BARODA BNP PARIBAS Mid Cap Fund - Regular Plan - IDCW Option

Fund House: Baroda BNP Paribas Mutual Fund| Category: Equity: Mid Cap |

| Launch Date: 01-01-2013 |

| Asset Class: |

| Benchmark: NIFTY Midcap 150 TRI |

| TER: 1.98% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 2,312.61 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 71% | Exit Load: If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment - Nil, If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment - 1% of the applicable NAV. If units of scheme are redeemed or switched out after 12 months from the date of allotment - Nil. |

59.3541

1.35 (2.2711%)

7.82%

Benchmark: 17.29%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The investment objective of the Scheme seeks to generate long-term capital appreciation by investing primarily in companies with high growth opportunities in the mid capitalization segment. The fund will emphasize on companies that appear to offer opportunities for longterm growth and will be inclined towards companies that are driven by dynamic style of management and entrepreneurial flair. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 12.5 |

| Sharpe Ratio | 1.3 |

| Alpha | 0.34 |

| Beta | 0.83 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| BARODA BNP PARIBAS Mid Cap Fund - Regular Plan - IDCW Option | 01-01-2013 | 1.15 | 1.86 | 10.74 | - | - |

| ICICI Prudential MidCap Fund - Growth | 10-10-2004 | 19.81 | 15.18 | 24.74 | 21.15 | 17.51 |

| HDFC Mid Cap Fund - Growth Plan | 25-06-2007 | 15.48 | 14.18 | 26.1 | 23.94 | 19.23 |

| Mirae Asset Midcap Fund - Regular Plan-Growth Option | 01-07-2019 | 15.45 | 10.6 | 20.98 | 18.94 | - |

| HSBC Midcap Fund - Regular Growth | 09-08-2004 | 14.3 | 14.42 | 24.77 | 19.65 | 17.01 |

| WhiteOak Capital Mid Cap Fund Regular Plan Growth | 07-09-2022 | 13.78 | 14.48 | 25.58 | - | - |

| NIPPON INDIA GROWTH MID CAP FUND - Growth Plan-Growth Option | 05-10-1995 | 13.29 | 13.72 | 25.88 | 23.02 | 19.36 |

| Invesco India Midcap Fund - Growth Option | 19-04-2007 | 13.05 | 18.2 | 26.33 | 21.46 | 18.67 |

| Union Midcap Fund - Regular Plan - Growth Option | 23-03-2020 | 12.87 | 11.98 | 21.12 | 19.79 | - |

| Sundaram Mid Cap Fund Regular Plan - Growth | 01-07-2002 | 12.72 | 14.77 | 25.19 | 20.7 | 16.23 |

Scheme Characteristics

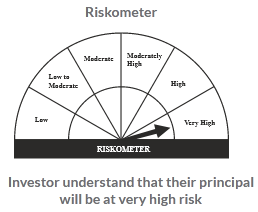

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

20.05%

Others

3.47%

Large Cap

8.11%

Mid Cap

68.37%

Scheme Documents

There are no scheme documents available