invested and in the long term, when the market recovers and makes fresh highs, equity funds will create wealth for you.

Suggested reading: Why smart asset allocation is crucial for retirement planning

Diversify across asset types to leverage possible opportunities

Within the broad asset classes, e.g. debt and equity, you can diversify your investments across different asset sub-classes to take advantage of any opportunities that arise. For example, in your debt portfolio, you can add some medium to long duration funds, so that you can take advantage of favorable interest rate movements. Yields have been on a downward slope, even though somewhat volatile trajectory, for the last 5 to 6 months. The RBI has signaled a move towards a more accommodative interest rate policy and this may work to the advantage of longer duration debt funds. Similarly, on the equity side, you may consider adding some midcaps to your portfolio, to take advantage of election results and an expected faster recovery in corporate earnings. These can be in the form of large and midcap funds, multi-cap funds, midcap funds etc. The proportion of riskier assets in your portfolio should be determined by your risk appetite.

Invest Systematically

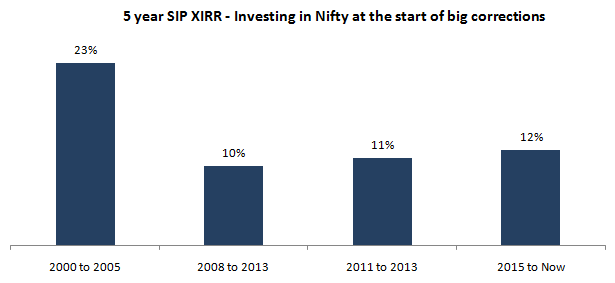

If you invest systematically through Mutual Fund Systematic Investment Plans (SIPs), then volatility will not have much of an impact on your investment returns. SIPs enable investors to take advantage of asset price volatility through Rupee Cost Averaging. We looked at 5-year SIP returns, when an investor started investing in Nifty near the start of a major correction or bear market over the last 20 years. The 4 major corrections in the Indian stock market in the last 20 years began in 2000, 2008, 2011 and 2015.

Source: Advisorkhoj Research

You can see that even in the worst bear markets, SIP investors got double digit 5-year CAGR returns. These are much higher returns than bank FDs even on a pre-tax basis. If you had gotten scared by corrections and stopped your SIPs, you would have missed out on a lot of returns. This conclusively shows, why SIPs are one the best ways to invest in uncertain or volatile markets.

Consider a hands-off approach

Many financial advisors have evidence to support that those clients who were totally hands-off, made the best returns in the long term. Often forgetting about an investment works out to be a wonderful strategy because you can remain invested for a very long time and create substantial wealth through the power of compounding. While we do not advocate a totally hands-off approach, in uncertain times, you can prevent yourself from making the wrong decisions by turning off the noise.

How can you turn off the noise? You read/ hear constant bytes in the media (print, electronic, digital, social media etc.). While there is always the desire to collect more information, it is difficult for many to discern whether they are informed views, speculation or completely irrelevant as far as you are concerned. Just go about your day to day work and don’t worry about speculation in uncertain times. You will likely do better this way.

Conclusion

Your financial goals are the most important to you. The market, economy and politics have gone through many upheavals in the past, but these factors have never changed our life-stage goals e.g. buying a house, education for children, children’s marriage, achieving financial independence after retirement etc. You need to have a financial plan and stick to it, if you want to reach your goals. Focus on your financial plan and do not worry about things which are not in your control. Consult a financial advisor, should you need help with your plan.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY