SWP: Reliance Regular Savings Fund Balanced option gave good regular returns

In our last post on this series we discussed how SWP from ICICI Prudential Balanced Fund was proved to be a good option if one was looking for regular returns by using the SWP method. Today we will analyze how the same worked for Reliance Regular Savings Fund Balanced Option – Growth Plan.

As you know already Balanced Mutual Funds invests 65 – 75 % of the portfolio in equities and rest in debt or money market instruments and also that the balanced funds are subject to equity taxation as these are hybrid equity oriented mutual funds. Long term capital gains, for investment period of more than 1 year and the dividends received from balanced funds, both are tax free. Short term capital gains applicable for investments of less than 1 year are taxed at 15%.

If you want to know more about Balanced Funds, please read these articles on our website –

Can mutual fund balanced fund be your best bet

Investing in balanced funds versus a portfolio of equity and debt funds

Why balanced funds may be the best investments for new mutual fund investors

What is Systematic Withdrawal Plan (SWP) in Mutual Funds

Systematic Withdrawal Plan or SWP, as popularly known, is a service offered by Mutual Funds which provides investors withdrawal of a specific amount of payout at a pre determined time frequency, like weekly, fortnightly, monthly, quarterly, half-yearly or annually.

Unfortunately, this is a much underestimated investment strategy in India. If understood properly, this could become the most effective and tax efficient way to earn regular returns from Mutual funds. Through a series of our articles on SWP, we will try educate the investors about SWP, how it works and the tax benefits etc. by showing some examples of top performing Balanced Funds.

How SWP worked in case of Reliance Regular Savings Fund Balanced Option – Growth Plan

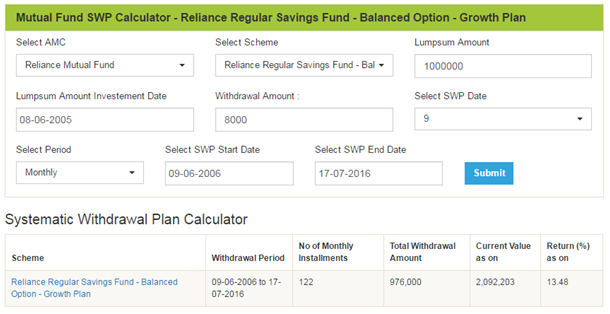

If you had invested र 10 Lacs in the NFO of Reliance Regular Savings Fund Balanced Option – Growth Plan on June 8, 2005 and withdrawn र 8,000 per month from June 9, 2006, then the current value of your investment would have been र 20.92 Lakhs even after withdrawing र 9.76 Lakhs!

We came to this conclusion by presuming that the lumpsum investment of र 10.00 Lakhs was made on the Scheme inception date i.e. June 8, 2005. We also presumed that the monthly SWP withdrawal of र 8,000 was started after one year (starting date June 9, 2006) and thereafter on the 9th day of every month so that each and every SWP amount in the hands of the investor is tax free.

Please look at the image below to understand how we have selected the different options in the research tool to get this result. You can also explore this SWP Research tool to explore SWP return of any fund you like.

Source: Advisorkhoj SWP Calculator (Data as on 15/7/2016)

SWP (Systematic Withdrawal Plan) results

From the above chart you can see that the investor would have withdrawn a total of र 9.76 Lakhs through 122 equal monthly SWP instalments of र 8,000 each, thus, he would have got a tax free return of 9.6% every year. Even after withdrawing a tax free amount of र 9.76 Lakhs, the current value of his investment would stand at र 20.92 Lakhs! The SWP returns were annual (IRR) 13.48%.

You may Download the cash flow in excel and check

Can SWP take care of Inflation

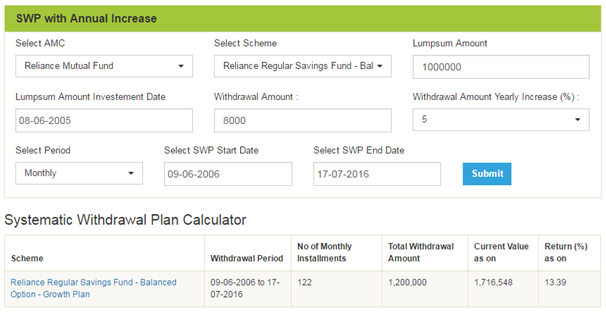

Inflation is a very vital point when you are planning your investments. In fact, two things are very important in any investment planning – Post tax return and inflation adjusted return - therefore, in this study, we will analyse what happens when we increase the SWP amount by 5% (presuming average inflation rate of 5%) every year.

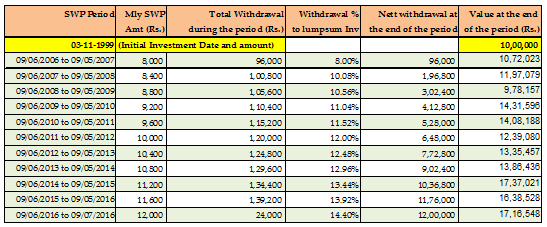

Source: Advisorkhoj SWP Calculator with Annual increase (Data as on 15/7/2016)

From the above image, you can see that the investor would have withdrawn a total of र 12.00 Lakhs through 122 increasing SWP instalments from Rs. 8,000 per month in the first year and ending with र 12,000 per month in the last year. Therefore, he would have got a tax free return of 9.6% in the first year which gradually increased every year and in the last year it was 14.40%. Even after withdrawing a tax free amount of र 12.00 Lacs, the current value of his investment would be र 17.16 Lakhs! The fund gave an annualised (IRR) 13.39% return.

Please download the cash flow in excel and check how it worked?

Let us now see how the SWP amount increased over a period of time, the increasing withdrawal % on the lumpsum amount and how the value of net investments changed annually post these systematic withdrawals.

You will notice from the above image, how we have increased the SWP amount annually by 5% on the initial investment. You will also notice that during this entire period, the net investment value dropped to lesser than the initial lumpsum investment amount i.e. र 10.00 Lacs, only during the period of October 2008 - May 2009. You must have also noticed that barring these 8 month, the remaining period the net investment value never gone down to less than the initial investment of र 10.00 Lacs even though we increased the SWP amount by 5% annually. It proves that if you remain invested over long period in balanced funds then the trailing returns should be positive.

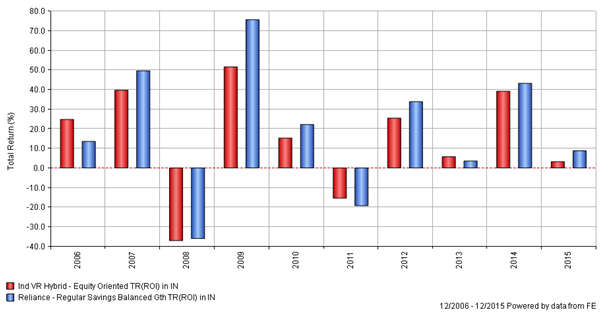

Now let us see the annual returns of Reliance Regular Savings Fund – Balanced option – Growth Plan against VR hybrid Equity Oriented index

Source: ValueExpress

You will notice that during the last 10 years, the fund has beaten the VR-Hybrid Equity Index in most of the years excepting 2006, 2011 and 2013 when the markets passed through volatile times.

About Reliance Regular Savings Fund Balanced Option

Reliance Regular Savings Fund Balanced Option is a hybrid equity oriented fund, popularly known as balanced funds. Launched in June 2005, it is another popular fund in the Balanced Fund category from one of India’s top AMCs, Reliance Mutual Fund, having AUM of र 2,691 Crores (As on June 30, 2016). It is one of the best performing Balanced Funds in the industry with a fairly long term track record of 10 years. Amit Tripathi and Sanjay Parkeh, are the joint fund managers for this fund.

The top 5 stocks that the fund is invested in, are – HDFC Bank. Infosys, Reliance Industries, Maruti Suzuki and Tata Motor DVR. The 3 top sectors are Energy, Financial and Automobile.

We reviewed this fund sometime back which you might like to read - 10 years of strong by this fund

Lumpsum returns of Reliance Regular Savings Fund Balanced Option – Growth Plan

So far we discussed the SWP returns of Reliance Regular Savings Fund Balanced Option – Growth plan and found how amazing the results were. Let us now examine the lumpsum returns of this fund. Had you invested र 10 Lacs in the NFO of this fund on June 8, 2005 the current fund value would have been a decent र 42.89 Lakhs, a decent CAGR of 14.00% since inception. If the same was invested for this period in bank fixed deposit, then you would have got only र 23.14 Lakhs

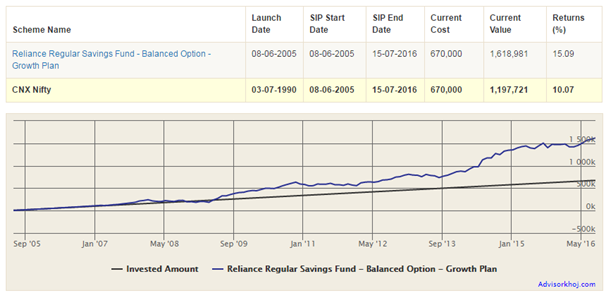

SIP Returns of Reliance Regular Savings Fund Balanced Option – Growth Plan

The SIP returns of Reliance Regular Savings Fund Balanced Option – Growth Plan have also been very good! If you had started a monthly SIP of र 5,000 on June 3, 2005, then you would have accumulated a corpus of र 16.19 Lacs, based on NAV of July, 15, 2016 whereas you had invested only र 6.70 Lakhs through 134 instalments of र 5,000 each. During this period the fund has given a decent XIRR return of 15.09% which is one of the best amongst the peer group of schemes. Check out SIP Return Calculator

Source: Advisorkhoj SIP Calculator

Conclusion

Reliance Regular Savings Fund Balanced Option – Growth Plan has given very good SWP returns since inception and may be a good choice for investors looking for regular income from their lumpsum investments in balanced funds and thus taking only moderate risk. However, investors should note that past performance of mutual funds are no guarantees for future returns. Mutual fund investments are subject to market risk and therefore investors must consult their financial advisors and check if investment in Reliance Regular Savings Fund Balanced Option is suited for their investment needs based on their risk profile.

Readers interested in knowing more about SWP, may read the following contents –

Mutual Funds are ideal investment option for retirement planning

Mutual Fund systematic withdrawal plans are smart option for income needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team