Continued benefits of debt funds and its role in building a strong investment portfolio

On 24th March 2023, the Finance Minister proposed an amendment to the Finance Bill 2023, whereby she proposed that the long term capital gains tax benefit for non equity schemes be removed. As per the provisions of Income Tax Act before this amendment, long term capital gains (holding period of 36 months or more) in non equity schemes was taxed at 20% after allowing for indexation benefits. As per the proposed amendment, all capital gains (short term or long term) in debt funds will be added to the income of the investor and taxed as per the marginal tax rate (income tax slab) of the investor.

Impact of this change

This tax change brings taxation of debt funds at parity with taxation of Bank Fixed Deposits. Many people have posted on social media that there is no longer any benefit of investing in debt mutual funds which are subject to market risks; one should invest in risk free Bank FDs instead. In this article, we will discuss the continued benefits of debt funds and its role in building a strong investment portfolio.

Potential of higher Pre-Tax returns

As per finance theory, risk and returns are related. You should understand that risk free return is the lowest possible return for the investor. If you do not take any risk, you will be compensated only for time. What does this mean? Money loses its purchasing power over time because of inflation. If you do not take any risks, you will be compensated only for the loss of purchasing power of your investment. In other words, the risk-free return is usually slightly higher than inflation rate on a pre-tax basis. In some cases, it is even lesser than the inflation rate. For example, savings bank interest rate is usually lower than the inflation rate on a pre-tax basis.

Let us compare a debt funds with a Bank FD. Debt funds invest in debt and money market instruments like Government Bonds (G-Secs), State Development Loans (SDLs), Non Convertible Debentures (NCDs), Commercial Papers (CPs), Certificates of Deposit (CDs) etc. Let us assume, as Bank FD is paying 6.5% interest rate for a 5 year term deposit. A company issuing a 5 year corporate bond or NCD will have to pay higher interest rate or coupon on the bond compared to Bank FD. If the company does not pay higher interest rate than bank FD, why will you invest in the bond? The issuer is paying you higher interest rate because you are taking the risk.

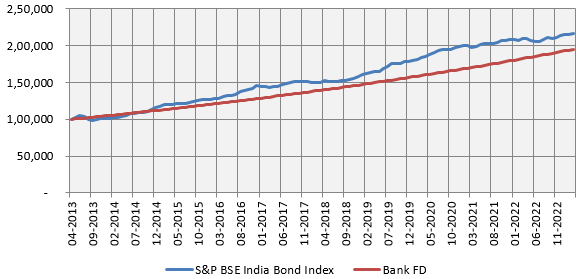

Historically, debt funds have given higher returns than Bank FDs of similar tenures. However, investors should be aware debt funds are subject to market risks and can be volatile in the short term. Investors in longer duration debt funds should have sufficiently long investment horizons. The chart below shows the growth of Rs 1 lakh investment in S&P BSE India Bond Index versus FD over the last 10 years (ending 31st March 2023). You can see that, even though S&P BSE India Bond Index was more volatile, it was able to outperform Bank FDs over the 10 last years. The CAGR return of S&P BSE India Bond Index was 8.14%, while that of Bank FD was 6.75%.

Source: S&P Global, BSE, SBI, Advisorkhoj. Bank FD interest is the average 1 year FD interest rate of SBI over the investment tenure. Period: 01.04.2013 to 31.03.2023. Disclaimer: Past performance may or may not be sustained in the future.

Potential of capital appreciation

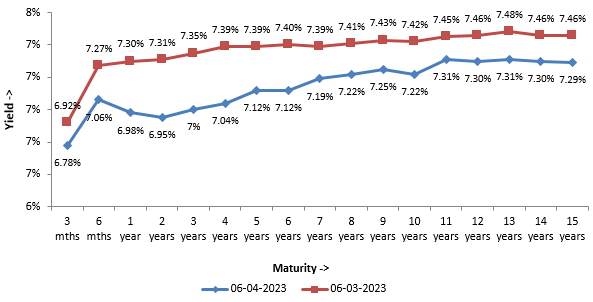

Though the primary investment objective in debt funds is income generation, there is the potential of capital appreciation also in favourable interest rate environment. Bond prices are inversely related to interest rate changes i.e. bond prices go up when interest rates go down and vice versa. The yield curve in India has been flattening over last 6 months, indicating potential mean reversion in the future (change in interest rate trajectory). Yields have come down across all maturities in the last one month (see the yield curve below). As mentioned earlier, bond prices and scheme NAVs will go up if yields come down further in the future. We should remind investors that the primary investment objective of debt funds is income generation; capital appreciation will be additional returns over accrual in favourable interest rate environment. You should always invest according to your risk appetite and consult with your financial advisor if you need help.

Source: worldgovernmentbonds.com, Advisorkhoj, as on 06.04.2023. Disclaimer: Past performance may or may not be sustained in the future.

Role of debt funds in your investment portfolio

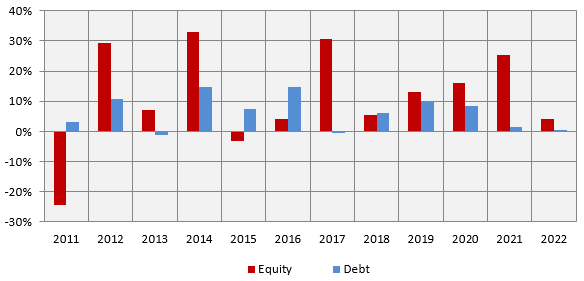

You should diversify your investment portfolio across different asset classes i.e. equity, debt, gold etc to balance risk and returns. Debt is one of the most important asset classes for asset allocation. The chart below shows the annual returns of equity and debt as asset classes. You can see that debt can bring stability to your portfolio when equity underperforms.

Source: NSE, Advisorkhoj. Equity as an asset class is represented by Nifty 50 TRI and debt as an asset class is represented Nifty 10 year Benchmark G-Sec Index. Period: 01.01.2011 to 31.12.2022. Disclaimer: Past performance may or may not be sustained in the future.

Different categories of debt funds for further diversification

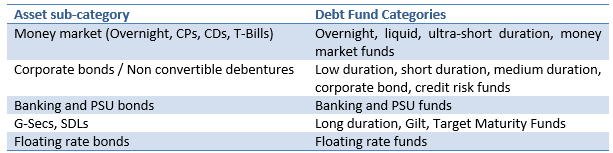

Within debt as an asset class there are several sub-classes e.g. money market (CPs, CDs, T-Bills), corporate bonds, banking and PSU bonds, G-Secs, SDLs etc. These sub-classes have different risk profiles. You can add further diversification to your investment portfolio by investing these categories of debt funds.

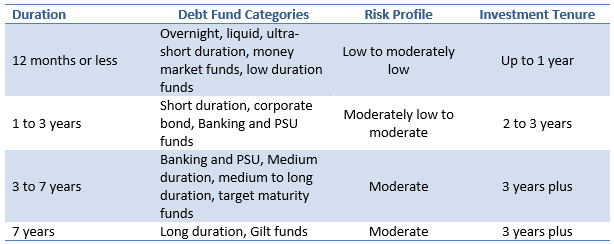

Different debt fund categories have different duration profiles. Duration and interest rate risk are directly related. You should invest in the suitable according to your investment tenure and risk appetite. Please note that the risk profile shown in the table is based on category level observations. SEBI requires each scheme to label the risk profile of the underlying instruments of the scheme. Please refer to the scheme Riskometer before investing. Also please note that the investment tenure is purely illustrative and is not a recommendation. You should discuss your investment needs and risk appetite with your mutual fund distributor or financial advisor and consult with him / her before investing.

Taxation during investment tenure

In a financial year, FD interest (whether paid out or accrued) is added to your income and taxed as per your income tax slab. The bank will deduct 10% TDS from your FD interest every year. You may have to pay additional tax in your Income Tax Return on your FD interest if you are in higher income tax slabs. There is no taxation on unrealized gains in debt funds; i.e. you do not have to pay any tax if you do not redeem your debt fund units. Since there is no taxation during the investment tenure, you gain more from compounding.

Conclusion

Over the last several years debt funds have been gaining popularity with retail investors. Debt funds provide investment solutions for a wide range of investment tenures and risk appetites. Many investors may have felt disappointed with the recent changes in capital gains taxation of debt funds. However, debt funds continue to provide many benefits to investors despite the tax changes. You should consult with your financial advisor to discuss which debt funds may be suitable for your investment needs.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Investor Rights in Mutual Funds

- Responsibilities of Regulators and Key Constituents of the Mutual Fund Industry

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY