Make money by investing in Wall Street

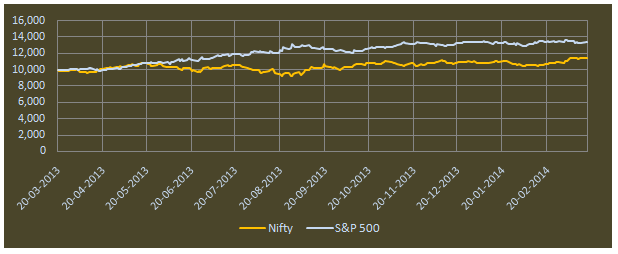

In the last one year the Nifty rose from 5694 to 6483, a rise of 14%. During the same period S&P 500, the US stock index, rose from 1558 to 1860, a rise of 19%. With the benefit of hindsight, as a rational investor, would it not have made more sense to invest in the US markets? Now let us bring currency into the equation. A year ago the dollar (USD) was at INR 54.35 and now it is at INR 61.29. The rupee (INR) has depreciated nearly 13% versus USD, in the last one year. So in INR terms, S&P 500 has given a return of over 34% versus 14% in the Nifty, a whopping difference of 20% in returns. The chart below shows the pre-tax growth of Rs 10,000 invested in S&P 500 versus the Nifty.

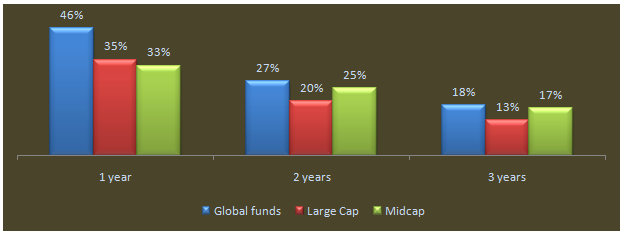

The chart above shows that Rs 10,000 invested the Nifty a year ago would have grown to Rs 11,457 as of yesterday. However, if you had invested Rs 10,000 in the S&P 500, it would have grown to Rs 13,412. How can you invest in S&P 500? Well, you can exchange your INR for USD, and invest in any good S&P 500 index fund in the US, like Vanguard 500 Index Admiral, Fidelity Spartan 500 Index Advantage, Schwab S&P 500 Index, USAA S&P 500 Index Reward, Black Rock S&P 500 stock etc. Sounds complicated? Well there is a far easier and better option. There are a number of good global or international funds from Franklin Templeton, ICICI Prudential, DSP Black Rock, Birla Sunlife, JP Morgan and other AMCs, that invest in US and other international markets, like Europe, Asia, other emerging markets etc. These funds also invest in themes like global indices, commodities and real estate. In the short term, one to three global or international funds have outperformed other equity fund categories. See the chart below, for comparison 1, 2 and 3 year trailing annualized returns of top performing global funds and other equity fund categories

Clearly global or international funds have outperformed large cap and midcap funds, in the last three years. Global or international funds are generally fund of funds which invest in international mutual funds. However, a few also invest directly in international equities. Investing a part of wealth into global funds serves as a risk diversification mechanism. As such, mature investors should consider investing a portion of their portfolio in global funds as a hedge against country specific market risk. One misconception of investors regarding global funds is that they have to pay fund management fees twice, because most global funds in India invest in another fund. The total fee that a global fund charges, is within the SEBI regulation and so the investors do not have to pay fees twice. There are several important considerations for investing in global funds.

Exchange Rate outlook

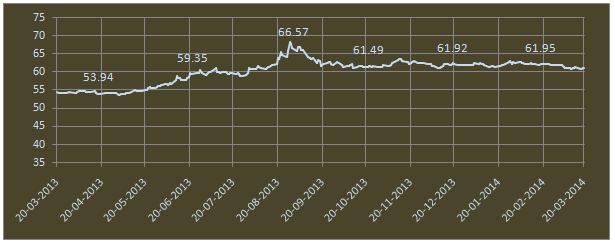

One of the reasons some of the top performing global funds have outperformed Indian equity funds is the INR depreciation in the last one year. During this period, the INR has depreciated versus most major currencies (USD, Euro, GBP, Chinese Yuan etc.) by 12 – 20%. The chart below shows how the INR has depreciated versus the USD in the last one year.

With improvement in current account deficit the INR slide has somewhat been arrested, but it still remains above the 61 mark. The future outlook of the INR is a little uncertain. In the recent FOMC meeting of the US Federal Reserve, earlier this week, the Fed Chairperson Janet Yellen has indicated that the Fed will stay on course with tapering (Fed asset purchase program). She further hinted that the Fed may actually increase interest rates earlier than anticipated. Increase in the US policy rates, will lead to higher demand for the US dollar and cause emerging market currencies like the Indian Rupee to depreciate further. There is another viewpoint that if we get a favourable Lok Sabha election result in India, FII flows will increase into Indian equity markets leading to demand for INR and its appreciation thereof. These are two contradictory views that Indian investors must consider and take a position depending upon which view has more conviction, before they make investments in global funds. It all depends on the outlook. If the investors have a negative outlook on the rupee, then investing in global or international funds is a smart choice

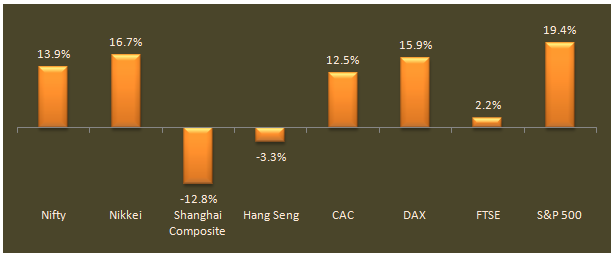

Global Market Performance

Apart from currency, the other factor is the relative performance of different markets, and their future outlook. In the last one year our equity market has done quite well, but some international markets have outperformed the Indian equity market. See the chart below for index returns of major international markets, like Japan, China, Europe and the US.

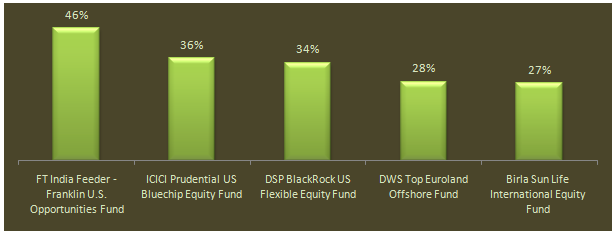

While the Nifty has given good returns, the US, Japanese and some European markets have given better returns. However investors need to be smart about selecting a winning theme. In 2012 – 2013, global funds which invested in Asian markets, like JPMorgan JF Greater China Equity, Kotak Global Emerging Market Fund, Franklin Asian Equity Fund etc., outperformed funds that invested in developed markets. However, with Asia and China, in particular, slowing down in the last one year, funds that invested in developed markets, like FT India Feeder - Franklin U.S. Opportunities Fund, ICICI Prudential US Bluechip Equity Fund, DSP BlackRock US Flexible Equity Fund, DWS Top Euroland Offshore Fund, Birla Sun Life International Equity Fund etc. were clear outperformers. See the chart below for top 5 global funds based on trailing one year returns.

The chart above tells us that all the top performing schemes were the funds that invested in the developed markets, primarily the US market. The reason why they did well is evident in the chart earlier in the article, showing the index returns of major international markets. The S&P 500 (US market) has outperformed all other indices. Some of these funds invest in other funds (fund of funds), while others invest in equities.

FT India Feeder - Franklin U.S. Opportunities Fund

invests in Franklin US Opportunities A Acc fund (fund of funds)ICICI Prudential US Bluechip Equity Fund

invests in a diversified portfolio of US blue chip stocks like Exelon Corp, Intuitive Surgical Inc, Eli Lilly, Accenture, Oracle etc.DSP BlackRock US Flexible Equity Fund

invests in BGF US Flexible Equity 12 USD fund (fund of funds)DWS Top Euroland Offshore Fund

invests in DWS Invest Top Euroland FC (fund of funds)Birla Sun Life International Equity Fund

invests in a diversified portfolio of US blue chip stocks like Northrop Grumman Corp, Exxon Mobil, Chubb Corp, McKesson, Aetna etc.

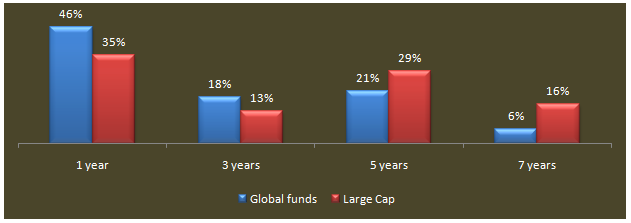

Investment Horizon

Investment horizon is a very important consideration while investing in global or international funds. Investors should note that global risk capital is very fluid and flows to market where the potential to earn better returns is higher. Once a market runs up significantly and valuations look expensive, FII fund flow may shift to other markets. Interest rates also play a crucial role in determining FII fund flows. Therefore the investment horizon is an important consideration. Over the long term, an emerging market like India give better equity returns than developed markets. That is because GDP growth rate in India will be higher than the GDP growth rate in developed markets like the US. See the chart below for the comparison of trailing returns of top performing global funds and large cap funds for the last 1, 3, 5 and 7 year periods.

Though global funds have outperformed large cap equity funds in the short term (1 – 3 years), in the long term large cap equity funds have outperformed the global funds by a big margin. Investors need to be clear about their time horizon when investing in global funds, to make the most of their investments.

Tax Treatment

Long term capital gains from equity funds in India are exempt from capital gains tax, if the investment period is more than one year. Global funds, on the other hand are treated like debt funds, from a tax perspective. Capital gains from global or international funds are taxed at 10.3% without indexation and 20.6% with indexation. Short term (less than one year) capital gains from both equity and global funds are taxed as per the income tax slab of the investor

Conclusion

Investing in global markets through global or international funds is a smart choice for matured and sophisticated investors with high risk appetite. Investors can hedge their India specific market risk by investing in such funds and also make excellent returns (e.g. by investing in the US equity funds in the last one year). However, it is important for investors to consider the currency outlook, global market relative performance, investment horizon and tax treatment in making a decision to invest in global funds and which funds to invest in. Investors should discuss with their financial advisors if global funds are suitable for them.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team