All you wanted to know about Nifty Next 50 Index

What is the Nifty Next 50 Index?

Nifty Next 50 Indexcomprises of the 51st to 100th largest companies by free float market capitalization on the National Stock Exchange (NSE). According to SEBI, the top 100 companies by market capitalization are categorized as large cap companies. Nifty 50 (top 50 companies by free float market capitalization) and NIFTY Next 50 indexes represent the universe of large cap stocks. The Nifty Next 50 index is calculated on a real time basis (daily) and rebalanced semi-annually in March and September based on data for six months ending January and July respectively.

Free float market capitalization is based on free floating shares i.e. shares held by the public. Shares held by the promoters and their families, trusts, management of the company and the Government are excluded from free market capitalization. In free float market capitalization-based index, the companies with highest free float market cap will have higher weights in the index.

Both the Nifty 50 Index and the Nifty Next 50 Index are based on free float market capitalization method. As on 31st December 2020, Nifty Next 50 Index constituted 13% of the total market capitalization of all stocks listed on the NSE (as on 31st December 2020, source: AMFI).

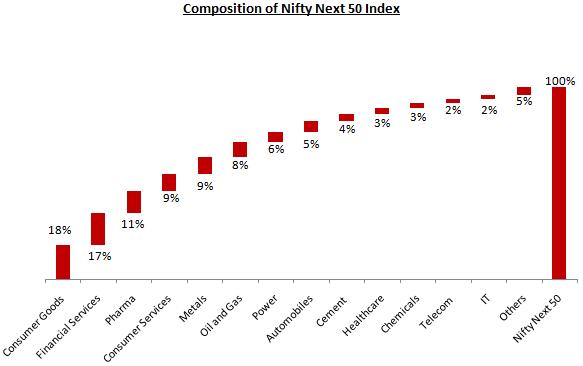

Composition of Nifty Next 50 Index

The chart below shows the industry sector composition of Nifty Next 50 (as on 30th April 2021, source: National Stock Exchange).

Source: National Stock Exchange, as on 30th April 2021.

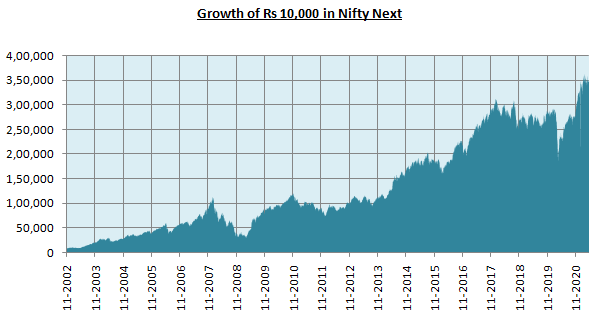

Performance of Nifty Next 50 TRI

The chart below shows the growth of Rs 10,000 in Nifty Next 50 Total Returns Index (TRI). Total Returns include both price appreciation and income (dividends). In the last 18.5 years, your investment of Rs 10,000 in Nifty Next 50 TRI would have multiplied 35 times to more than Rs 3.5 lakhs. The compounded annual growth rate (CAGR) over the last 18.5 years was over 21% CAGR.

Source: National Stock Exchange, as on 30th April 2021

How to invest Nifty Next 50

Exchange Traded Funds (ETFs) and index funds are the instruments to invest in market indices. ETFs and index funds invest in basket of stocks that replicate a benchmark index. ETFs do not aim to beat the index but merely replicate their performance. Since ETFs and index funds are passively managed, their cost is relatively lower than that of an actively traded mutual fund scheme. Lower cost will generally result in higher returns for the same level of performance.

Difference between ETFs and Index Funds

ETFs are listed and trade on stock exchanges. You need to have demat and trading accounts to invest in ETFs. Index funds, on the other hand, are passive mutual fund schemes which are exactly like ETFs in their portfolio compositions but can be bought or redeemed with the Asset Management Companies (AMC). In other words, you do not need to have demat and trading accounts to invest in index funds. Another major difference between ETFs and index funds is in costs (total expense ratio). Though the expense ratios of index funds are much less than actively managed mutual funds; the expense ratios of ETFs are even lower compared to index funds.

One major advantage of index funds over ETFs, especially from the point of retail investors, is the ease of liquidity. ETFs, unless redeemed in lot sizes specified by the AMCs, can be sold on the stock exchange through your trading account. If an ETF is not very liquid (thinly traded in the market), then you may not find sufficient buyers in extreme market situations. In some cases, you may have to sell your ETF units at prices significantly lower than the NAV depending on the market situation. There is no such problem in index funds. Units of index funds can be redeemed with the AMCs, just like other mutual fund schemes.

About SBI Nifty Next 50 Index Fund

SBI Mutual Fund has launched SBI Nifty Next 50 Index Fund. The NFO opened on 28th April 2021 and will close on 11th May 2021. Ravi Prakash Sharma is the fund manager of this scheme. You can invest in this fund either in lump sum or SIP. Minimum subscription amount for lump sum is Rs 5,000. Minimum monthly SIP amount is Rs 1,000 only. The scheme will charge exit load of 1% for redemptions within one year of investment and nil thereafter.

Why invest in SBI Nifty Next 50 Index Fund?

- Gain access to growth of potential market leaders: Nifty 50 companies are market leaders and the largest companies of the country. Nifty Next 50 index companies can become Nifty 50 companies in the future (as they have done in the past) with potential of wealth creation for investors.

- Well diversified portfolio: Nifty Next 50 Index covers 16 industry sectors. Among them they cover most of the core sectors of the economy e.g. power, metals, oil and gas, cement, construction etc. and also large industry sectors like Banking and Finance, Pharmaceuticals, Consumer Goods, Automobiles, Telecom, Information Technology etc.

- No unsystematic risks: Fund managers of actively managed mutual funds have to be overweight / underweight on certain stocks / sectors relative to the benchmark index in order to beat the index. This gives rise to unsystematic risks in addition to market risk. There is no unsystematic risk in ETFs – only market risks.

- Low costs: The cost or Total Expense ratios (TERs) of ETFs and Index Funds are much less than the cost (TERs) of actively managed mutual funds schemes. Lower cost can result in significantly higher returns over long investment horizons due to compounding effect.

Investors need to have risk appetites and long investment horizons for investing in SBI Nifty Next 50 Index Fund. Investors should consult with their financial advisors if this scheme is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY