Axis Short Duration Fund - Regular Plan - Growth Option

Fund House: Axis Mutual Fund| Category: Debt: Short Duration |

| Launch Date: 22-01-2010 |

| Asset Class: Fixed Income |

| Benchmark: NIFTY Short Duration Debt Index A-II |

| TER: 0.91% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 12,701.38 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: - | Exit Load: Nil |

31.8627

0 (0.0088%)

7.5%

Benchmark: 8.16%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY 3 YEAR SDL

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

9 Years 1 Months

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

To generate stable returns with a low risk strategy while maintaining liquidity through a portfolio comprising of debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be achieved.

Current Asset Allocation (%)

Indicators

| Standard Deviation | - |

| Sharpe Ratio | - |

| Alpha | - |

| Beta | - |

| Yield to Maturity | 7.04 |

| Average Maturity | 2.84 |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Axis Short Duration Fund - Regular Plan - Growth Option | 22-01-2010 | 7.47 | 7.72 | 7.4 | 5.99 | 7.1 |

| ICICI Prudential Short Term Fund - Growth Option | 01-10-2001 | 7.53 | 7.66 | 7.6 | 6.32 | 7.4 |

| Axis Short Duration Fund - Retail Plan - Growth Option | 05-03-2010 | 7.47 | 7.71 | 7.39 | 5.98 | 7.1 |

| Nippon India Short Duration Fund-Growth Plan | 01-12-2002 | 7.28 | 7.63 | 7.39 | 6.06 | 6.92 |

| HDFC Short Term Debt Fund - Growth Option | 05-06-2010 | 7.26 | 7.75 | 7.57 | 6.11 | 7.33 |

| SBI Short Horizon Debt Fund-Short Term Fund - Retail - Growth | 27-07-2007 | 7.22 | 7.47 | 7.22 | 5.7 | 6.86 |

| SBI Short Term Debt Fund - Regular Plan -Growth | 05-07-2007 | 7.22 | 7.47 | 7.22 | 5.7 | 6.86 |

| Aditya Birla Sun Life Short Term Fund - Growth - Regular Plan | 09-05-2003 | 7.13 | 7.51 | 7.34 | 6.1 | 7.27 |

| HSBC Short Duration Fund - Regular Growth | 01-01-2013 | 7.11 | 7.3 | 7.06 | 5.52 | 6.67 |

| TRUSTMF Short Duration Fund-Regular Plan-Growth | 06-08-2021 | 7.01 | 7.1 | 6.9 | - | - |

Scheme Characteristics

Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 1 year - 3 years.

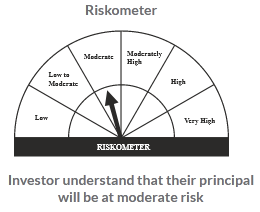

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.06%

Scheme Documents

There are no scheme documents available