Best Mutual Funds SWP returns: Fantastic performance by Sundaram Select Midcap Fund

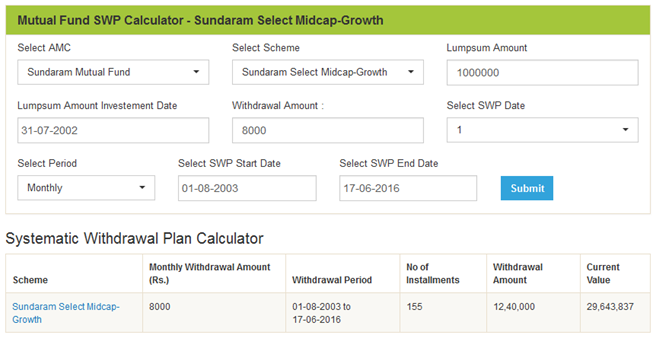

If you had invested र 10 Lacs in the NFO of Sundaram Select Midcap - Growth, 14 years back (launch date July 31, 2002) and started withdrawing र 8,000 per month after one year then the current value of your investment would have been र 2.96 Crores even after withdrawing र 12.40 Lacs through 155 SWP instalments of र 8,000 each in the last 13 years (Based on June 17, 2016 NAV).

To come to this conclusion we assumed that the lumpsum investment of र 10.00 was made on July 31, 2002, the launch date. We have also presumed that the monthly Systematic withdrawal of र 8,000 was started after one year i.e. on the 1st of every month (starting from August 01, 2003) so that each and every SWP withdrawal amount is treated as tax free!

At Advisorkhoj, we are doing this study to show our readers how the SWP in mutual funds work and how it could be an important tool for those looking for regular returns from their lumspum investments.

Please look at the chart below to understand how we have selected the different options in the SWP Research Tool to get the results. You can also like to explore our SWP Return Calculator to know the SWP returns of any fund of your choice.

Source: Advisorkhoj SWP Calculator – Sundaram Select Midcap Fund - Growth

SWP (Systematic Withdrawal Plan) results

From the above chart you can see that you would have withdrawn a total of Rs. 12.40 Lacs in last 13 years, through 155 equal monthly SWP instalments of Rs. 8,000 each, thus, you would have got a tax free return of 9.6% every year. Even after withdrawing a tax free amount of Rs. 12.40 Lacs, the current value of your investment in Sundaram Select Midcap - Growth is amazing Rs. 2.96 Crores! Based on June 17, 2016 NAV.

On August 3, 2015, Sundaram Select Midcap - Growth hit its life time high NAV of र 366.6987 (considering all the NAVS of the SWP date of 1st of every month) and the value of your investment on that day was र 3.11 Crores! After that you have withdrawn 10 more SWP instalments of र 8,000 each and the current value as on June 17, 2016 stands at an amazing र 2.96 Crores!

Download the cash flow in excel showing the details of SWP withdrawals, NAVs and values on respective dates – Click here

We have analysed similar samples with other Mid Cap funds and found that SWP returns of Sundaram Select Midcap - Growth so far is one of the best amongst its peers and certainly one of the biggest wealth creators amongst midcap funds.

About Sundaram Select Midcap - Growth

Sundaram Select Midcap - Growth is one of the marquee funds from Sundaram Mutual Fund stable. The Fund has an AUM of Rs. 3,553 Crores (as on May 31, 2016) and is being managed by well known fund manager, Mr. S. Krishna Kumar since 2012.

Sundaram Select Midcap - Growth is one of the consistently performing equity mutual funds in the Mid Cap Category. The scheme aims to achieve capital appreciation by investing in high growth mid-cap stocks.

The fund defines 'midcap' as a stock whose market capitalization shall not exceed the market capitalization of the 50th stock (after sorting the securities in the descending order of market capitalization) listed with the NSE.

It is a Valueresearch 3 Star rated fund and CRISIL also has given it Rank 3. As the risk and return grade of the fund is ‘Above Average’ it could be a good pick for those willing to take high risk in order to get higher return by investing in midcap stock.

The 58% assets of Sundaram Select Midcap - Growth are currently invested in five sectors - Financial, Automobiles, Textiles, Services and Engineering and the top 5 stock holdings are FAG Bearings, SFL, United Phosphorous, ashok Leyland and Bajaj Finance.

The 3, 5 and 10 years annualised returns of the fund is quite impressive at 30.78%, 18.92% and 17.947% respectively (Based on NAV of June 17, 2016). The fund has beaten the Benchmark S&P BSE Mid Cap Index with very good margin.

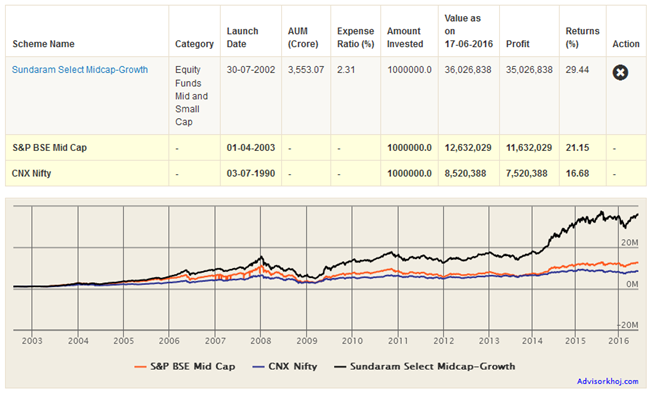

Lumpsum returns of Sundaram Select Midcap - Growth

Sundaram Select Midcap - Growth has given exceedingly well lumpsum returns as well. The current value of investment of र 10 Lacs made on the fund launch date of July 30, 2002, is around र 3.62 Crores! A CAGR growth of whopping 29.44% since inception (Based on June 17, 2016 NAV).

If you had invested the same amount in S&P BSE Mid Cap and CNX NIFTY then your accumulated amount on the invested amount of र 10.00 Lacs would have been only Rs. 1.26 Crores and र 85.20 Lacs respectively (Based on June 17, 2016 NAV). Therefore, it has beaten the return of both the Benchmarks by a huge margin.

Source: Advisorkhoj Lumpsum Return Calculator – Sundaram Select Midcap - Growth (Data as on 17/6/16)

Simply speaking your lumpsum investment in Sundaram Select Midcap - Growth has grown by whopping 36 times in 14 years!

Please check here Lumpsum Returns of Sundaram Select Midcap Fund – Growth

To know lumpsum return of any fund, you may like to check our LUMPSUM RETURNS OF MUTUAL FUNDS - CALCULATOR

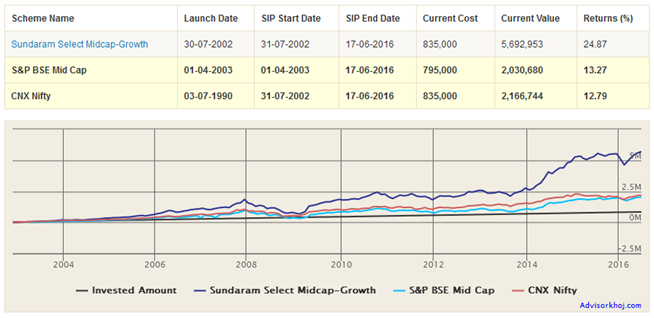

SIP Returns of Sundaram Select Midcap - Growth

The SIP returns of Sundaram Select Midcap - Growth have also been excellent! If you had started a monthly SIP of र 5,000, 14 years back on the launch date of July 30, 2005, you would have accumulated a whopping corpus of Rs. 56.92 Lacs as of June 17, 2016 whereas you had invested only र 8.35 Lacs through 167 instalments of र 5,000 each. During this period the fund has given superb XIRR return of 24.87% which is one of the best amongst the peer group of schemes. Check SIP RETURN CALCULATOR

Further, if you see the chart below, you will notice that SIP in Sundaram Select Midcap - Growth has also beaten the CNX NIFTY and S&P BSE Mid Cap Index SIP returns with a huge margin.

Source: Advisorkhoj SIP Return calculator – Sundaram Select Midcap Growth (Data as on 17/6/16)

You may try this tool Top Performing SIP Funds to check Top Funds of any category.

What is Systematic Withdrawal Plan

In a Systematic Withdrawal Plan (SWP), you regularly withdraw a fixed amount on a fixed date or dates from a fund. The amount to be withdrawn and the frequency of withdrawal/s are decided by you. You can withdraw a fixed amount, based on your requirement, weekly, fortnightly, monthly, and quarterly or annually from your investment.

SWP withdrawals from an equity fund, after one year from the date of investment, is totally tax free as it is treated as long term capital gains. It is a good investment option for investors willing to take high risk and with lumpsum investible surplus, looking for regular income from their investments and at the same time want to see their investments grow in value.

Try our SWP RETURN CALCULATOR to know SWP returns of your favourite funds.

Conclusion

Sundaram Select Midcap - Growth has given very excellent SWP returns since inception and may be a good choice for investors looking for regular income from their lumpsum investible surplus albeit with a high risk. The lumpsum and SIP returns of Sundaram Select Midcap - Growth have also been exceedingly well and it has proved to be one of the best wealth creators for the investors who remain invested with the fund for long. Needless to mention it has also beaten the Benchmark S&P BSE Mid Cap Index and CNX NIFTY with huge margin.

The fund is suitable for investors with high risk taking appetite, looking for long term wealth creation by investing in high growth midcap stocks to meet their long term financial goals.

Investors should note that past performance of mutual funds are no guarantees for future returns. Mutual fund investments are also subject to market risk and therefore investors must consult their financial advisors and check if investment in Sundaram Select Midcap is suited for their investment needs based on their risk profile.

Would you like to check your risk profile? Try this

You may like to read our recent review of this fund Consistent outperformance makes it a big wealth creator

Those readers interested in knowing more about SWP, should read the following –

Mutual Funds are ideal investment option for retirement planning

Mutual Fund systematic withdrawal plans are smart option for income needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team