Sundaram Financial Services Opportunities Fund: Good choice after smart turnaround

Thematic and sector funds are considered to be more risky than diversified equity funds, but in certain periods of times these funds can provide a booster to your portfolio returns. For example, in the last one year, banking and financial services sector funds outperformed large cap and diversified equity funds. Median returns of banking sector funds in the last one year was 15.3%, while that of diversified equity funds was 11.6% (median returns of large cap funds was 8%).

However, investors should know that, there are periods when sector funds will underperform diversified funds. Different sectors outperform each other in different parts of economic cycles and therefore, investors should base their decision of investing in sector funds depending on the outlook for specific sectors in the market cycle. In other words, we are saying that, an element of market timing is required to get the best results from sector funds.

Banking sector is one of the most important sectors for any economy, including India. In fact, in our stock market, banking and financial services sector, arguably, plays the biggest role in determining market direction. The market recovery, in the last 6 months or so, has been led primarily by the banking stocks. On the other hand, banking stocks were among the worst hit in the correction of 2015.

While, banking sector funds can be highly volatile, over the last 3 years, banking sector funds have been amongst the best performing mutual fund categories. Given our (India’s) strengthening macros (GDP growth, declining fiscal deficit, inflation etc) and RBI’s commitment to lower interest rates in the long term, we believe that, banking sector funds are poised to do well over the next 3 – 5 years, the NPA woes (which fund managers believe are mostly discounted in prices) and US interest rate hike notwithstanding.

In this post, we will review Sundaram Financial Services Opportunities Fund, banking and financial services sector fund. The fund has staged a smart recovery over the last 2 years or so, after a few years of relative underperformance, and is now worth looking at from an investment perspective over a 3 – 5 years investment horizon. The fund has consistently been in the top two quartile over the last two years (please our research tool, Top Consistent Mutual Fund Performers).

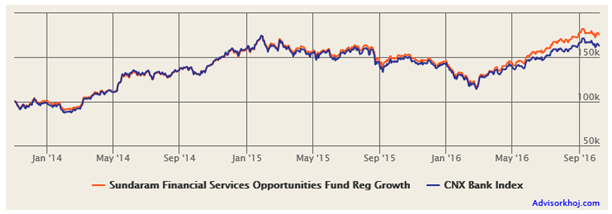

In the last one year the fund has given 15.7% returns comfortably beating the category average returns (14.1%). Over the last 3 years, the fund has given 26% compounded annual returns. The chart below shows the growth of र 1 lakh lump sum investment in the fund from August 1 2013, a little over a month after the Fed announced the tapering of the Quantitative Easing Program, which spooked capital markets around the world (including here in India) especially banking stocks.

Source: Advisorkhoj Research

Some readers may wonder why we chose August 1, 2013 as an investment date. Let me remind readers that, investing in sector funds involves of timing, if we are to get the best results. However, timing the market for sector funds is not like day trading. You should understand the difference between timing the market for sector funds and catching the market bottom in intra-day or positional trading. When you are timing the market for sector funds, you are essentially trying to determine an approximate event based timing, when stock prices are low. In this case, we chose a date, which was approximately a month after the Fed announcement. It was by no means the market bottom (which came a month later), but as you can see in the chart above, र 1 lakh lump sum investment in Sundaram Financial Services Opportunities Fund on August 1, 2013 would have doubled in value in little more than 3 years time (a CAGR of 24.5%).

You may ask, is timing the market difficult? I will say that, it requires more courage than skills. In stock markets, if you follow the old saying, “the night is darkest just before dawn”, you can be a successful investor and make money in stock markets. This saying applies to the banking sector, probably more than any other sector in stock markets. If you follow events in the market, which affects it negatively, give some time for market to correct a bit (in the above case Nifty corrected by about 5%), and make your investment, then over a sufficiently long investment horizon, you can get superior returns.

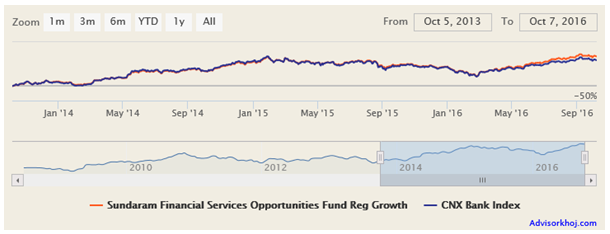

I should stress, however that, you do not need to get the exact timing right. The chart below shows, how much returns you would have made, if you invested even 3 months later (November 1, 2013).

Source: Advisorkhoj Research

Even if you would have invested 3 months later, your र 1 lakh lump sum investment in Sundaram Financial Services Opportunities Fund would have grown to nearly र 1.8 lakhs (CAGR of 21%). Therefore, exact timing is not required, but you should not wait for year, to get a firm confirmation of a bull market, because then your returns will not be as high.

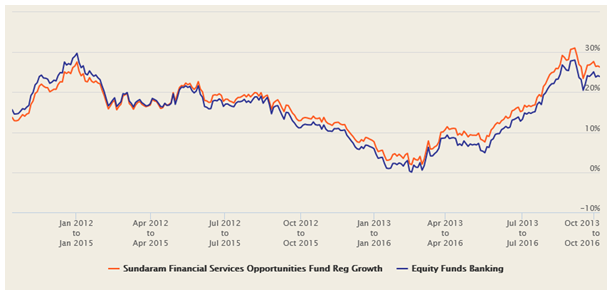

Sundaram Financial Services Opportunities Fund was launched in 2008 and has र 139 crores of AUM. The expense ratio of the fund is 2.95%. Shiv Chanani is the fund manager of this scheme. The chart below shows the NAV movement of Sundaram Financial Services Opportunities Fund over the last 5 years.

Source: Advisorkhoj Research

The chart below shows the 3 year rolling returns of the fund over the last 5 years. We chose a 3 year rolling returns period, because investors need to have a sufficiently long investment horizon for even sector funds. You can see that, even though the fund underperformed relative to its category, the outperformance over the last two years has enabled Sundaram Financial Services Opportunities Fund to catch up and beat the category in terms 3 year rolling returns for most periods of times, over the last 5 years (see the orange line relative to the blue line).

Source: Advisorkhoj Research Rolling Returns Calculator

The rolling returns chart also shows you, the importance of timing for banking funds. If you got your timing wrong, then even over a three year investment horizon, you returns would have been very low. On the other hand, if you got your timing right, your returns could have been around 20% or even more (approximately 50% of the times).

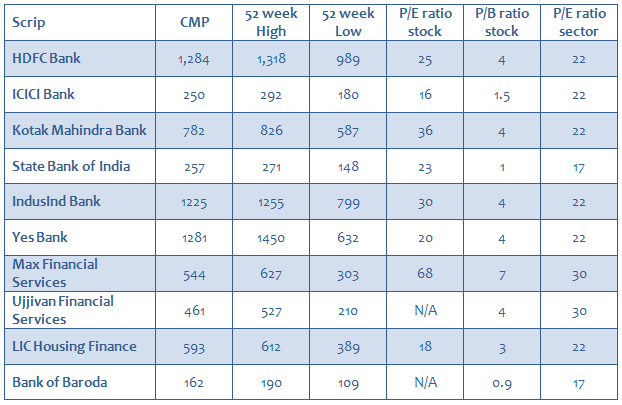

Portfolio Stocks

Approximately, 80% of Sundaram Financial Services Opportunities Fund portfolio is invested in banking stocks, while the balance is invested in NBFCs and some cash equivalents. Of the top 10 stock holdings, which account for nearly 80% of portfolio value, State Bank of India and Bank of Baroda are the only two public sector banks; the rest are top private sector banks and NBFCs. The chart below shows some of the key statistics of the top 10 stock holdings of Sundaram Financial Services Opportunities Fund.

Source: Moneycontrol.com, Economic Times

You can see that, the top 10 stocks (accounting for almost 80% of the portfolio) are leading names in the banking and financial services industry. Some stocks are trading below the sector P/E ratio, while others are trading above it. If the stocks that are trading below sector P/E deliver good earnings over the coming quarters, their valuations are likely to get re-rated and can deliver excellent returns over the moderate to slightly longer term. On the other hand, market experts believe that, the valuations of the funds, trading above the sector P/E are not stretched and further P/E expansion is possible. A benign interest environment and revival of credit cycle is likely to help Sundaram Financial Services Opportunities Fund.

Conclusion

Sundaram Financial Services Opportunities Fund has staged a smart recovery over the past 2 years or so. For a number of times, it has been seen that, mutual fund schemes, which turnaround after a period of relative underperformance, go on to deliver strong returns for their investors. The current economic environment is conducive for the fund to continue its strong performance in moderate to slightly longer term. Investors should have at least a three year investment horizon for Sundaram Financial Services Opportunities Fund. Investors should consult with their financial advisors if Sundaram Financial Services Opportunities Fund is suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY