Reflections of 2022 and Resolutions for 2023

2022 was a tumultuous year for global markets. We started the year with concerns regarding the highly infectious COVID variant, Omicron. As we ended 2022, COVID has reared its head again in China with a surge of cases. In 2022, we saw the first conventional war in Europe since World War 2. Russia invaded Ukraine in 2022 and the war is still continuing. With the West imposing sanctions on Russian exports, crude prices surged causing very high inflation.

Inflation and interest rates

Inflation had been rising globally since 2021 partly due to measures taken by central banks in response to COVID-19 and partly due to supply chain disruptions caused by the pandemic. Till as late as December 2021, the US Federal Reserve described the inflation as transitory. However, the central banks were forced to change their stand as inflation proved to be very stubborn. After Russia invaded Ukraine, the Fed hiked interest rate by 25 bps, in what go on to be series of rate hikes that would continue throughout 2022. In aggregate, the Fed hiked interest rate by 4.25% in 2022. As a result, the US Dollar (USD) surged against other currencies; the Indian Rupee (INR) depreciated by 11% against USD in 2022. In December 2022, in another extraordinary move, the Bank of Japan changed its decade old policy, by allowing its 10 year bond yield to move 50 bps from the 0% target. This may have ramifications for global markets. Global macroeconomic conditions forced the RBI to change its accommodative stance and raise interest rates (repo rate) 4 times in 2022, taking the repo rate to 6.25%.

Tough year for global equity markets

2022 was an extremely volatile year for global equity markets. The S&P 500 fell by nearly 20% (source: Bloomberg, as on 31st December 2022). The year was particularly bad for Technology Stocks. The tech-heavy NASDAQ crashed by 33% (source: Bloomberg, as on 31st December 2022). The war in Ukraine has led European economies to the brink of recession. The DAX (German stock market index) and CAC (French stock market index) fell by 10 – 12% (source: Bloomberg, as on 31st December 2022). The Chinese economy also faced slowdown in 2022 due to repeated lockdowns; a consequence of Chinese Government’s zero COVID policies. The Hang Seng fell by 15% in 2022.

India a bright spot in global markets

With recession looming in many parts of the world, India emerged as a bright spot in global economy and markets. The World Bank has revised India’s GDP growth in FY 2022-23 to 6.9%. While major global markets were in the red, Nifty closed the year with a 4.3% gain (source: National Stock Exchange, as on 31st December 2022). FII sentiments towards India turned positive in July and barring a couple of months FIIs have been net buyers of Indian equities. While the long term outlook on Indian equities is bright, investors should be prepared for short term volatility due to global headwinds, especially still persisting inflationary conditions. As such, investors should stick to basic investing principles e.g. long term investment horizon, disciplined approach, asset allocation and focus on quality.

Diversification is important

Historical stock market data shows that winners rotate across industry sectors. This was reiterated again in the last 2 - 3 years. The big winners of COVID era, IT and Pharma underperformed in 2022. The old economy sectors like BFSI, Capital Goods, Infrastructure, FMCG etc outperformed in 2022. The lesson for investors is diversification. You should diversify your investments across industry sectors by investing in mutual funds.

Multi asset allocation can optimize risk and returns in different market cycles

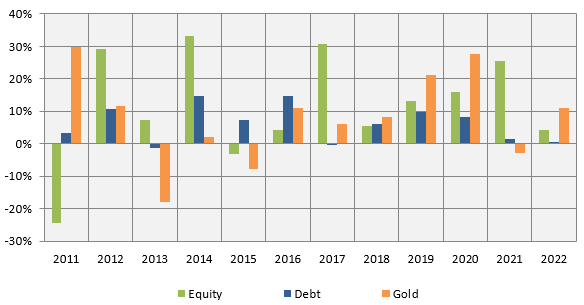

Another lesson from 2022 is the importance of asset allocation. Investors usually think of equity and debt as far as asset allocation is concerned. However a multi asset allocation strategy can optimize risk and returns better across different market cycles. There is low correlation between returns of different asset classes in different market conditions; equity and gold are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa. Gold in INR terms, outperformed equity giving 11% returns in 2022 (source: goldprice.org, 31st December 2022). Debt has low correlation with equity and gold (see the chart below). Investors may also consider adding international equity in their asset allocation, as per their risk appetite and investment needs. The correction in international equities may provide attractive investment opportunities.

Source: National Stock Exchange, Goldprice.org, Advisorkhoj Research, as on 30th December 2022. Equity is represented by Nifty 50 TRI, debt by Nifty 10 year G-Sec Benchmark Index and gold by gold prices in INR. Disclaimer: Past performance may not be sustained in future. The chart above is purely for investor education purposes and not intended to provide any asset allocation recommendation. You should discuss your asset allocation needs with your financial advisor.

Suggested reading: How can multi asset allocation work for you?

Understand risk and avoid risky assets

The Crypto crash wiped out hundreds of billions of dollars of investor’s wealth in 2022. We also saw several tech IPOs underperforming, with some of them trading significantly lower than issue price. You should understand risks and invest according to your risk appetite. You should always have long investment horizon in equities and avoid speculative bets.

Resolutions for 2023

Like 2022, market will react to global events in 2023. Economists are predicting the interest rate tightening cycle will come to its end, sometime in 2023. Though interest rates may remain high for a period of time, the market will start consolidating and build a base for the next bull phase

- Stick to your financial goals: Market may go up or down but your financial goals will not change. You should remain committed to your financial goal and keep investing for your goals.

- Optimize your asset allocation: You should rebalance your asset allocation from time to time to make sure that your portfolio is aligned to your risk profile and investment needs. Mutual funds offer Multi Asset Allocation Funds which helps you get automated asset allocation as these funds invest in multiple asset classes. Therefore, instead of investing in multiple funds for asset allocation purposes, you can just invest in one single fund “Multi Asset Allocation” which takes care of it. You should consult with your mutual fund distributor or financial advisor if you want to know more about asset allocation funds and how they work.

You may also like to read: Role and importance of asset allocation fund in the investor’s portfolio - Remain disciplined: The legendary investor, Warren Buffett said that “We don’t have to be smarter than the rest. We have to be more disciplined than the rest”. You should remain disciplined in your investments and react impulsively to market movement. To quote Buffett again, “Successful investing takes time, discipline, and patience”; all three are important attributes of a successful investor.

- Continue your SIP: Systematic Investment Plans (SIP) take emotions out investing and helps you remain disciplined. From January to November 2022, more than Rs 1.35 lakh crores were invested through SIP despite high volatility (source: AMFI, 30th November 2022). You should remain disciplined in your SIPs.

- Consult with your financial advisor: Different investors have different investment needs. At times you may need guidance to understand your needs and select the right investment products. You should consult with a financial advisor if you need any help in making investment decisions.

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Investor Rights in Mutual Funds

- Responsibilities of Regulators and Key Constituents of the Mutual Fund Industry

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY