How to protect wealth created by SIP: Part 2

SIP is a disciplined way of investing from your regular savings to accumulate corpuses for your long term goals. However, a severe market crash can erode considerable amount of wealth accumulated over several years through SIP.

In this two part blog post, we are discussing how you can protect your wealth created by Mutual Fund SIPs. When you are investing through SIP over long investment tenures, the accumulated profits constitute a much bigger portion of your wealth compared to your cumulative investments (SIP instalments).

In the first part of this series, How to protect wealth created by SIP: Part 1, we discussed how we can protect our accumulated profits by booking profits at the right levels.

Brief recap of Part 1

We strongly urge investors who have not read the first part of this blog post to read by clicking on this link ->How to protect wealth created by SIP: Part 1. We have explained in the investment strategy, its rationale and execution in Part 1. For the benefit of investors who have read Part 1, here is a brief recap of the investment strategy we discussed:-

- Start a monthly SIP in a scheme of your choice.

- At the end of every month check Nifty 50 PE multiple. If PE multiple is 26 times or more, book 75% of the accumulated profits (Investment market value – Cumulative Investments).

- If Nifty 50 PE multiple is 28 times or more, book 100% of the accumulated profits. If you had booked 75% of the accumulated profits earlier when Nifty 50 PE had crossed 26, then you should book the balance 25% profits when PE is 28 or more.

- Invest the redemption proceeds in a liquid fund immediately after you book profits partially or fully.

- You should always continue your SIP, whether you have booked profits or not.

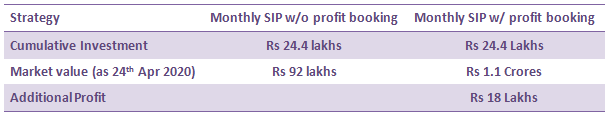

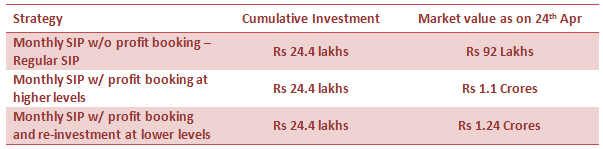

Here is a summary of the results of our investment strategy assuming you were investing Rs 10,000 monthly in Nifty 50 TRI from 1st Jan 2000 till 24th Apr 2020. With no profit booking, you could have accumulated a corpus of Rs 92 lakhs on a cumulative investment of Rs 24.4 lakhs over the last 20 years. By following the profit booking strategy described above, you would have accumulated a corpus of Rs 1.1 Crores with the same cumulative investment (Rs 24.4 lakhs).

Buy low and sell high

You can see that we were able to make an additional profit of Rs 18 lakhs by following a simple but disciplined strategy of profit booking at higher valuation levels. In other words, we applied one part of the age old stock market wisdom – buying low and selling high to SIP.

Please note that we applied only one part of the “buy low and sell high” in this strategy. While we were selling, we were not buying low. We were buying at average prices because through SIP you average the rupee cost of purchase, buy both low and high. Is there a way by which we can apply both parts of the age old stock market wisdom buying low and selling high by modifying our strategy a bit?

Re-invest in equity when prices are low

In our profit booking strategy, we booked profits when valuations (PE multiples) exceeded 26 – 28 times and invested the redemption proceeds in a liquid fund. Can we look to re-invest in equity when valuations are low by switching from liquid fund back to equity? To answer this question we must determine what low valuation is and for this we need to revisit a chart we showed in Part 1.

The average PE multiple of Nifty 50 over the last 20 years was around 20 times. A PE multiple below 20 times, therefore can be considered low. Can prices fall further below PE multiples of 20? Yes, we have seen PE dip to 15 times and even fall closer to 10 – 12 times. But we have also seen prices rebound from 19 – 20 PE levels. Therefore, we will consider PE of 20 as a trigger for re-investing in equity. If valuations dip further, you will be able to buy at lower levels since you will be continuing your SIP. In theory this strategy looks sound - Let us now put it to practise by back-testing it.

Profit booking and re-investing in SIP

The investment strategy is very similar to profit booking strategy. The only modification is that when end of month Nifty PE multiple is less than 20 times then we will switch from liquid fund to equity. The rest of the strategy that profit booking at 26 to 28 times PE multiple and investing the proceeds in liquid fund remains unchanged. Also whether we are booking profits or switching from liquid fund to equity, we will continue our monthly SIP.

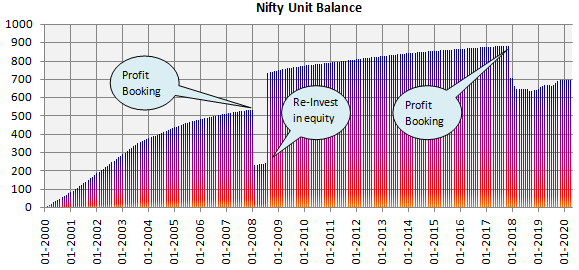

Let us assume you began with a monthly SIP of Rs 10,000 in Nifty 50 TRI on 1st January 2000. The chart shows the unit balance (net of unit accumulation and redemption) over the investment period. You can see that units accumulate steadily, then a sharp fall due to redemption for profit booking, sharp rise again when Nifty valuation fell below 20, steady accumulation and again redemption when valuation was high. We assumed liquid fund returns to be 6% annualized.

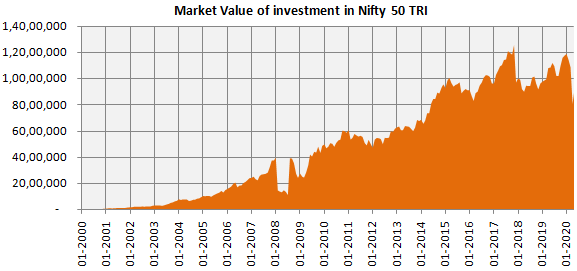

Let us now see the market value of our investment in Nifty 50 TRI over the investment period (see the chart below). You should note the sharp value in investment value is mainly due to profit booking and much smaller impact of market volatility. At the end of the investment tenure (24th April 2020) around Rs 90 lakhs is invested in Nifty. If you compare the market value of investment in Nifty 50 TRI in this strategy versus “profit booking only” strategy (see Part 1), a much bigger portion of your wealth is invested in equity.

Source: Advisorkhoj Research

If you compare the market value of investment in Nifty 50 TRI in this strategy versus “profit booking only” strategy (see Part 1), a much bigger portion of your wealth is invested in equity from an asset allocation viewpoint. This strategy will result in higher portfolio volatility but can potentially give much higher returns in the future because prices are low currently.

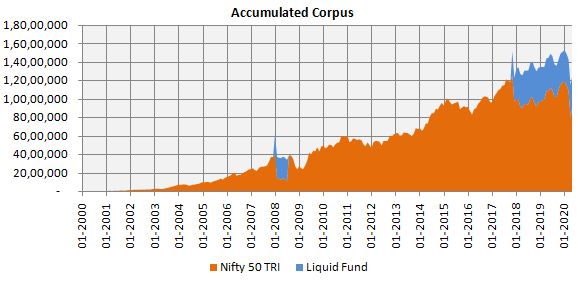

Let us now see how much wealth you were able to create using this strategy by layering in the liquid fund investment value on top of your Nifty 50 investment. The value of your liquid fund investment as on 24th April 2020 was Rs 34 lakhs.

Source: Advisorkhoj Research

Comparing results of 3 strategies

Conclusion

It is no surprise that the third strategy yielded the highest returns because we were buying low and selling high, whereas in the second strategy we were only selling high and continuing our SIP. Both the strategies are based on sound investment logic and easy to execute if you monitor your portfolio on a monthly basis.

Though the third strategy may yield the highest returns in the long term it may not be suitable for all investors. As discussed earlier, the re-investment in equity at lower levels will result in higher equity weight in your asset allocation making your portfolio more volatile. You should take your financial goals and risk appetite in account before forming an investment strategy.

SIPs can span across different stages of life. You may start with the third strategy (profit booking and re-investing) in the early life-stages and then switch to the second strategy (profit booking only) as you approach your different life-stage goals.

You should always consult with your financial advisor to understand your risk appetite and suitability of different asset allocations for your risk profile.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team