Best Health Insurance Plans for Parents who are Senior Citizens

Health insurance is a critical need for senior citizens because health risks increase substantially with advancing age and the cost of quality healthcare in India has grown exponentially in the last decade. In India, it is quite common for senior citizens to be financially dependent on their children. Naturally, the healthcare need of our aged parents is an important concern for us. When selecting health or medical insurance plans for your parents, you need to assess several important factors when buying individual health insurance. These factors are as follows:-

Cover:

Health cover or sum insured is an important consideration in choosing a health insurance policy. Senior citizens need higher cover to protect their health, as with age the risk of health disorder increases. The public sector insurers usually offer lower sum insured compared to the private sector insurers.Premiums:

Premiums are obviously an important consideration in buying a health insurance policy. Premiums charged by the private sector insurers are usually on the higher side compared to the premiums charged by the public sector insurers.Co-payment:

Health insurance for senior citizens comes with a co-payment clause. In other words, the insured needs to share a portion of the medical expenses incurred by them. Co-payment policies differ for insurer to insurer. For example, in case of hospitalization, a policy may stipulate 30% co-payment if the insured chooses a single or higher category room and 15% co-payment if the insured chooses a twin sharing or a lower category room.Waiting period for pre-existing medical conditions:

This is the waiting period before a claim can be for a pre-existing medical condition (recognized in the policy). This is an important consideration for senior citizens because the risk of illness and consequent hospitalization due to a pre-existing medical condition is higher for senior citizens.Medical check-up:

Some insurers like National Insurance, requires medical check-ups to be done before they issue health insurance policies, while some insurers do not require medical check-up. Some aged seniors may be uncomfortable with certain tests like treadmill tests.

It is debatable whether you should cover your parents in your own family floater plan that also includes you, your spouse and children, or buy a separate plan for them. It really depends on the health condition of your family including your parents. It is more economical to include your parents in your family floater plan because in such a plan all the members of your family are covered at a lower premium. However, there is a disadvantage of including senior citizen parents in your own family floater plan because in the times that we are living in, it is common for senior citizens to have pre-existing medical conditions like hypertension, diabetes, cardio vascular and coronary diseases etc, which puts them at a higher health risk compared to the rest of your family. If one or more members of the family have higher health risks compared to the other members, he or she is likely to consume a higher portion of the cover or sum insured, and therefore will potentially leave the rest of the family underinsured. In such cases, it is more prudent to buy a separate individual Mediclaim policy for the parent who has higher health related risks. If both of your parents have significantly higher risks than the rest of your family, you should buy a separate family floater plan just for your parents and not include them in the family floater plan for you, your spouse and children.

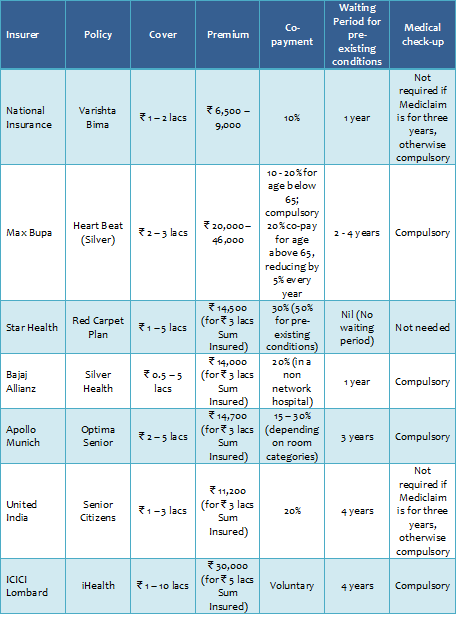

About two years back, we reviewed some of the most popular Mediclaim plans for senior citizens in India in our article, How to choose the best Health Insurance policy for senior citizens. In this blog post we will again review, some of the best Mediclaim plans for senior citizens based on the criteria discussed above, i.e. cover, premium, co-payment, waiting period for pre-existing medical conditions etc. It is not a surprise that many of the plans featured in our article nearly two years back, feature even now in this review. This observation has one positive and one negative. The positive aspect is that, the best Mediclaim plans for senior citizens have been able to retain their advantage over others. The negative aspect is that, unfortunately the basket of Mediclaim product offerings for senior citizens in India has not expanded as much as we would have liked it to. The table below shows the most popular Mediclaim plans for senior citizens. Please note that premiums are estimated based on the assumption that the insured is a male between the ages of 60 to 65. To get a more accurate of your premium, you can ask your health insurance advisor or use the premium calculator available on websites of most companies.

Source: Company websites

Tax Benefit for buying health insurance for your parents

Medical insurance premium for self, spouse, dependent children and parents are eligible for deduction from your taxable income under Section 80D of the Income Tax Act. The maximum allowable deduction is र 25,000 for self, spouse and dependent children. The applicable deduction for parents who are senior citizens is र 30,000. If an individual pays for medical insurance of parents who are senior citizens, then he or she can claim an “additional” maximum deduction of र 30,000. Therefore the total amount of the deduction from taxable income an individual claim for medical insurance for self, spouse, dependent children and senior citizen parents is र 55,000 and you can save up to nearly र 17,000 in taxes.

Conclusion

Based on some estimates average Indians spend 75% of his or her family’s medical bills out of their own pocket. The cost of healthcare of aged parents, especially if they suffer from a serious illness requiring prolonged hospitalization, can be a severe drain on your financial resources. If you buy adequate health insurance for your parents, you can not only ensure high quality healthcare for your parents, but you will also be able to manage your finances much better and ensure that your family is stress free. In this blog, we discussed some of the best and most popular health insurance plans for your parents who are also senior citizens. Every family has unique healthcare needs and you should buy the right health insurance product which is suitable for your family’s needs. You should discuss with your health insurance advisor, which Mediclaim plan is most suited to needs of your family, especially your parents.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Shriram Mutual Fund launches Shriram Money Market Fund

Jan 19, 2026 by Advisorkhoj Team

-

PPFAS Mutual Fund launches Parag Parikh Large Cap Fund

Jan 19, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team