Do you know the Top 5 Diversified Equity Mutual Fund picks for 2014

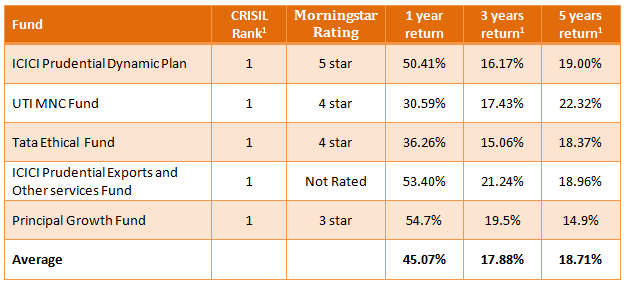

In this article, we will review top 5 diversified equity funds based on CRISIL’s latest mutual fund rankings for the January to March quarter. Diversified equity funds, which comprise of both large cap and midcap stocks carry slightly more risk than purely large cap funds, but also give higher returns. CRISIL ranks equity funds based on several parameters like average 3 year annualized returns, volatility, portfolio concentration risk (both industry and company) and portfolio liquidity risk. On each of these parameters, each scheme is accorded a cluster rank (from 1 to 5) relative to its peer group. To derive a composite cluster rank, CRISIL has assigned different weights to each parameter, with average 3 year annualized return given the highest weights at 50%, volatility 30%, industry concentration risk 10%, company concentration risk 5% and liquidity risk 5%. The period of analysis is broken into four periods, latest 36, 27, 18 and 9 months. Each period is assigned a progressive weight starting from the longest period as follows: 32.5%, 27.5%, 22.5% and 17.5% respectively. Each of the five diversified equity funds in our review has been assigned Rank 1 by CRISIL. The table below lists the top 5 diversified equity funds, based on CRISIL’s latest ranking. Returns in the table are for growth options in regular plans. NAVs as on June 9, 2014.

ICICI Prudential Dynamic Fund:

This diversified equity fund is a winner of the recent Morningstar fund awards. The fund was launched in October 2002. It has a large asset base of nearly Rs 4,000 crores and an expense ratio of 2%. The fund has performed well relative to its category across 1 year, 3 years and 5 years, both in terms of returns and risk. In terms of risk or volatility measures, the fund has outperformed the diversified equity with an annualized standard deviation of only 16.6%. This fund has given excellent risk adjusted returns. ICICI Prudential Dynamic Fund has a large cap bias with an orientation to cyclical sectors which tend to outperform in bull markets. In terms of sector concentration, the fund is overweight on BFSI with substantial allocations to Technology, Utilities, Oil & Gas and Industrials. The top 5 sectors account for over 75% of the portfolio value. In terms of company concentration, the fund is fairly well diversified, with the top 5 holdings, Power Grid Corp, Infosys, ICICI Bank, HDFC Bank and SBI, accounting for 29% of the portfolio holdings. This fund is indeed a star performer.UTI MNC Fund:

This diversified equity fund was launched in May 1998. It has a relatively smaller asset base of over Rs 350 crores and an expense ratio of 2.57%. The fund outperformed the diversified equity fund category in terms of 1 year, 3 years and 5 years trailing annualized returns. In terms of volatility or risk, the fund’s 3 year annualized standard deviation of monthly return of 15.3% was much lower than the category. This fund has given excellent risk adjusted returns. The fund has an MNC focus and has allocations to Automotive, FMCG, Engineering, Pharmaceuticals sectors and technologies. The top 5 sectors account for about 74% of the portfolio value. In terms of company concentration, the fund is fairly well diversified, with the top 5 holdings, Maruti Suzuki, Bosch, Eicher Motors, Sesa Sterlite and Cummins India, accounting for about 31% of the portfolio value.Principal Growth Fund:

This diversified equity fund was launched in May 1996. Surprisingly, it has a small asset base of only Rs 160 crores and an expense ratio of 2.6%. Despite the small asset base, the fund has performed extremely well relative to its category across 1 year, 3 years and 5 years, both in terms of returns and risk. In terms of volatility or risk, the fund’s 3 year annualized standard deviation of monthly return of only 10.9% was much lower than the category. The fund has a large cap bias with a high growth focus. Because of the fund’s investment objectives, the fund avoids certain sectors. The fund has substantial allocations to Technology, Oil & Gas, Pharmaceuticals, Engineering and FMCG. The top 5 sectors account for about 77% of the portfolio value. In terms of company concentration, the fund is fairly well diversified, with the top 5 holdings, TCS, Reliance, ONGC, Gujarat Minerals Development Corporation and HCL Tech, accounting for only 26% of the portfolio value.ICICI Prudential Exports and Other services Fund:

This diversified equity fund was launched in November 2005. It has a small asset base of Rs 300 crores and a fairly high expense ratio of 2.75%. This fund has given excellent 1, 3 and 5 year trailing returns, both in absolute terms and relative to its category. In terms of volatility or risk, the fund’s 3 year annualized standard deviation of monthly return of 16.9% was lower than the category. The fund has a large cap bias with a high growth focus. Because of its investment objectives, the fund has substantial allocations to export oriented sectors. Pharmaceuticals, Technology and Automotive comprise about 85% of the portfolio value. Despite its focused sector approach, the fund is fairly well diversified in terms of company concentration, with the top 5 holdings, Infosys, Dr Reddy’s Lab, Cipla, TCS and Tech Mahindra accounting for only 28% of the portfolio value.Principal Growth Fund:

This diversified equity fund was launched in October 2000. It has a small asset base of about Rs 150 crores and an expense ratio of 2.6%. The recent performance of this fund, especially in the 1 to 3 years periods has been exceptionally strong. In terms of volatility or risk, the fund’s 3 year annualized standard deviation at 20.1% is slightly higher than other funds in our selection. However, in terms of risk adjusted returns the fund has done extremely well. The fund has a large cap bias with a high growth focus. Because of the fund’s investment objectives, the fund avoids certain sectors. The fund is overweight on BFSI, and has substantial allocations to Automotive, Technology, Oil & Gas, and FMCG. The top 5 sectors account for about 66% of the portfolio value. The fund manager has hit the bull’s eye in picking some winners for his portfolio. In terms of company concentration, the fund is fairly well diversified, with the top 5 holdings, ICICI Bank, ITC, Reliance, Motherson Sumi and Aurobindo Pharma, accounting for only 20% of the portfolio value. This fund has proven to be a hidden gem.

1CRISIL Rank: 1 - Very Good; 2 - Good; 3 - Average; 4 - Below Average; 5 - Relatively Weak

Conclusion

In this article, we have reviewed the top picks among diversified equity funds based on the most recent CRISIL rankings. You can see all these funds have given very strong returns. However, the suitability of each of these funds would depend on risk profile and time horizon. You should consult with your financial adviser if these diversified equity funds are suitable for your portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team