RBI Monetary Policy: Disinflationary Hawkism

Mutual Fund

The RBI MPC decided raise policy rates by 50 bps, slightly hawkish to market consensus. While the decision to raise rates was unanimous, the mildly hawkish stance had one dissenter, Prof. Jayanth R. Varma who expressed reservations. The rate hikes today can be seen in tune with other major global central banks.

Policy Action

- Policy repo rate increased by 50bps to 5.40%

- The Standing Deposit Facility (SDF) rate stands adjusted to 5.15% and

- Marginal Standing Facility (MSF) rate and the Bank Rate to 5.65%.

The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

Market Reaction

The markets, in the build up to the policy had expected a rather dovish policy and yields across the board cooled off pre-policy. The statement today, caught participants off guard resulting in the 10 Year G-Sec retracing past gains almost completely. At the time of writing this note, the benchmark 10 year traded at 7.30% up 18bps.

Highlights of the Policy

- Sticky Inflation – Committed RBI

The statement today is RBI’s strongest commitment yet to getting inflation down to 4% over the medium term. This is despite the fact that the latest projections of Q1 FY24 at 5% implying that the glide path to inflation could take anywhere between 12-24 months to achieve.

![Inflation projection Inflation projection]()

Source: RBI monetary policy statement dated 5th August 2022

- System Liquidity withdrawal continues

Average system liquidity for June- July 2022 stood at Rs 3.8 lakh Cr. Latest release indicates this number is closer to Rs 2.1 lakh Cr. Forex interventions may have been the primary reason for this liquidity absorption as the RBI buys INR and sells dollars. With system liquidity normalizing, call money rates are also now finally tracking policy rates. The implied rate move basis call money rates is close to 200bps. - Greater Focus on the external sector

The governors statement had a detailed segment on the external sector. The rising trade deficit and FPI outflows have clearly raised eyebrows at the RBI. The RBI will keenly monitor this space especially from a currency standpoint. The central bank has been very active over the last few months in the currency markets using its large Forex reserves to ensure INR stability.

Our View

The overarching emphasis on inflation targeting is evident across the governor’s statement. For the first time, the statement mentions a target level for inflation at 4%. Further, as it attempts to bring down inflation, we believe the RBI is comfortable with lower growth. This commitment can be perceived as a sign of ‘hawkishness’ and is a significant change in language since the previous policy statements. While we believe, policy rate hikes will continue till there is visibility on the inflation glide path, large rate hikes are unlikely going forward.

Another step today’s policy has in common with global central bankers is clear indication to market participants that the RBI will not provide future guidance on policy action. This is now the globally accepted practice to avoid speculative volatility across capital markets.

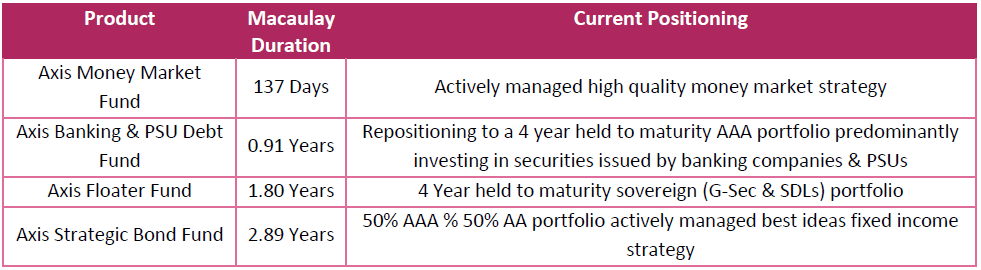

The current yield curve presents material opportunities for investors in the 4-year segment. This category also offers significant margin of safety given the steepness of the curve. For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. For investors with short term investment horizons (6 months - 2 years) money market strategies continue to remain attractive offering competitive ‘carry’ and low volatility. Credits can also be considered as ideal ‘carry’ solutions in the current environment.

Allocation and strategy is based on the current market conditions and is subject to changes depending on the fund manager’s view of the markets. Data as on 29th July 2022

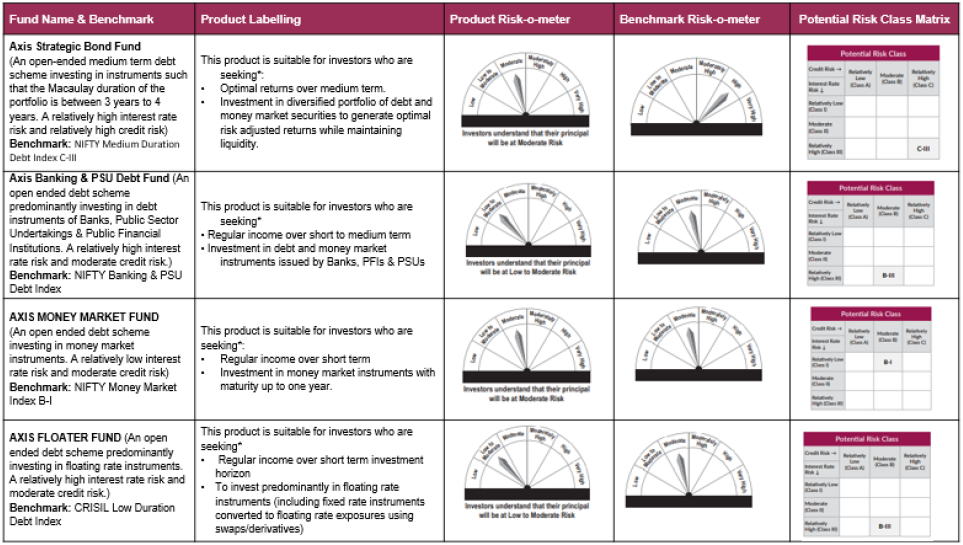

Product Labelling

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer

Source of Data: RBI Governor’ Statement, RBI Monetary Policy Statement & RBI post policy press conference dated 5th August 2022, Axis MF Research

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025