The right Equity Mutual Funds when investing for the first time

Advisors and experts often mention that equity mutual funds are idle for investments as they provide long term capital gains and some schemes especially the ones under ELSS category qualify for tax rebate under Section 80C. The dividends received from these funds are also tax free in the hands of the investors. Also, the returns from equity mutual funds have beaten the returns from any other asset class over a long term period. These features make the equity mutual funds attractive enough for investors to invest. However, those investors who are just beginners and have not experienced long term investing through mutual fund route must note that all or any type of equity mutual funds are not suitable for them. Please note that investments in equity mutual funds are risky and meant for long term. Therefore, it is necessary for these investors to know more about category of equity mutual funds which are popular but may or may not be suitable for them.

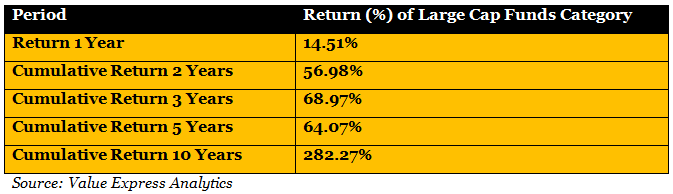

Large Cap Oriented Equity Funds

Large Cap Oriented Equity Funds are those mutual funds, which seek capital appreciation by investing primarily in equities of large blue chip companies. Different mutual funds have different criteria for classifying companies as large cap. Generally, companies with a large market capitalisation are known as large cap companies. Some examples of large cap companies are – Reliance, ITC, L&T, ICICI Bank, TATA Steel, and Infosys etc.

The major advantages of large cap funds is that they are less volatile than mid cap and small cap funds and the near term prospects of large cap funds can be more accurately predicted. On the flip side, the large cap funds may offer lower returns than mid cap or small cap funds. However, when compared in totality, large cap funds outperform all other funds. In volatile times it is advisable to invest in large cap funds.

Diversified Equity Funds

These are funds as the names suggest, have investments diversified across large cap, mid and small cap stocks and various sectors. As the investments are so diversified in nature it reduces the risk as the loss or less returns of one sector or market cap gets balanced by the profit of the other. This feature makes these equity funds safe with low risk and moderately high returns.

The diversified equity funds that heavily incline on mid and small cap stocks are considered to be risky rather than the funds which emphasize on large cap. Hence, investors are advised to check the asset allocation which is carried out in the funds which also determines the risk factor associated with the fund.

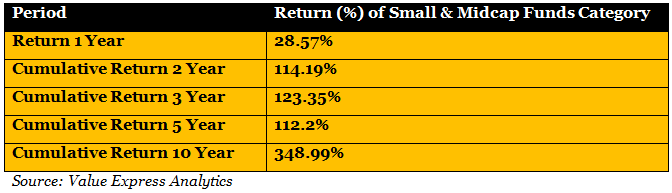

Small and Midcap equity Funds

Mid and Small cap funds are those mutual funds, which invest in the equity of small and medium sized companies. These Mutual funds thus diversify their investments in between mid and small cap companies. Due to their exposure in high beta and smaller company stocks, small and midcap equity funds are often considered to be riskier than large cap or diversified equity funds. However, even though they are volatile in nature but if the risk pays off they also give higher returns. Therefore, these funds are suitable only for investors with a high risk taking appetite. As it can be seen in the table below in the last 10 years the cumulative return has been 345% from this category. Experts and advisors are of the opinion that these funds should not be the core investment element in a portfolio of investors who are beginners in investing in mutual funds.

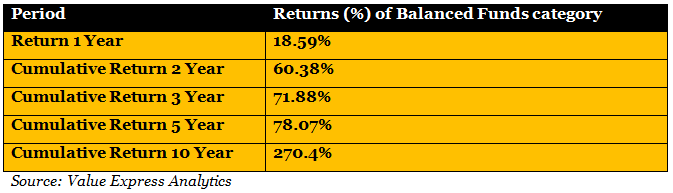

Hybrid Equity oriented Funds

These funds are also called balanced funds and allocate at least 65% of the portfolio in equities. As the name suggests, balanced funds invests in stocks, bonds and short term money markets in a single fund. It is the diversity in the asset class that is reflected in these funds. These funds are less risky than large cap, diversified and small and midcap funds and thus suitable for investors with a moderate risk taking appetite. Balanced funds provide a safe option for those who are looking for a less risky equity oriented fund with the ability to generate higher returns.

Balanced Funds also help in automatically rebalancing your portfolio. Most importantly, when the market goes down, Balanced Funds fall lesser than that of pure equity funds. An analysis of last 5 years when the market went through a volatile period, the equity oriented Balanced Funds has given better returns than diversified fund or large cap fund categories.

Experts and advisors are of the opinion that these funds should be the core investment element in a mutual fund portfolio of first time investors.

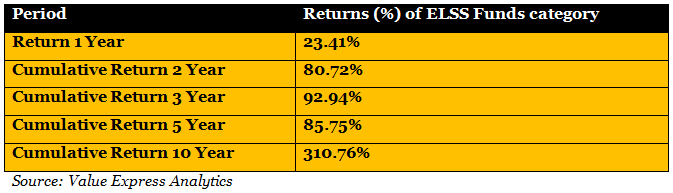

Equity Linked Savings Scheme

An equity linked savings scheme, or ELSS as popularly known, is a tax saving fund which invests in equities. This tax saving instrument (which gives a tax benefit under Section 80C upto Rs.150,000 per annum as per current IT rules) has the shortest lock in period of just three years when compared to other instruments like NSC and PPF. The experts and advisors often advise investors to pick funds not on the basis of past performance but rather on the consistency of returns over a long period of time.

The best part about an ELSS funds is investors can generate returns in three years and the dividends as well as long term capital gains are totally tax free. In the table given below are the cumulative returns up to ten years.

ELSS as a category is suitable for investors who pay tax and need to save tax under Section 80C. However, in terms of tax benefit and lock-in period all ELSS Funds are identical, therefore, an investor must check the portfolio and figure out if the fund is large cap oriented or diversified or tilted towards small and mid cap stocks. This is necessary keeping in view the risk taking appetite of the investor.

Experts and advisors are of the opinion that these funds should be the core investment element in a mutual fund portfolio of first time investors provided the portfolio is tilted towards large cap stocks.

Thematic or Sectoral Funds

Equity Mutual Funds which invest in a particular sector or industry are called sector or thematic funds. The portfolio of these funds invests in a particular sector (For example – Banking and Power Sector etc.) and thus offers no diversification. The performance of the sectoral funds is aligned with the performance of the sector in which it is investing. Therefore, these kinds of funds are riskier than any other category of equity or equity oriented mutual funds.

These funds are normally suitable for investors with high risk taking ability and therefore should preferably be non-core holding of your portfolio if you are investing for the first time in mutual funds.

Conclusion

Equity funds are often considered to be one of the best avenues of generating higher returns if invested for a long period of time. These funds that are generating such high returns are often accompanied by very high, high and moderate risk catering to the risk palate to a varying investor audience. It has something for every investor who wants to get high returns with low risk or want to make sector specific investments or want to make a balanced investment. For the beginners, investment in Balanced Funds and or large Cap Funds and or ELSS Funds could be the right choice. However, to be able to successfully invest in equity mutual funds you need to assess your risk taking appetite first with the help of an investment expert. So start as the returns await you!

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team