Mirae Asset India Equity Fund: Strong SIP and SWP performance since inception

10,000 crore AUM is an important landmark for equity mutual fund schemes and Mirae Asset India Equity Fund has recently crossed this landmark. Popularity of this fund among Indian mutual fund investors comes on back of strong performance since inception of the scheme.

Mirae Asset India Equity Fund, formerly known as Mirae Asset India Opportunities Fund was launched in 2008 and celebrated its 10th anniversary in April earlier this year. A Multicap fund, which invests across different market cap segments, this scheme has been one of the most consistent performers over the last 5 years.

We had reviewed this scheme in July (please see our article, Mirae Asset India Equity Fund: One of the most consistent multi cap mutual funds). In this post, we will review certain aspects of the scheme performance namely SIP and SWP since launch of the scheme.

SIP performance

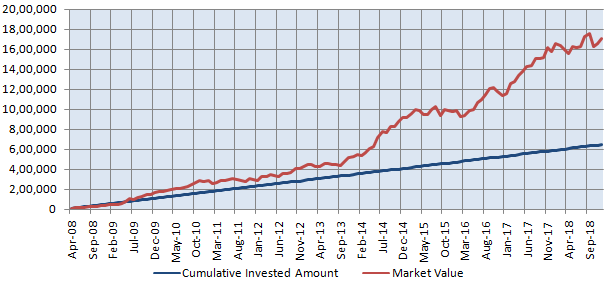

Let us assume you started a monthly SIP of Rs 5,000 in Mirae Asset India Opportunities Fund (rechristened as Mirae Asset India Equity Fund this year) – Growth Option at the time of its launch in April 2008 and you have continued your SIP till date. The chart below shows how much wealth you would have accumulated over the SIP’s tenor till date.

Source: Advisorkhoj SIP Calculator

With a cumulative investment of Rs 6.45 Lakhs over the last 10 years, you would have accumulated a corpus of Rs 16.81 Lakhs. The annualized SIP returns (XIRR) of the scheme over this period was nearly 17%. Over the same period Nifty has given only around 10% total returns (capital appreciation plus dividends). The superior SIP performance of Mirae Asset India Equity Fund is a testimony of the advantage of investing through SIP, whereby you can benefit from market volatility through Rupee Cost Averaging. The strong SIP return of the scheme is also testimony of the fund manager’s track record of creating alphas over long periods of time.

SWP Performance

Regular Advisorkhoj readers will be familiar with SWP, but for the benefit of new investors, SWP is investment plan whereby investors can draw a fixed amount every month (or any other frequency) from their investment in a mutual fund scheme.

Read more on this – How is mutual fund SWP plan a better option than dividend

Let us assume you invested Rs 10 Lakhs in Mirae Asset India Equity Fund (erstwhile Mirae Asset India Opportunities Fund) at the time of its inception. You wanted to draw Rs 5,000 every month from the scheme through SWP. To avoid exit load and short term capital gains tax you began your withdrawals from April 5, 2009. The chart below shows the result of the SWP over the investment tenor.

Source: Advisorkhoj SWP Calculator

Your cumulative withdrawal over the investment tenor is Rs 5.85 Lakhs. Despite withdrawing Rs 5.85 Lakhs from your investment over the last 10 years, your investment value would have multiplied more than 3 times to Rs 34.32 Lakhs (from Rs 10 Lakhs) as on December 24, 2018. For moderate rates of withdrawals, SWP can not only generate cash-flows for investors but also create wealth over long investment tenors. The last 10 year period included 3 bear market phases, when the market fell by 20% or more and yet the wealth creation in this SWP example is quite spectacular. This is another evidence of the excellent fund management of this scheme.

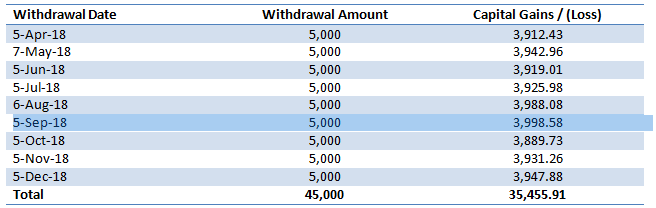

We often get questions and comments from investors regarding taxation of SWP withdrawals. We will address the taxation angle now. Readers should note that we began the SWP one year after the investment date to avoid short term capital gains tax. Long term capital gains (investments held for a year) were tax free until this financial year. There was no incidence of taxation in this SWP until April 2018. In this year’s Union Budget, the Finance Minister announced changes to long term capital gains tax for equity mutual fund schemes, which came into effect from April 1. Long term capital gains of up to Rs 1 Lakh in a financial year will continue to be tax exempt. Long term capital gains in excess of Rs 1 Lakh will be taxed at 10%. Let us the capital gains for withdrawals in this SWP from April onwards.

Source: Advisorkhoj SWP Calculator

Total capital gain so far in this financial year is Rs 35,455. It is well below the long term capital gains tax exemption limit of Rs 1 Lakh. Even if we extrapolate for the next three months based the average capital gains of the last 9 months, the total capital gains in this financial year will be well below the Rs 1 Lakh exemption limit for long term capital gains tax. You can use our SWP Calculator to get the capital gains of your SWP withdrawal. You can also get a capital gains statement from the Registrar (Karvy Fintech is the Registrar for Mirae Asset Mutual Fund) or you can ask your financial advisor for the same.

Conclusion

We have reviewed Mirae Asset India Equity Fund / Mirae Asset India Opportunities Fund a number of times in the past. In this blog post, we saw how the scheme has delivered very strong SIP and SWP performance since inception. Advisorkhoj congratulates Mirae AMC for strong performance of Mirae Asset India Equity Fund and crossing the landmark Rs 10,000 crore AUM mark. We hope the scheme will sustain its strong performance track record in the future as well.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team