Thinking Aloud: The YTM Vs Capital Appreciation Tradeoff revisited

Mutual Fund

In different market scenarios, different strategies come into play. During a rising interest rate scenario, shorter duration (maturity) instruments, higher yields, and floating rate bonds tend to perform well. Conversely, in a falling interest rate scenario, longer duration (maturity) instruments and fixed rate bonds tend to outperform.

The popularity of floating rate bonds surged during the Covid era, serving as a hedge against mark to market losses in the face of rising interest rates.

In the current market scenario, we believe that we are at the peak of Global and India interest rate cycle.

This, coupled with the expectation of inflation in India below 5%, a subdued GDP at ~ 6% for next financial year, and the U.S. FED initiating a rate cut cycle in the second half of the year, markets may start pricing in RBI rate cuts of 25-50 bps.

Given the above macro environment and the general theory that falling interest rates leads to capital appreciation, fixed rate bonds may outperform floating rate bonds going forward.

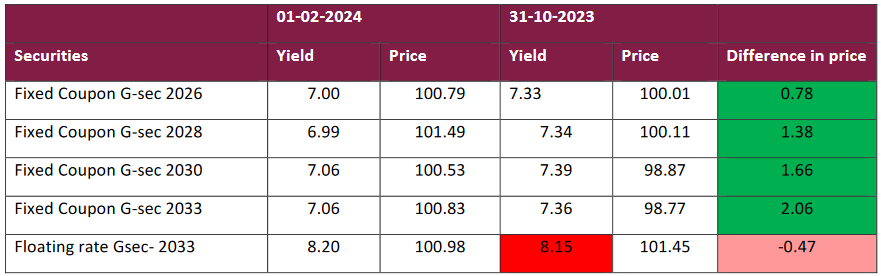

A case in point is the performance of Fixed and Floating Rate Bonds in last 3 months, highlighted in this table:

Source: Bloomberg, data as on 1st Feb 2024

The performance comparison of Fixed and Floating Rate bonds over the last 3 months has shown that while Floating rate bonds have offered higher yields (thereby translating to higher scheme YTMs), it is the Fixed Coupon bonds that have outperformed via capital appreciation in the backdrop of a bullish interest rate view environment.

Our View:

We believe that with expectation of rate cuts and an expected shift in liquidity stance (less tight liquidity situation) by April 2024, its time to focus on capital appreciation over higher yields. Fixed rate bonds may continue to outperform floating rate bonds. The expected shift in liquidity dynamics may also lead to the continued decline in yields of floating rate bonds.

Disclaimer

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025