SBI Magnum Balanced Fund: One of the Best Balanced Funds in last 5 years

Balanced Funds are hybrid equity oriented mutual funds. Minimum equity allocation in these funds is 65% and the rest in debt instruments. Being an equity oriented mutual fund, Balanced Funds enjoy equity taxation. Apart from the long term capital gains (investment tenure of more than I year) being totally tax free, the dividends paid by Balanced Funds are also tax free. While the equity allocation of Balanced Funds generates superior returns over a long investment horizon, the debt allocation limits volatility and downside risks in market corrections.

Launched in December 1995, SBI Magnum Balanced Fund is a very popular fund in this category and is one of the best performing balanced funds in the last 5 years. The fund has an exceptional performance track record in the last 5 years; it has given around 20% annualized returns and over 16% return since inception. With AUM of over 12,000 Crores, it is one of the biggest balanced funds in terms of size as well. The expense ratio of 1.98% for the regular plan is one of the lowest in this category.

SBI Balanced Fund is a product from SBI Mutual Fund which is the 5th biggest Asset Management Company in India. SBI Balanced Fund is a high rated Fund – 4 Star rating from both, Valueresearch and Morningstar. The fund managers of this scheme are Dinesh Ahuja and R Srinivasan.

Our internal research in Advisorkhoj shows that, Even though Balanced Funds do not have 100% equities in their portfolio, it has delivered superior returns compared to large cap equity mutual funds.

In the last 3, 5 and 10 years period, the balanced fund category has given 13.96%, 17.12% and 10.85% respectively. Large cap fund category has given lesser returns in these periods – 12.15%, 16.56% and 9.81% in 3, 5 and 10 years periods respectively.

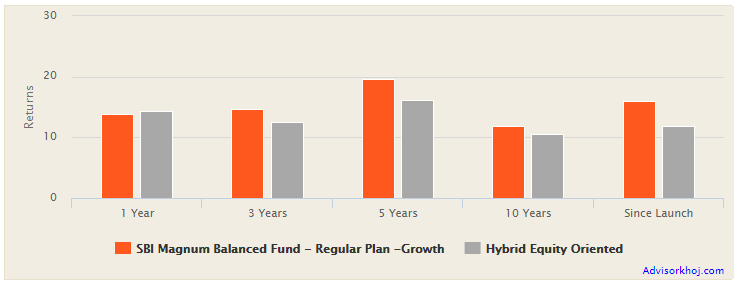

The chart below shows the trailing returns of SBI Magnum Balanced Fund versus the Balanced Fund category across different time-scales. As we can see the fund has given far superior trailing returns than the Balanced Fund category over different time-scales.

Source: Advisorkhoj Research

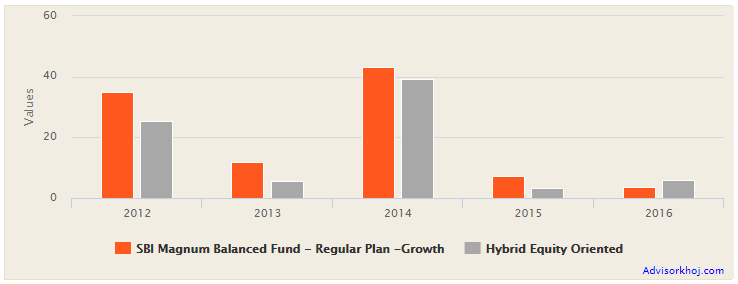

Now, let us see how are the annual returns of SBI Magnum Balanced Fund versus the fund category in the last 5 years.

Source: Advisorkhoj Research

As you can see above, SBI Magnum Balanced Fund outperformed the category returns in all years except in 2016 wherein it could not outperform the category by a slight margin.

Rolling Returns

The 3 year rolling returns chart shows why SBI Magnum Balanced Fund is such a strong performer. The chart below shows the 3 year rolling returns of the fund versus the balanced fund category over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that the 3 year rolling returns of this fund has consistently outperformed the balanced fund category. You can also see that, the fund has almost always given more than 13% three year rolling returns over the last 5 years. This shows strong performance consistency. The fund has given more than 20% three year rolling returns nearly 42% of the times in the last 5 years. The maximum 3 year rolling returns of SBI Magnum Balanced Fund is around 25%, while the minimum 3 year rolling returns of SBI Magnum Balanced Fund is around 13%. The average 3 year rolling returns of the fund is over 19%, while the median three year rolling returns is also around 20%. Such high rolling returns from a balanced fund, with minimum fixed income exposure of 20%, is indeed exceptional performance.

Portfolio

The current asset allocation of the scheme is 70% equity, 27% debt (fixed income) and the balance 3% is in cash equivalents. The equity portfolio of SBI Magnum Balanced Fund is multi cap oriented and heavily tilted towards financial service sector. 30% of the holding is in this sector with HDFC Bank, ICICI Bank, SBI and Kotak Mahindra Bank being the top holdings in the portfolio.The other sector that the fund is invested in is Services, Healthcare and FMCG. The debt portion of the scheme portfolio has around 50%. The fund has also invested in lower rated corporate bonds (A, A+) for higher accruals.

SIP Returns of SBI Magnum Balanced Fund

The chart below shows the returns of Rs 5,000 monthly SIP in SBI Magnum Balanced Fund for the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment of just Rs 3 lakhs you could have accumulated a corpus of almost Rs 4.64 lakhs in the last 5 years (a profit of over Rs 1.64 lakhs). The SIP return (XIRR) of SBI Magnum Balanced Fund in the last 5 years was around 17.55%.

The since inception SIP returns of this fund has also been amazing! You would have accumulated a corpus of over Rs 75 Lakhs against your investment of Rs 13 Lakhs only (assuming Rs 5,000 invested every month since inception, Dec 31, 1995 till now). The fund SIP return has been over 14% since inception.

Lump sum Returns of SBI Magnum Balanced Fund

If you had invested Rs 1 Lakhs in the NFO of SBI Magnum Balanced Fund, the investment would have multiplied approx 28 times (Rs 27.89 Lakhs as on 28/7/17).

SWP Returns of SBI Magnum Balanced Fund

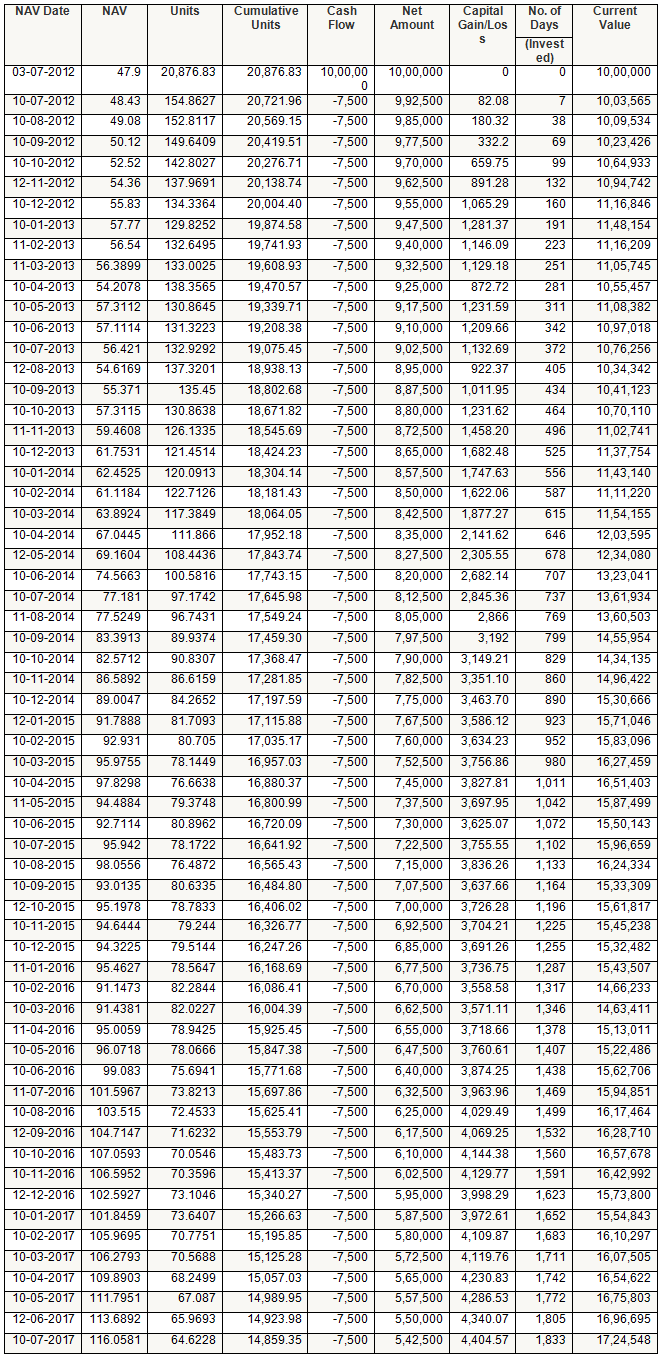

In the last few years SWP has become a preferred choice of those investors who want to withdraw a fixed amount from their investments every month. SWP from Balanced Funds is a smart option to get regular return from your investments as they are less volatile than that of equity funds. Let us see how SWP in SBI Magnum Balanced Fund has worked in the last 5 years through the chart below –

Source: Advisorkhoj SWP Return Calculator

As you can see above, we assumed that the investor invested Rs 10 Lakhs in July 2012 and withdrawn Rs 7,500 per month (annual withdrawal rate 9%). Within these 5 years the investor has withdrawn Rs 457,500 (Rs 7,500 per month x 61 months) but the current value of Rs 17.24 Lakhs is higher than the initial investment amount of Rs 10 Lakhs! This is because the fund has given 19.7% annual returns during the period but the investor has withdrawn only @9% per annum.

Therefore, we can conclude that even after regular withdrawals through SWP, capital appreciation is possible on your investments provided you have a long investment horizon.

To explore how SWPs work, you may check this link

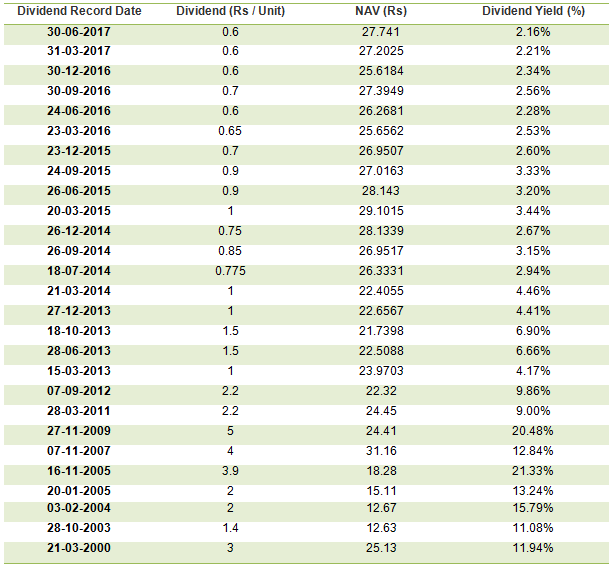

Dividend Payout Track Record

SBI Magnum Balanced Fund has an excellent dividend payout track record. For the last 7 years the fund has paid dividends every year and currently the Dividend option of the regular plan pays quarterly dividends.

Source: Advisorkhoj Historical Dividends

Conclusion

We have seen Balanced Funds have given better return than large cap funds even though they have only 65% equities in their portfolio. Having 65% equity in the portfolio also makes balanced fund less risky than pure equity funds. Therefore, investors may consider SBI Magnum Balanced Fund for their retirement planning and other long term financial objectives, through systematic investment plans or lump sum with a minimum 5 years investment horizon.

Given its good dividend pay-out track record, investors who prefer dividends can opt for the regular dividend payout option which pays quarterly dividends. Other than dividends, investors can also draw a fixed amount by way of SWP (Systematic Withdrawal Plan) depending on their monthly cash flow requirements. Investors should consult with their financial advisors, if SBI Magnum Balanced Fund is suitable for their financial planning objectives.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team