Mutual Fund Systematic Withdrawal Plans are smart option for income needs

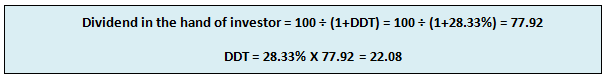

Investors looking for regular income from their investments opt for dividend plans. However, in the last two years, the Government has been taking more out of dividends, in the form of Dividend Distribution Tax (DDT), leaving less for the investors. In the Union Budget of 2013, the Dividend Distribution Tax (DDT) on all non-equity funds was doubled from 12.5% to 25%. Including the surcharge of 10% and educational cess of 3%, the dividend distribution tax for non-equity funds was 28.3%. In this Union Budget (2014), the methodology of calculation of DDT has been changed. As per this Budget, DDT will be levied on the gross amount, i.e. the dividends declared before DDT. How this will impact the investors of dividend paying non equity mutual funds? As discussed earlier, for retail investors the DDT is 28.33%, including the surcharge of 10% and educational cess of 3%. Let us assume the fund has a distributable surplus of Rs 100. Since in the previous tax regime, DDT was levied on the actual dividend received by the investor, the net dividend to the investor was calculated using the following formula:-

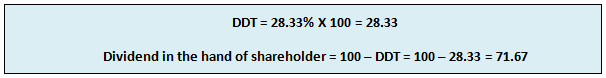

In the new budget, the DDT will be levied on the gross amount (i.e. Rs 100). Therefore, the DDT and the net dividend will be:-

Since effective dividends to investors are lower on account of the tax regime, it makes more sense for the investors to opt for growth schemes and long term capital gains tax (at 20% with indexation, as per the new Budget), which is more benign than dividend distribution tax. So for investors who want a regular income from their investments, growth option and then switching to a systematic withdrawal plan (SWP) after the holding period of long term capital gains (3 years as per the 2014 Union Budget) makes more sense from a tax perspective.

What are Systematic Withdrawal Plans?

In Systematic Withdrawal Plans (SWP) you regularly withdraw a fixed amount of money from your mutual fund. The amount to be drawn and the frequency of withdrawal are fixed by the investor. So you can have a monthly, quarterly or annual frequency for any fixed amount that you wish to draw.

Why does long term capital gain make more sense than DDT, in terms of taxation?

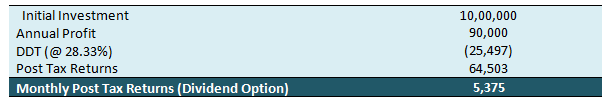

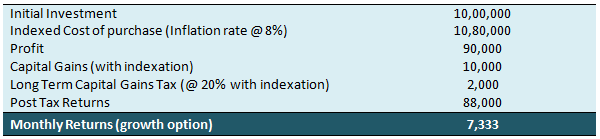

The DDT of debt funds as per the new Budget is 28.33% of the gross dividends (dividends before DDT), whereas long term capital gains tax is 20% with indexation. Let us understand the difference between DDT and long term capital gains tax. Please note that the mutual fund has to pay, Dividend Distribution Tax before distributing dividends to unit holders. So even though the dividends are not taxable in the hands of the investors, the mutual fund has to pay DDT on it. Therefore the dividends are lower to that extent in the hands of the investors. Let us assume your initial investment is Rs 10 lacs. Further let us assume you invested this amount in an income plan with returns of 9% per annum. What is the post tax annual return, if you opt for the dividend plan?

Let us now see, what is the monthly post tax return, if you opt for the growth option in a debt fund?

Therefore, with the same amount of capital you will get nearly Rs 2,000 of additional income every month for the same amount of capital, purely on account of tax benefits if you opt for the growth option as compared to the dividend option in a debt fund. Therefore, instead of a monthly dividend plan, if you opt for a systematic withdrawal plan of Rs 7,333 in the growth option of an income plan instead of a dividend option of an income plan, you will get almost Rs 2,000 of additional income every month. With a systematic withdrawal plan of Rs 7,333 you can protect your capital of Rs 10 lacs, yet draw a higher amount every month.

Be mindful of the holding period for the new long term capital gains tax regime?

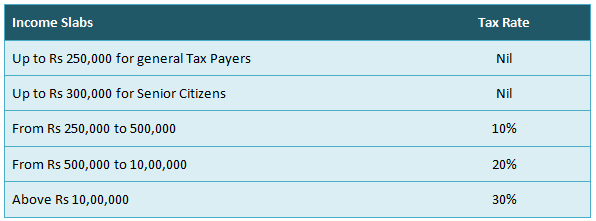

The holding period for long term capital gains has been increased from 12 months to 36 months. Therefore, if the investor redeems his or her debt fund units before 36 months, the capital gains will be taxed at the applicable income tax rate of the investor. The income tax rates for individuals and Hindu Undivided Families are as follows:-

Therefore, if you hold your investment for less than 3 years, your capital gains will be taxed at your slab rate. In order to avail of the benefit of long term capital gains tax as per the new Union Budget, you need to hold on to your investment for more than 3 years. If you need income in the first 3 years of your investment, you should opt for the dividend plan, if you are in the highest (30%) tax bracket rate. However, if you are in the lower tax bracket (less than 30% tax rate), you may as well opt for growth option, because your effective tax rate will be lower, than that of the dividend option. However, if you are in highest tax bracket and yet you need regular income, opt for the dividend option for the first three years, and then switch to systematic withdrawal plans from a growth option going forward, three years and beyond. Please note that, these tax considerations only apply to debt funds. For equity oriented funds, the holding period for capital gains tax is only 12 months. However, as is common knowledge, equity funds are more volatile than debt funds.

Monthly payments in SWP are more stable than dividends

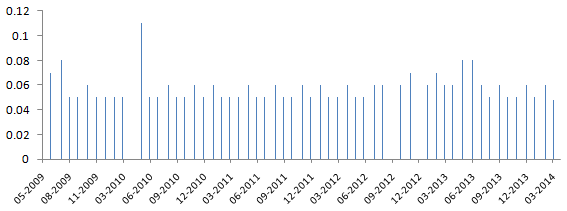

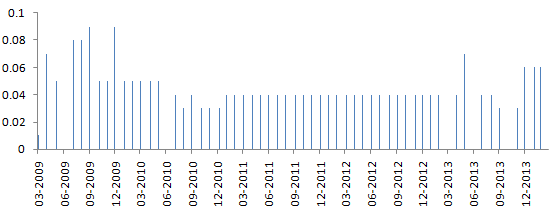

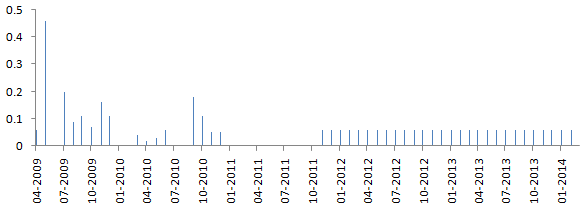

While dividend plans aim to pay regular dividends, the dividends are not assured. We have seen that monthly dividend options of mutual fund monthly income plans have missed regular monthly dividends. Please see below the monthly dividend payouts of some monthly income plans. While some plans have been regular in monthly dividend payouts, others have not been:-

Birla Sun Life MIP II - Wealth 25 Plan (dividend per unit)

FT India Monthly Income Plan (dividend per unit)

DSP Black Rock MIP Fund (dividend per unit)

We can see from the charts above that, the dividends are not regular in the monthly dividend option of monthly income plans. In a systematic withdrawal plan (SWP) you can draw a fixed regular payment every month, irrespective of when or whether the dividend is declared or not. If you are a senior citizen, you will be better off, from a financial planning perspective, if you opt for a Systematic Withdrawal Program rather than relying on monthly dividends. Not only, do you get more tax efficient returns in the SWP of growth plans, the monthly income is much more predictable and can be fixed by you, based on your needs in an SWP.

SWP gives you the flexibility to withdraw as much as you need

From a financial planning perspective, what is most important is to be able to generate the income that you need, irrespective of how your investment is performing. You may need to draw more or less, depending on your needs and your financial situation. Systematic Withdrawal Plans afford you that flexibility. SWP is indeed a powerful financial solution for your retirement needs. For example, if your investment corpus is Rs 10 lacs and your monthly income need is Rs 10000, at the rate 9% return on your investment and assuming that only long term capital gains tax apply, your investment will last for 15 years. On the other hand, if your monthly income need is Rs 15000, then your investment, under the same assumptions will last about 8 years. If your monthly income need is just Rs 8000, then your investment will last much longer.

Conclusion

Systematic withdrawal plan is a very flexible solution for your monthly income needs , while at the same time it ensures tax efficiency, because of the differential tax rate of dividends versus long term capital gains. You should consult with your financial adviser if systematic withdrawal plan is suitable for you.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team