How Life Insurance Annuity Plans can help in your retirement years

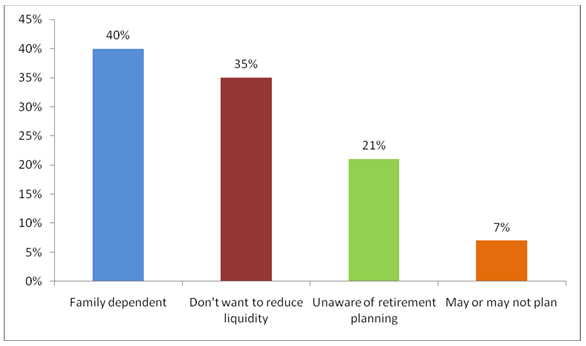

A recent research on retirement planning conducted by Reliance capital asset management in association with IMRB international reveals shocking data on the percentage of people actually planning for retirement in India. With an increase in the overall life expectancy rate, it is expected that the percentage of people falling in the retired category by the year 2050 will form about 20% or more of the total population in India. In was found that out of the total working population, over 40% of the people stated that they would be taken care of by their family post retirement, while 35% did not want to invest as they felt that invest for future will reduce their liquidity of funds. Another 21% were surprisingly unaware at all about retirement planning and its benefits.

Now that you have seen the above chart, do you know that out of the working population (mostly people lying between the ages of 30-35 years) only 15% have actually thought about retirement planning? The problem is not that that only 15% have planned for retirement but the problem lies in the fact that out of the 15% people planning for retirement only 35% are active investors. It means that out of every 100 people only 15 people have thought of retirement out of which only 6 people are actually investing regularly.

As per the report India's per capita retirement and pension assets are not up to the mark. But, why is it so? Is it just because we are not interested or it's because we do not know the importance of retirement planning and various avenues where we can invest.

We all wish to have a happy retired life but fail to make arrangements for the same. The reason is not that we do not want to invest. It is the lack of awareness about the available options that will help us to achieve a comfortable retired life.

Do you know about investment plans which would help in retirement?

It is Life insurance Annuity Plans! We all have come across this term numerous times and have very well managed to ignore it. Some ignore it out of pure arrogance while someignore it mistaking it to be just any other type of insurance plan. Yes, of course it is an insurance plan but meant for retirement planning. Under this plan, you pay a premium in lump sum amount or regular mode for a specific period of time and then get a regular stream of income till you or your spouse survive.

Life Insurance 'Annuity Plans' or 'Annuities' offer regular income to people who have retired from work till such time they are alive. Let us now understand the plan in details:

What is an annuity plan and how does it work?

- An annuity plan is an insurance product which aims at providing a regular source of income to you post your retirement. The premiums to be paid towards purchasing this plan can either be made in a lump sum or regular instalments over the defined premium paying term.

- The annuity is payable to you till the time you die. Most of the companies pay annuities in the frequency chosen by you – monthly, quarterly, half yearly or yearly. it basically ensures a lifelong security and works under the philosophy that the longer you live, the more you receive by way of annuities

- Certain life insurance annuity plans offer a minimum period of monthly income which is guaranteed. Even if you die during this period your family will receive the regular monthly income till the completion of the guaranteed income period.

- Certain annuity plans also offer payment of the remaining amount as a lump sum payout in case of death of the buyer during the initial years of the policy.

Example

- Rakesh is planning to save for his retirement. His age is 23 and risk profile moderate. He wishes to retire at age 50 and his current monthly expense is around Rs 20,000 per month. He wants to withdraw first annuity at his 51st birthday. The current inflation rate is 5%

Assuming he wants to lead a comfortable life, Rakesh will needs a corpus of around Rs 1 Crore and 4 Lakhs and for this Rakesh needs to save Rs 11,228 per month.

Types of annuity

Life Insurance Annuity plans can be divided into two basic categories which are again subdivided into other categories

- Defined Benefit Pension Plans and

- Individual annuity Plans.

Defined Benefit Pension Plans

These types of plans are, by and large, offered to the employees of a particular organization or by the government. The amount to be offered under this plan is decided depending upon various factors such as the age, the amount of the salary being received by the employee and his/her years of work tenure in the organization.

Individual Annuity Plans

Individual annuity plans are offered by the insurance companies to individual customers. A wide range of options are available under this category, which makes it flexible for an individual to select the annuity plan most appropriate for her or his need. The various types of annuity plans available are

- Deferred Annuity

- Immediate Annuity

- Fixed and variable annuity

- Guaranteed annuity

- Joint annuity

- Impaired life annuity

Let us now have a detailed look of all the categories:

Deferred annuity

- Deferred annuity comprises of two phases - One phase is known as the accumulation or the deferral phase and the other one is known as the distribution phase (when the annuities are paid).

- The investments made in deferred annuities help in capital growth of the investment during the first phase i.e. the accumulation phase. This annuity plan can be purchased either as a single premium deferred annuity (SPDA) or as a flexible premium deferred annuity (FPDA).

- In SPDA, the purchaser has to pay a single premium and the premium amount will be further invested. No additions or modifications can be done in this case.

- In FPDA, the purchaser may choose to pay the premium multiple times. Any number of premiums paid by the purchaser will be further invested by the insurance company.

- The second phase is known as the distribution phase wherein the annuity is paid in the frequency chosen by the annuitant till his or her death or death of both of the annuitants (In case of joint annuity).

Example

- Raj is a working professional who has received a lump sum amount by selling an old property. He wishes to invest the entire sum towards the purchase of a good annuity plan. He can buy the single premium deferred annuity (SPDA) which will help him get annuity from the age chosen by him.

Vikas is a business man who has invested in various businesses. He gets return on his investments at different times. He wishes to invest these returns towards purchase of a good annuity plan, therefore, he may choose to invest in FPDA by paying premiums at different times.

Immediate Annuity

- Immediate annuities offer payments to the policy holder immediately after the premium is paid and till the time of his death.

- However, the payment to be done towards the purchase of this annuity plan has to be done as a single premium.

- It basically comprises only of a distribution phase.

- It is also known as single premium immediate annuity, payout annuity or an income annuity.

Example

- Amita a single mother has worked hard all her life and has saved a good sum for herself. She is still works but want to use her hard earned money for post retirement period. Hence, she needs a regular monthly income post retirement. She is afraid of spending her savings before her retirement. So, it’s suggested that she invest her money in an immediate annuity plan whereby, the monthly income will begin immediately after she retires till she dies.

Fixed and variable annuities

- Certain annuities pay in certain annuity amounts that are pre fixed or in amounts which increases as per a fixed rate. Such annuities are known as fixed annuities.

- Unlike, fixed annuities there are certain kinds of annuities that pay depending upon the performance of certain specified investments (generally equities or investments in bonds). Such annuities are known as variable annuities.

Example

- Aman and Akash are two friends wishing to invest and plan for a better life post retirement. But both have different risk taking capacities.

Aman wishes to invest in a fund which will offer him a fixed annuity return and will not cause any kind of financial loss to him. So he chooses to invest in fixed annuities.

Akash has a higher risk taking capacity and wishes to invest in a fund which might give him returns depending upon the market rate. So he chooses to invest in variable annuities in anticipation of earning higher returns.

Guaranteed Annuity

A guaranteed annuity offer payments to the annuity holder for a certain number of years known as the "period certain". In cases, where the annuitant lives beyond the decided period certain, this plan continues to make annuity payments till the time of death of the annuity holder. And, in cases where the annuitant dies before the expiry of the period certain then the legal heir of the annuitant will receive the remaining payments also known as "payments certain". However, one thing to be kept in mind, while purchasing this plan is that the payment to be received under this plan will be smaller as compared to the payments to receive under a pure life annuity plan. A pure life annuity plan makes payments only till the time of death of the annuitant.

Example

- Raj has purchased a guaranteed annuity plan for 20 years of period certain. He has kept his son as the legal heir of the annuity. Now, in case Raj dies before the completion of 20 years than his son will receive the remaining payments till the period certain( 20 years) is over, but if Raj manages to live beyond the expected 20 years than he will receive annuity payments till the period he actually lives.

Joint Annuity

Joint annuities also known as Joint life and joint survivor annuities offer regular payments till the time of death of either or both of the holders. An annuity plan may offer payment to a legally wedded couple till the time of death of both the holders or may also choose to reduce the amount of payment to be made to the surviving holder in case of death of one of the holders.

Example

- Mr. & Mrs. Sharma have invested in joint annuity. They receive an amount of Rs 50,000 per month. Mr. Sharma dies due to a heart attack. Mrs. Sharma now receives the annuity amount and will continue to receive so till the time she lives.

In India, increasing life expectancy rate, rising health care costs, absence of social security system and disintegration of joint family system are some of the key reasons for you to make retirement planning a priority

Life Insurance Annuity plans is many. But to choose the right plan for you is the key to a happy retired life. By keeping certain factors such as the amount of retirement income required by you, the inflation rate and the life expectancy, you must select the most appropriate annuity plan for yourself. After all the years of hard work you deserve to have a happy and comfortable retired life.

Insurance is the subject matter of the solicitation..

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team