Taurus Ethical Fund - Regular Plan - Payout of Income Distribution cum Capital Withdrawal option

Fund House: Taurus Mutual Fund| Category: Equity: Thematic-Others |

| Launch Date: 06-04-2009 |

| Asset Class: Equity |

| Benchmark: BSE 500 Shariah TRI |

| TER: 2.38% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 500.0 |

| Minimum Topup: 500.0 |

| Total Assets: 370.14 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 99% | Exit Load: 1% if exited on or before 365 days. Nil, if exited after 365 days. |

86.17

2.05 (2.379%)

16.03%

Benchmark: 12.23%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The prime objective of the scheme is to provide capital appreciation and income distribution to unitholders through investment in a diversified portfolio of equities, which are based on the principles of Shariah/ethical set of principles.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 12.64 |

| Sharpe Ratio | 0.88 |

| Alpha | 0.62 |

| Beta | 0.86 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Taurus Ethical Fund - Regular Plan - Payout of Income Distribution cum Capital Withdrawal option | 06-04-2009 | 3.36 | 4.51 | 16.5 | 13.11 | 13.29 |

| HDFC Defence Fund - Growth Option | 02-06-2023 | 29.61 | 23.68 | - | - | - |

| SBI COMMA Fund - REGULAR PLAN - Growth | 05-08-2005 | 21.41 | 9.77 | 19.22 | 18.1 | 18.07 |

| ICICI Prudential Commodities Fund - Growth Option | 05-10-2019 | 19.85 | 11.03 | 18.89 | 25.26 | - |

| ICICI Prudential India Opportunities Fund - Cumulative Option | 05-01-2019 | 14.38 | 15.46 | 23.72 | 24.94 | - |

| ICICI Prudential Rural Opportunities Fund - Growth | 28-01-2025 | 13.65 | - | - | - | - |

| ICICI Prudential Equity Minimum Variance Fund - Growth | 09-12-2024 | 11.99 | - | - | - | - |

| ICICI Prudential Exports & Services Fund - Growth | 01-11-2005 | 11.47 | 13.26 | 19.59 | 17.97 | 14.1 |

| ICICI Prudential Housing Opportunities Fund - Growth | 18-04-2022 | 10.56 | 9.3 | 17.03 | - | - |

| Sundaram Services Fund Regular Plan - Growth | 21-09-2018 | 8.89 | 11.18 | 18.2 | 17.79 | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments of a particular sector/ particular theme - 80% of total assets.

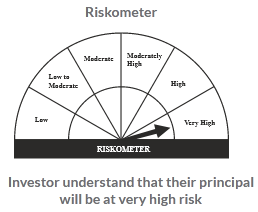

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

12.55%

Others

0.99%

Large Cap

50.13%

Mid Cap

36.33%

Scheme Documents

There are no scheme documents available