Reliance Gowth Fund is one of the biggest wealth creators ever among mutual funds

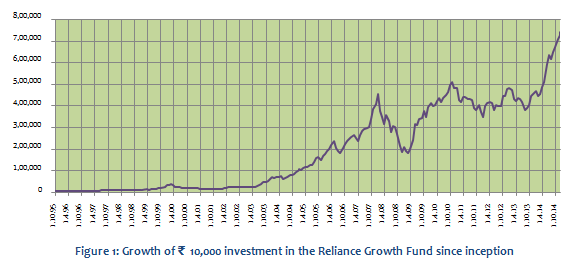

Mutual funds are excellent investment options for investors for meeting their financial goals across different time horizons. However, some mutual fund schemes acquire legendary status as wealth creators. By the virtue of its long term performance, Reliance Growth Fund has earned the reputation of one of the biggest wealth creators ever. The chart below shows the growth of र 10,000 investment in the Reliance Growth Fund since inception.

An investment of just र 25,000 in Reliance Growth Fund at inception in 1995 would have grown to about र 20 lacs by Dec 5 2014, enough to fund your child’s higher education and marriage or other financial goals. The fund has given an astonishing 25% annualized returns since inception nearly 20 years ago.

Fund Overview

Reliance Growth Fund was launched in September 2008. The fund has an asset of almost र 5,400 crores. The expense ratio of the fund is 2.23%. Reliance Growth Fund is managed by veteran fund manager Sunil SInghania. Funds managed by Sunil have given excellent returns in the past. Reliance Growth Fund is a diversified equity funds which invests across market capitalization. Multicap funds have the potential to give higher returns than large cap oriented funds, while their downside risks are limited compared to small and midcap funds. Reliance Growth Fund is open for subscription for both Growth and Dividend options.

Portfolio Overview

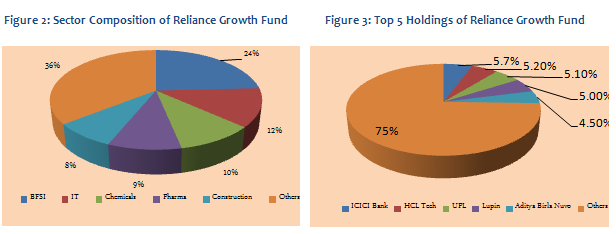

The fund manager employs a research based investment approach. As discussed earlier, the portfolio invests in companies across market capitalizations. Large cap companies comprise about 47% of the investment portfolio, while mid and small companies comprise about 53% of the investment portfolio. In terms of sector allocation, the portfolio has a bias towards cyclical sectors like BFSI, Chemicals, Construction, Engineering, Automobiles etc. To balance the exposure to cyclical sectors, the fund also has significant allocations to defensive sectors like IT, Pharmaceuticals and FMCG, which comprise about 28% of the portfolio value. With cyclical sectors poised to do well with the revival in economic growth and capex cycle, the Reliance Growth fund is positioned strongly to do well in the medium term. In terms of company concentration the fund is fairly well diversified, the top 5 companies, ICICI Bank, HCL Technologies, United Phosphorus Limited, Lupin and Aditya Birla Nuvo accounts for only 25% of the portfolio value. Even the top 10 companies account for only about 44% of the portfolio holdings.

Risk and Return

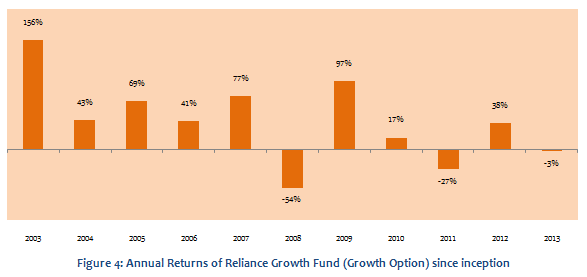

Over the last 10 years, the Reliance Growth fund has consistently given good returns every year, except during the market downturns in 2008 and 2011. In 2013 the return of the fund was muted with respect to the benchmark BSE 100 index, but on year to date basis in 2014 the fund has done well giving over 57% YTD returns. The chart below shows the annual returns of the Reliance Growth Fund (Growth Option) since 2003.

In terms of risk measures, the standard deviation of monthly returns of the Reliance Growth Fund is 19.1%, which is slightly on the higher compared to the category of diversified equity fund.

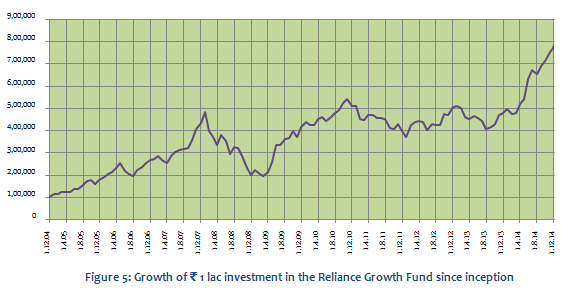

र 1 lac lump sum investment in the Reliance Growth Fund (growth option) 10 years back would have grown nearly 8 times in the last 10 years. The chart below shows the growth of र 1 lac investment in the Reliance Growth Fund (growth option).

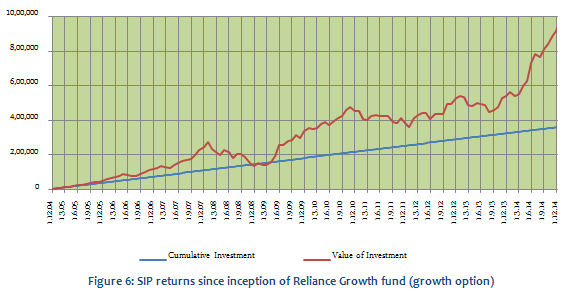

The chart below shows the returns over the last 10 years of र 3,000 invested monthly through SIP route in the Reliance Growth fund (growth option). The SIP date has been assumed to first working day of the month. The chart below shows the SIP returns of the fund. NAVs as on Dec 5 2014.

The chart above shows that a monthly SIP of र 3000, started 10 years back in the Reliance Growth fund (growth option) would have grown to over र 9.3 lacs by December 5 2014, while the investor would have invested in total only about र 3.6 lacs. The SIP return (XIRR) is nearly 18% over the last nearly 10 years.

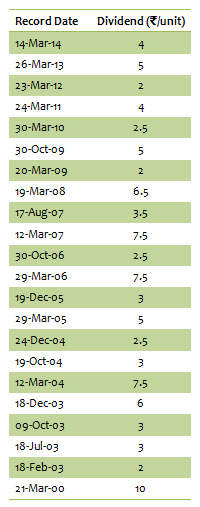

Dividend Payout Track Record

Reliance Growth Fund, Dividend Option has a strong dividend payout track record. The dividend option has paid dividends every year for the last 10 years, even during bear markets.

Conclusion

Reliance Growth Fund is one of the biggest wealth creators in the history of mutual funds in India. It has sustained strong performance over a long period of time. The fund manager of the scheme is one the most respected fund managers in the industry. This fund is suitable for investors looking for high capital appreciation over a long time horizon, for long term financial objectives, such as retirement planning, children’s education etc. Investors looking for regular dividend payments can also invest in the dividend option of the fund. Investors can consider investing in the scheme through the systematic investment plan (SIP) or lump sum mode with a long time horizon. Investors should consult with their financial advisors, if Reliance Growth Fund is suitable for their financial planning objectives.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty 500 Healthcare ETF

Jan 30, 2026 by Advisorkhoj Team