Reliance Money Manager Fund: Solid Performance from this ultra short term debt fund

In our post from last year, Top Liquid Mutual Funds: Better options than savings bank for parking your surplus cash, we had discussed why liquid funds are much better savings options compared to your savings bank account for parking short term funds. It certainly offers much higher returns than savings bank interest. Over the last 3 months liquid funds have given average returns of 1.71% (please see Average Category Returns in MF Research Section), which implies that income from liquid fund would have been almost 75% higher than that from your savings bank over the last 3 months.

Liquid funds are money market mutual funds and they invest in money market instruments like Treasury Bills, Commercial Papers and Certificates of Deposits. There is another category of money market mutual funds, known as Ultra-Short term debt funds. A few years back, these funds were also known as liquid plus funds, due to their similarity with liquid funds. Both liquid and ultra-short term debt funds offer high degree of safety, liquidity and stability of returns. Many investors do not make any distinction between these two fund categories. However, there are differences and if you understand the differences, then you can potentially get a higher return on your investment.

Liquid funds invest in money market securities that have a residual maturity of less than or equal to 91 days, while ultra short term debt funds invest in securities that mature in 6 to 12 months. It is important to know the implications of the difference in maturity profiles of debt mutual funds.

In order to do that, let us understand an important concept in fixed income investing, known as term structure of interest rates. The term structure of interest rates is a graph, which plots interest rates for different maturities. The X-axis (horizontal axis) of the graph represents maturities of different securities and the Y-axis (vertical axis) represents the yields (interest) of the securities. If you plot the yield of the securities for different securities with different maturities and pass a trend curve (or line) through this plot, the curve (or line) is known as the term structure of interest rates (also known as the yield curve).

In general terms, it is seen that yields increase with maturity and hence the term structure of interest rates or yield curve is generally upward sloping. The chart below shows, a typical structure of term structure of interest rates of yield curve.

Please note our emphasis on the words, general terms. The yield curve can be downward sloping too, in other words, yields may decline with maturity, but that is usually observed towards the longer end of the maturity spectrum (securities with long maturities, e.g. securities with 20 or 30 year maturities).

However, since we are discussing the difference between liquid fund and ultra-short term debt funds, we are focused on the short end of the maturity spectrum (i.e. maturities of less than a year), that is the left side of the graph. The short end of the yield is almost always upward sloping. Therefore, the yield of portfolio securities of ultra-short term debt funds (slightly longer residual maturities than portfolio securities of liquid funds) is very likely to be higher than liquid funds as per theory. Over the last 3 months, ultra-short term debt funds gave more than 2% monthly returns (compared to 1.71% from liquid funds). Therefore, if you do not need liquidity within 3 or 4 months from investment date, then ultra-short term debt funds are better investment options than liquid funds.

Reliance Money Manager Fund

Reliance Money Manager Fund is an ultra-short term debt fund with a solid performance track record. Over the last one year it has given 8.6% trailing returns (period ending July 28, 2016), ranking in the top 2 quartiles consistently, in the last three quarters (please see our quartile ranking tool, Mutual Fund Quartile Ranking - Ultra Short Term Debt Funds).

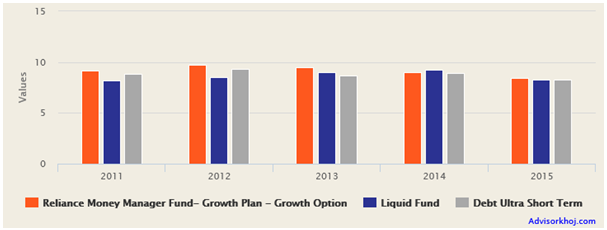

Reliance Money Manager Fund was launched in March 2007 and recently crossed र 10,000 crores of AUM (current AUM is nearly र 13,800 crores). The expense ratio of this fund is 0.54%. Amit Tripathi and Anju Chajjer are fund managers of this scheme. Reliance Money Manager Fund has given 8.44% annualized returns since inception. The chart below shows the annual returns of Reliance Money Manager Fund over the last 5 years.

Source: Advisorkhoj Research

The chart above shows you that Reliance Money Manager Fund has outperformed the ultra-short term debt fund category consistently over the last 5 years. The annual returns have been fairly stable.

Rolling Returns of Reliance Money Manager Fund

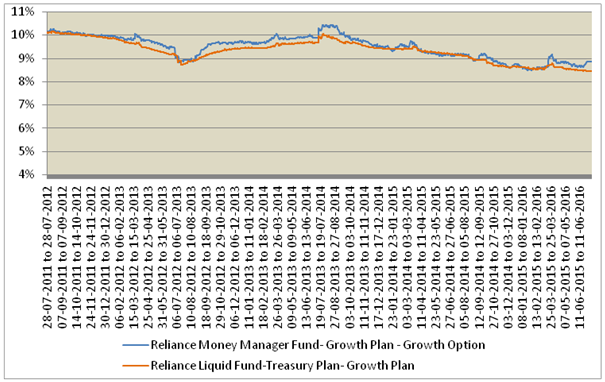

The chart below shows the 1 year rolling returns of Reliance Money Manager Fund, over the last 5 years. The stability of rolling returns of ultra-short term funds is an evidence of good fund management.

Source: Advisorkhoj Research

You can see that, the 1 year rolling returns of Reliance Money Manager Fund consistently beat the average category rolling returns over the last 5 years. What you also see that, the performance gap between the category and the fund is fairly stable. The rolling returns, at times were close to double digits, but are now around 8 – 8.5%.

Key differences with liquid fund

Let us compare the 1 year rolling returns of Reliance Money Manager Fund with well known liquid fund from the Reliance Mutual Fund stable, Reliance Liquid Fund – Treasury Plan.

You can see in the chart above that, Reliance Money Manager Fund was able to give higher rolling returns than the liquid fund most of the times, over the last 5 years.

The average maturity of Reliance Money Manager Fund is 0.9 years and the yield to maturity (YTM) is 7.9%. This implies that, assuming no portfolio changes over the next 10 – 11 months, Reliance Money Manager Fund will give 7.9% returns before expenses.

Please note that, this is only a directional indicator because there will be portfolio changes and therefore, the fund’s returns will deviate a bit from what is indicated by the current YTM. The final return will also be net of expenses. Compare the average maturity and YTM of Reliance Money Manager Fund with those of Reliance Liquid Fund – Treasury Plan. The average maturity and YTM of Reliance Liquid Fund – Treasury Plan are 0.16 and 7.39% respectively. You can see that, while the average maturity of the liquid fund is lower, the YTM is also lower compared to the ultra-short term debt fund.

Instant Redemption Feature

Reliance Mutual fund recently announced a first of its kind redemption feature, wherein investors can redeem a maximum of र 2 lakhs of their investment into Reliance Money Manager Fund in maximum 30 minutes at any time of the day, 365 days an year. Further, this feature is available to resident Indian investors 24 X 7, in all the 365 days of the year.

For example, if you have an investment in Reliance Money Manager Fund and want to redeem up to र 2 lakhs on a Saturday or Sunday evening, you do not have to wait till Monday morning, to put in your redemption request. All you have to do is to go to Reliance Mutual Fund website and put in an instant redemption request. Reliance Mutual Fund will credit the money to your registered bank account within minutes of your online redemption request.

To read more about this feature please refer our post, Reliance Mutual Fund launches revolutionary INSTANT REDEMPTION Feature. This feature brings Reliance Money Manager Fund a step closer in terms of convenience offered by savings banks.

Dividend Payout Track Record and Dividend Reinvestment Options

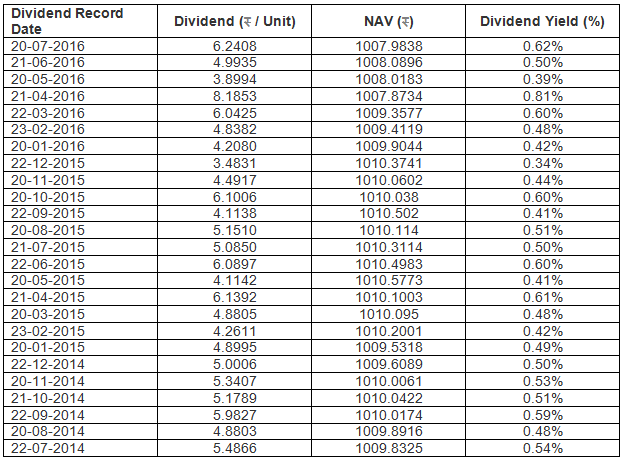

Reliance Money Manager Fund has a strong dividend pay-out track record. The table below shows the dividends paid by Reliance Money Manager Fund Monthly Dividend Option, over the last 2 years.

Source: Advisorkhoj Historical Dividends

For investors, in the highest tax bracket, it will be more tax efficient to opt for dividend or dividend re-investment options. Please note that, debt fund returns for investments held for a period of less than 3 years are taxed as per the income tax rate of the investor. On the other hands, dividends are tax free in the hands of investors, but the AMC has to pay dividend distribution tax at the rate of 28.3%, before distributing dividends to investors. Therefore, if you are in the 30% tax bracket, it is more tax efficient to opt for dividend options than the growth option. If you do not need the dividend cash-flows, you can invest in the dividend re-investment options, whereby the dividends declared are used to purchase units of the fund at the ex-dividend NAV. In effect the return of the dividend re-investment will be the same as the growth option; however, you will gain through the tax arbitrage.

Conclusion

Reliance Money Manager Fund has delivered solid and consistent performance over the years. The instant redemption feature is a huge advantage for investors, looking for incremental liquidity. You should consult with your financial advisor, if Reliance Money Manager Fund is suitable for your financial planning purposes.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team