Is the Rally Over in Long Duration Bonds?

Mutual Fund

Synopsis

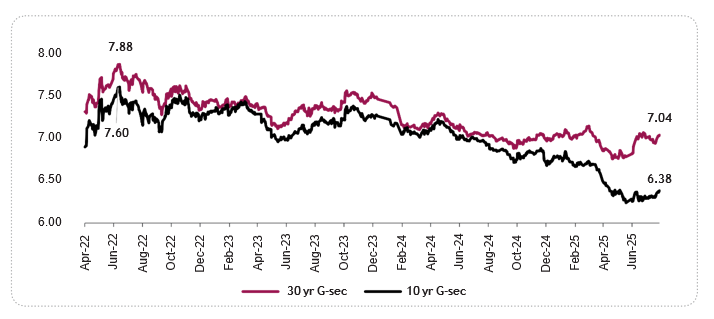

Over the past 12–15 months, India's fixed income market has delivered stellar returns, particularly in long-duration government securities. Investors have benefited from capital appreciation as yields have fallen and spreads on 10-year and 30-year bonds compressed sharply. This rally was driven by a confluence of macroeconomic easing, fiscal discipline, and tactical demand-supply dynamics.

Source: Bloomberg

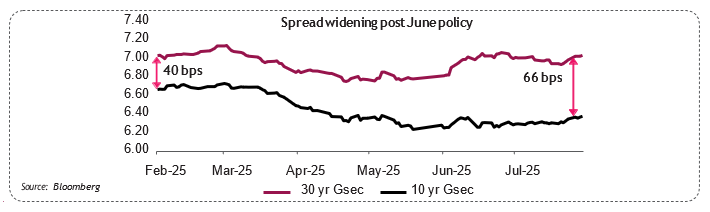

However, spread widening post the June monetary policy stance raises a critical question: is this the end of the rally for long duration bonds?

This Acumen outlines the key drivers behind the rally and explains why those catalysts may no longer be in play. Even though interest rates are expected to remain lower for an extended period, the structural rally in long-duration bonds appears to have largely run its course.

What Fueled the Massive Duration Rally?

The rally was underpinned by three key drivers:

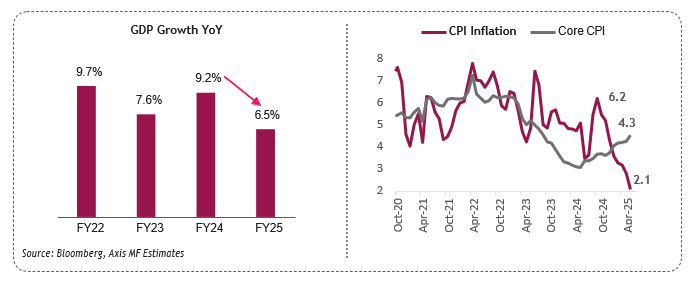

1. Macro Slowdown and Policy Easing

India's economic growth decelerated in 2024, prompting the Reserve Bank of India (RBI) to front-load rate cuts. CPI inflation fell steadily, and the central bank slashed the repo rate by 100 basis points over the course of last few months. This easing cycle culminated in a surprise 50 bps cut in June 2025, alongside a 100 bps CRR reduction.

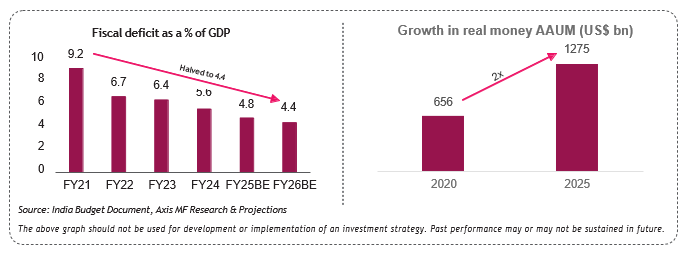

2. Structural Fiscal Consolidation

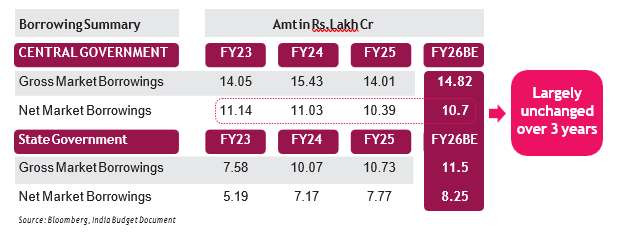

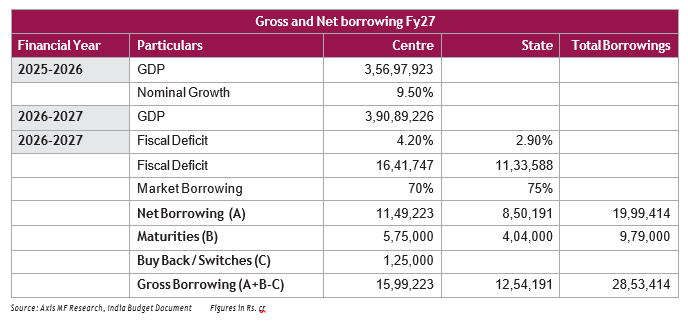

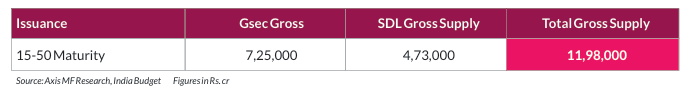

India's fiscal deficit narrowed from 9% during the COVID peak to 4.4%, supported by stable gross and net borrowings over the past three years (as shown in the table below). This fiscal discipline created a favorable backdrop for long- duration bonds. Real money investors AUM grew at a faster pace, further improving the supply-demand equation.

3. One off lever for the rally - Tactical and positive Demand-Supply Dynamics

The RBI's Rs 5 lakh crore of OMO purchases and strong FPI inflows to the tune of US$ 22 bn-especially post JP Morgan's inclusion of Indian bonds boosted demand thereby leading to positive demand supply dynamics.

Are the Catalysts Still Working?

Let's examine whether the rally's original drivers remain intact:

1. Limited Room for Further Easing

The RBI's shift to a neutral stance signals that aggressive rate cuts are unlikely. With operative rates already eased by 150 bps, any further cuts may be limited to just one more or two at best in case the growth surprises on downside. In fact the RBI itself reiterated that following successive rate cuts, there is limited room for further cuts to support growth.

2. Fiscal Consolidation Nearing Its Limits

While the deficit will narrow to 4.4% in FY26, we believe that further consolidation scope is limited due to:

- Slowing growth leading to weaker tax revenues

- The 8th Pay Commission

- Probable fall in RBI dividend

- A shift in fiscal metrics from deficit to centre debt-to-GDP

Gross borrowings for both central and state governments are projected to rise in FY27, potentially causing a strain on the bond market.

3. Tactical Tailwinds Fading

With Rs12 trillion injected via CRR cuts and other tools, and a current liquidity surplus of Rs 6 trillion, the need for OMOs is minimal. We do not expect any major OMOs until March 2026. FPI flows have dried up, with net outflows of Rs 27,643 crore over the last four months. Most JP Morgan and Bloomberg-related flows are already in, leaving little room for incremental demand.

Post-Policy Spread Widening: A Turning Point?

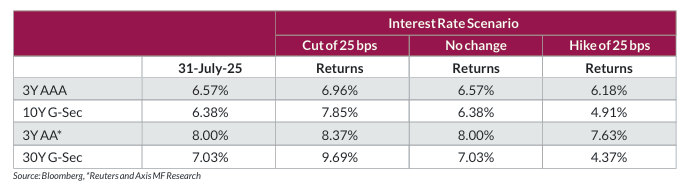

Since the June policy, spreads on long bonds have widened significantly-from 30–40 bps to nearly 70 bps.

Are These Attractive Levels or a Trap?

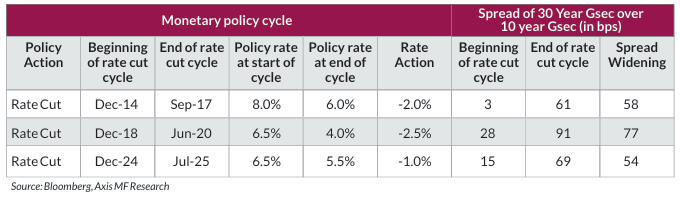

1. Fag end of rate cycle shows spread widening

Historical data shows that spreads tend to widen at the tail end of rate-cut cycles as highlighted in the table below. The previous rate cut cycles saw spreads (between 10 year and 30 year Gsecs) widen by 58 and 77 basis points, respectively. In the current cycle (Dec 2024 – Jul 2025), spreads have already widened by 54 basis points, indicating a similar steepening trend.

2. Fundamental Demand-Supply Mismatch in FY26

The current year's demand-supply mismatch is worsening, with limited tactical support and rising issuance. This imbalance could pressure yields higher, especially in long-duration segments.

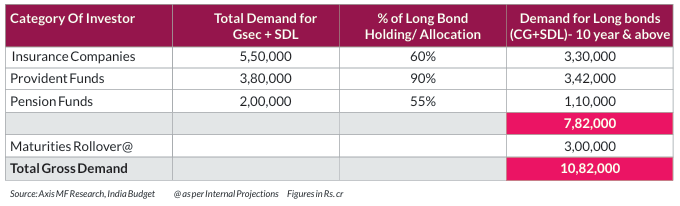

Demand for Long Bonds

Supply of Long Bonds

Central and state government bonds come out with half yearly and quarterly Issuance calendar for bonds. On the basis of auction calendar for the last three years we have observed a ~50% issuance in Long Bonds – 15 year and above by central government and ~40% issuance in long SDL.

The above analysis suggests a large mismatch in gross demand and supply for long bonds.

Furthermore, we believe that end of rate cut cycle and changes in the Held to Maturity (HTM) guidelines, participation from Banks, mutual funds and FPI would be limited and would not be sufficient to bridge the gap.

Key factors contributing to reduced demand from real money investors include

- Revised HTM guidelines for banks, impacting their ability to absorb long-duration securities.

- Changes in NPS (National Pension System) regulations, allowing for increased equity allocations from 15% to 25%, thereby reducing appetite for long bonds.

- Restrictions on incremental FPIinvestments in securities beyond 14 years underthe Fully Accessible Route (FAR).

Are These Attractive Levels or a Trap?

30 year bond yields rarely fall below 6.75%

Over the longer term, as seen below it is observed that the yields do not fall below 6.75% in the 30 year bonds. The chart below shows that through the 10 year period yields have traded in a band of 6.75-7.75% since 2016 when Flexible Inflation Targeting was implemented. The only exception being the 2020-2021 period when during COVID yields rose higher. Consequently, we expect that there will be a resistance for long bond yields to fall below this threshold.

Investor Strategy: how to navigate the new normal?

- Real Money Investors: Those with long-term liabilities may still find value in long bonds, especially if they can withstand short-term volatility.

- Mutual Funds & Tactical Investors: Investors should consider shifting to short-duration or accrual strategies. The steepening yield curve favors 2–5-year corporate bonds, which offer better risk-adjusted returns.

Risks to our view

- Aggressive rate cuts if growth surprises on downside

- Inclusion in Bloomberg bond indices

Conclusion

The primary concern for long-duration bonds is no longer about spreads or yield levels-it lies in the deteriorating demand- supply dynamics, both structurally and tactically. Unless India faces a significant growth shock where we see aggressive rate cuts or sees renewed momentum from inclusion in Bloomberg indices, which improves the demand supply dynamics- we believe the scope for rally in long duration bonds is limited. While interest rates are likely to remain lower for an extended period, the structural rally in long bonds appears to have largely played out. That said, tactical opportunities offering 10–15 basis points may still emerge intermittently. For investors focused on yield and near-term capital appreciation, alternative strategies as explained above may present a more compelling risk-reward profile.

Disclaimer

Source & Date: Bloomberg, Axis MF Research, India Budget Documents. Date: 31 July 2025

Disclaimer: This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025