Buzzing Equity Mutual Funds in 2014: Midcap and sector funds

In our previous article, we had discussed the buzzing large cap and diversified equity funds. In the last 6 months large cap and diversified equity funds categories have given average returns of 26 – 30%. While the returns of large cap and diversified equity funds have been great, the returns of the midcap funds have been phenomenal this year. Small and Midcap funds category has given average returns of over 50% in the last 6 months. Infrastructure funds, as a category, have done even better. Infrastructure funds category has given average returns of over 58% in the last 6 months. In this article, we will discuss the buzzing midcap and sector funds in 2014, based on the returns in the last 6 months.

For our selection of buzzing funds, we have applied a few filters. Firstly, we have selected only those funds which have at least Rs 100 crores of assets under management (AUM). Also, we have excluded funds, which have been ranked "Below Average Performers" or "Relatively Weak Performers" by CRISIL in their latest mutual fund ranking, even though they may have given very high returns in 2014. Finally, in this article we have shown the returns of the Regular Plans only. Direct plans can give a few percentage points higher returns than Regular Plans. Investors should note that, we are not making fund recommendations here. We are just reporting funds that gave the highest returns based on the criteria mentioned above. Investors should not go with short term performance, when selecting mutual funds for investment, because short term performance may not be sustained in the future.

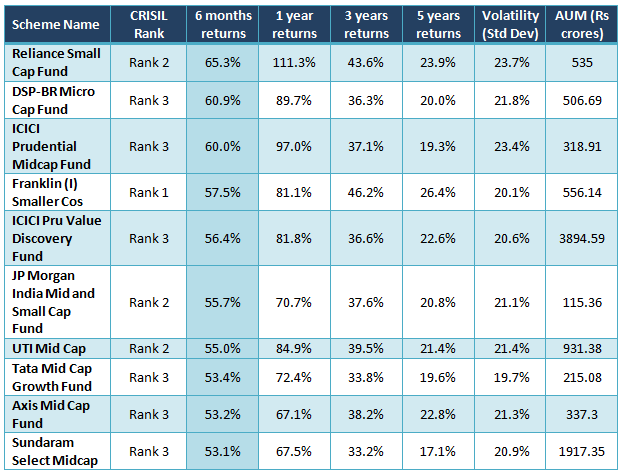

Buzzing Small and Midcap Funds

As discussed earlier, small and midcap funds as a category has given average returns of more than 50% in the last 6 months. Small and midcap funds are more volatile than large cap and diversified equity funds. However, they have the potential to deliver superior returns in the long term, since midcap and small cap companies tend to be more undervalued relative to large cap companies. The buzzing funds in this category have given the highest returns in the last 6 months, based on the criteria discussed earlier, and include perennial favourites like the ICICI Prudential Value Discovery Fund, Sundaram Select Midcap, UTI Mid Cap and Franklin India Smaller Companies funds along with a number of funds with much smaller AUMs. The buzzing funds in this category have given returns of over 57% in just the last six months. We had reviewed a number of these funds over the past few months (please visit the Mutual Funds sub-section in our Articles section). The table below shows the buzzing small and midcap funds (growth option).

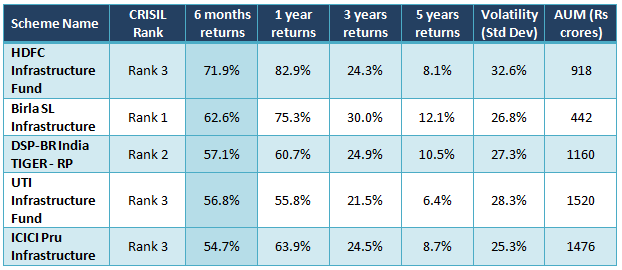

Buzzing Infrastructure Sector Funds

Infrastructure funds have made a strong comeback this year. Unlike diversified equity funds infrastructure funds are exposed to both systematic (i.e. market) and unsystematic (i.e. sector) risks. As such, only informed investors should invest in sector funds. It is important to get the timing of your entry and exit in such funds correct. Over 2 years or more, infrastructure funds had been lagging behind diversified equity funds for reasons that are well known. The rally in equity market leading up to the Lok Sabha election held in April - May, was riding on the expectation of a reversal of the policy paralysis situation that characterized the previous government. Stocks in the infrastructure sector have been among the biggest beneficiaries of the pre-election rally. The election results did not disappoint the market, with NDA and BJP getting absolute majority in the Parliament. Post elections, the structure of the new NDA government has been viewed by the market as one that will enable faster decision making and will kick start the stalled infrastructure projects. Consequently, post elections infrastructure funds have continued to perform well. Infrastructure funds category has given average return of over 58% in the last 6 months. For our selection of buzzing infrastructure funds, we have selected top 5 funds, based on the criteria discussed above. The buzzing funds in this category have given returns of over 60% in just the last six months. The table below shows the buzzing infrastructure funds (growth option).

Conclusion

In this blog we have discussed the buzzing midcap and thematic infrastructure funds in 2014. As discussed earlier, investors should not rely purely on short term return as a performance measure, when selecting mutual funds for investment. Investors can add these buzzing funds to their investment watch-list. If these funds are able to sustain the strong performance they have shown this year to date in the future, investors should discuss with their financial advisers, if they are suitable investment options.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team